Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

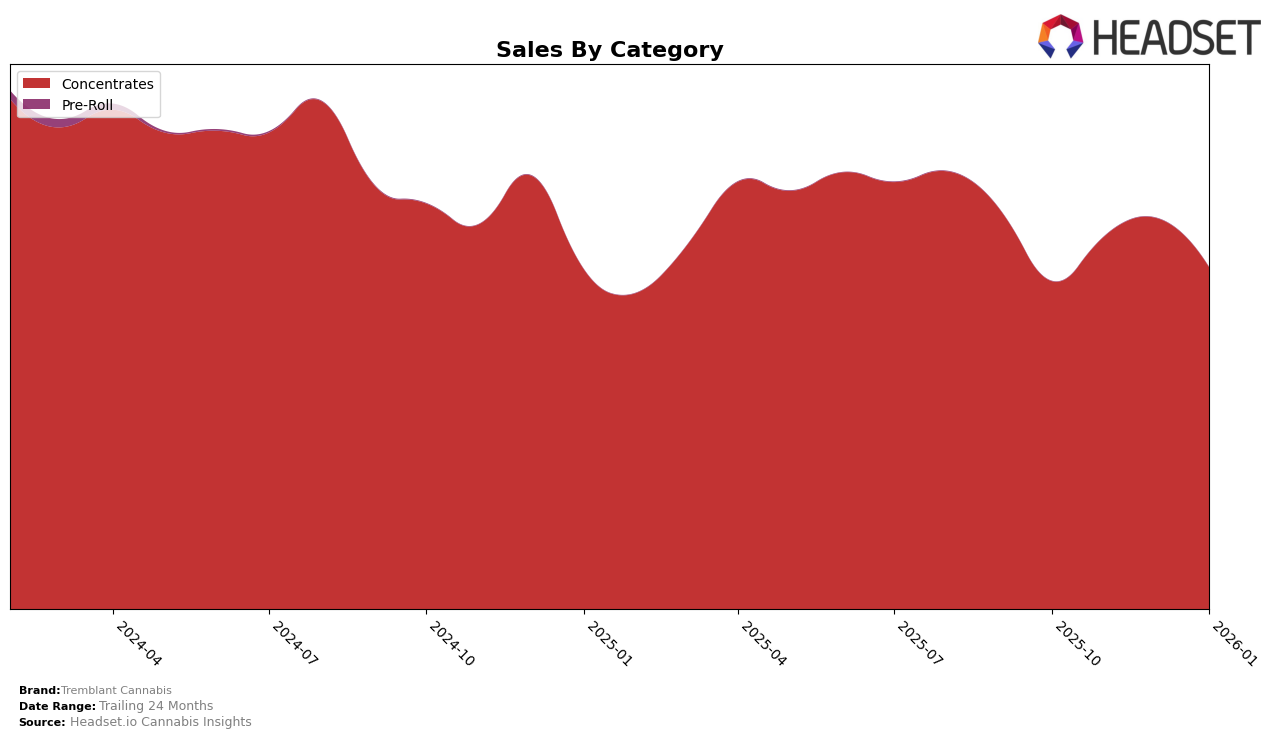

Tremblant Cannabis has shown varied performance across different Canadian provinces in the concentrates category. In Alberta, the brand experienced a decline in rankings, moving from 29th in October 2025 to falling out of the top 30 by January 2026. This drop is significant and indicates a potential challenge in maintaining their market presence in Alberta. Conversely, in British Columbia, Tremblant Cannabis demonstrated a positive trend, climbing from 23rd to 19th place over the same period. This upward movement in British Columbia suggests a growing acceptance or preference for their concentrates in this province, despite a slight sales decrease from December to January.

In Ontario, Tremblant Cannabis maintained a strong position, consistently ranking within the top 6 for the entire period. This consistent performance in Ontario is noteworthy, especially given the fluctuation in other provinces. The brand's ability to hold its position in Ontario could be attributed to a robust market strategy or strong consumer loyalty. It is also worth noting that while sales in Ontario showed some fluctuation, they remained relatively high, indicating a stable consumer base. These insights suggest that while Tremblant Cannabis faces challenges in some regions, it continues to perform well in others, highlighting the importance of localized market strategies.

Competitive Landscape

In the Ontario concentrates market, Tremblant Cannabis has shown a resilient performance, maintaining a consistent rank between 5th and 6th place from October 2025 to January 2026. This stability is noteworthy, especially considering the competitive landscape. Pura Vida has consistently held the 4th position, indicating a strong market presence with sales figures notably higher than those of Tremblant Cannabis. Meanwhile, MTL Cannabis has experienced a decline, dropping from 5th to 7th place, which could present an opportunity for Tremblant Cannabis to strengthen its market position. Additionally, BoxHot has shown improvement, moving from outside the top 20 to 8th place by January 2026, suggesting increasing competition. Thrifty has also made significant strides, climbing from 7th to 5th place, surpassing Tremblant Cannabis in January 2026. These dynamics highlight the competitive pressures Tremblant Cannabis faces, emphasizing the need for strategic initiatives to enhance its market share and sales growth.

Notable Products

In January 2026, Hashish (2g) maintained its position as the top-performing product for Tremblant Cannabis, recording sales of 4782 units. Afghani Black Hash (2g) continued to hold the second spot consistently over the months, with sales slightly decreasing to 1937 units. Tremblant Hash Strips (2g) remained steady at third place, while Indica Hash Strips (2g) improved its ranking from fifth in December to fourth in January. B.C.P Bubble Hash Strips (2g) dropped to fifth place, showing a decline in sales. Overall, the top three products have shown remarkable consistency in their rankings, with minor shifts observed in the lower ranks.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.