Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

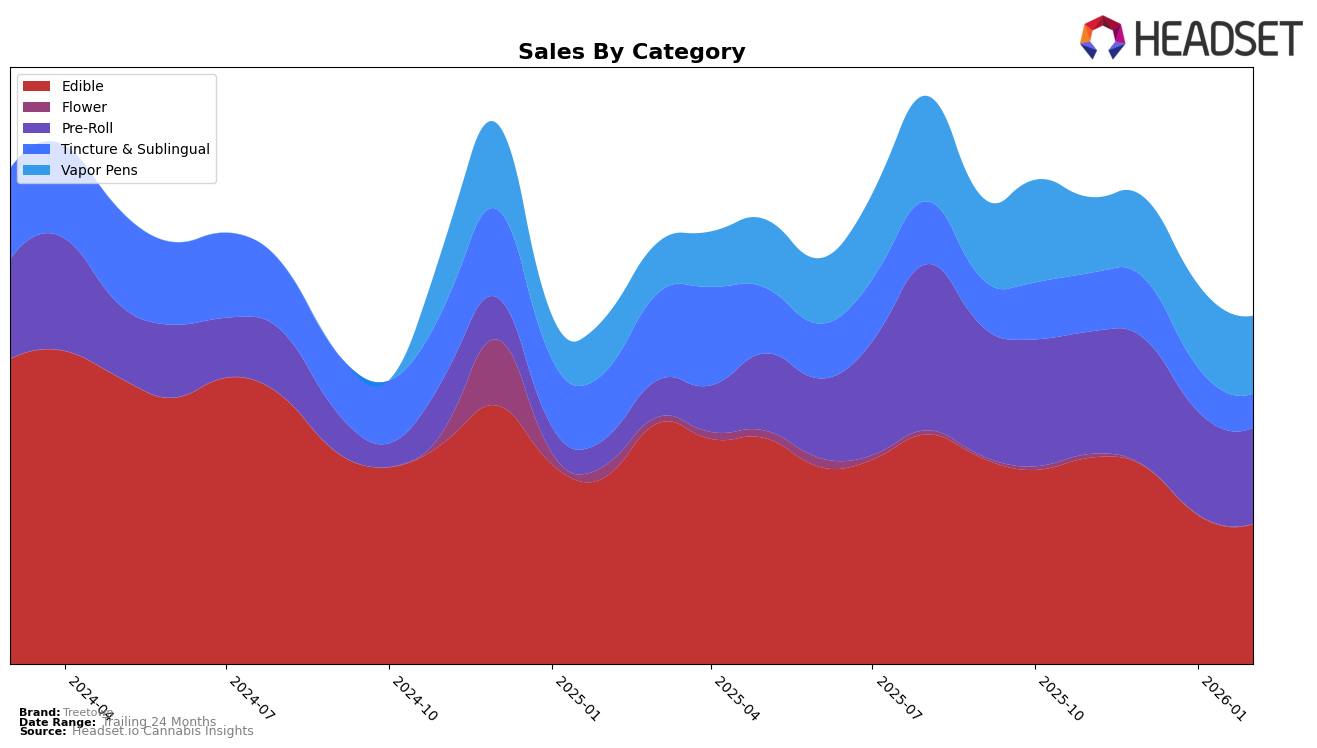

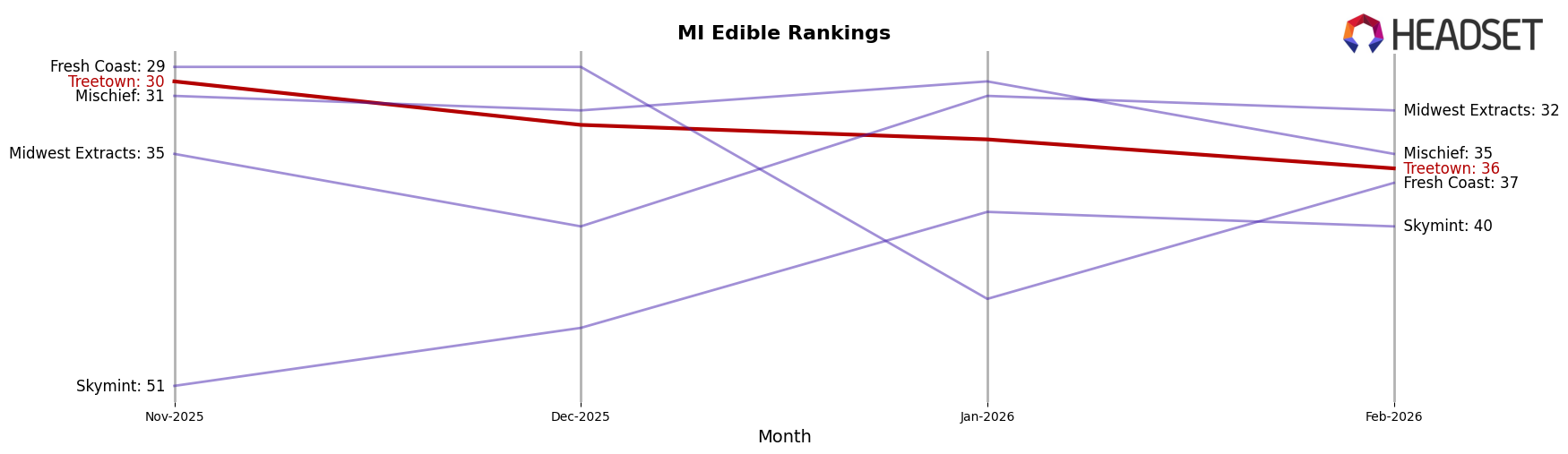

Treetown's performance in the Michigan cannabis market shows a varied trend across different product categories. In the Edible category, Treetown has seen a gradual decline, slipping from 30th place in November 2025 to 36th by February 2026, indicating a need for strategic adjustments to regain traction. On the other hand, their presence in the Vapor Pens category is more stable, with a slight improvement from 79th to 73rd over the same period. Notably, Treetown has maintained a strong position in the Tincture & Sublingual category, consistently ranking in the top two, which suggests a strong consumer preference for their offerings in this segment.

While Treetown's performance in Michigan shows promise in certain categories, there are areas that could benefit from increased focus. The Pre-Roll category, for instance, remains relatively stagnant, with rankings hovering in the mid-70s. This suggests potential for growth if Treetown can differentiate its products or enhance its market strategy. The lack of presence in the top 30 for categories like Edibles and Vapor Pens in the most recent months highlights potential challenges in maintaining market share. These insights suggest that while Treetown has strongholds in specific areas, there is room for improvement and strategic development in others to enhance overall brand performance in the state.

Competitive Landscape

In the Michigan edible cannabis market, Treetown has experienced a notable decline in its competitive ranking, dropping from 30th place in November 2025 to 36th by February 2026. This downward trend in rank correlates with a consistent decrease in sales over the same period. In contrast, Skymint has shown a more stable performance, improving its rank from 51st to 40th, with sales figures that have been gradually increasing, albeit still lower than Treetown's. Meanwhile, Fresh Coast initially maintained a strong position but saw a significant drop in January 2026, before recovering slightly in February. Mischief has been a close competitor, consistently ranking near Treetown, and even surpassing it in January 2026. Midwest Extracts has shown resilience, improving its rank to 32nd by February, suggesting a potential threat to Treetown's market share. These dynamics highlight the competitive pressures Treetown faces, emphasizing the need for strategic adjustments to regain its standing in the Michigan edible market.

Notable Products

In February 2026, Treetown's top-performing product was the Standard Fruit Punch Gummies 10-Pack (200mg) in the Edible category, achieving the number one rank with impressive sales of 5798 units. This product climbed from the second position in January 2026, indicating a significant increase in popularity. The Cherry Gummies 10-Pack (200mg) maintained its strong performance, holding the second rank with a slight improvement from its fourth position in January. The Mango Full Spectrum Gummies 10-Pack (200mg) secured the third spot, consistent with its performance in January. Meanwhile, the Sleep - CBN/THC 2:1 Blackberry Lavender Gummies 10-Pack (100mg CBN, 50mg THC) experienced a drop to fourth place, reflecting a decrease in sales momentum.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.