Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

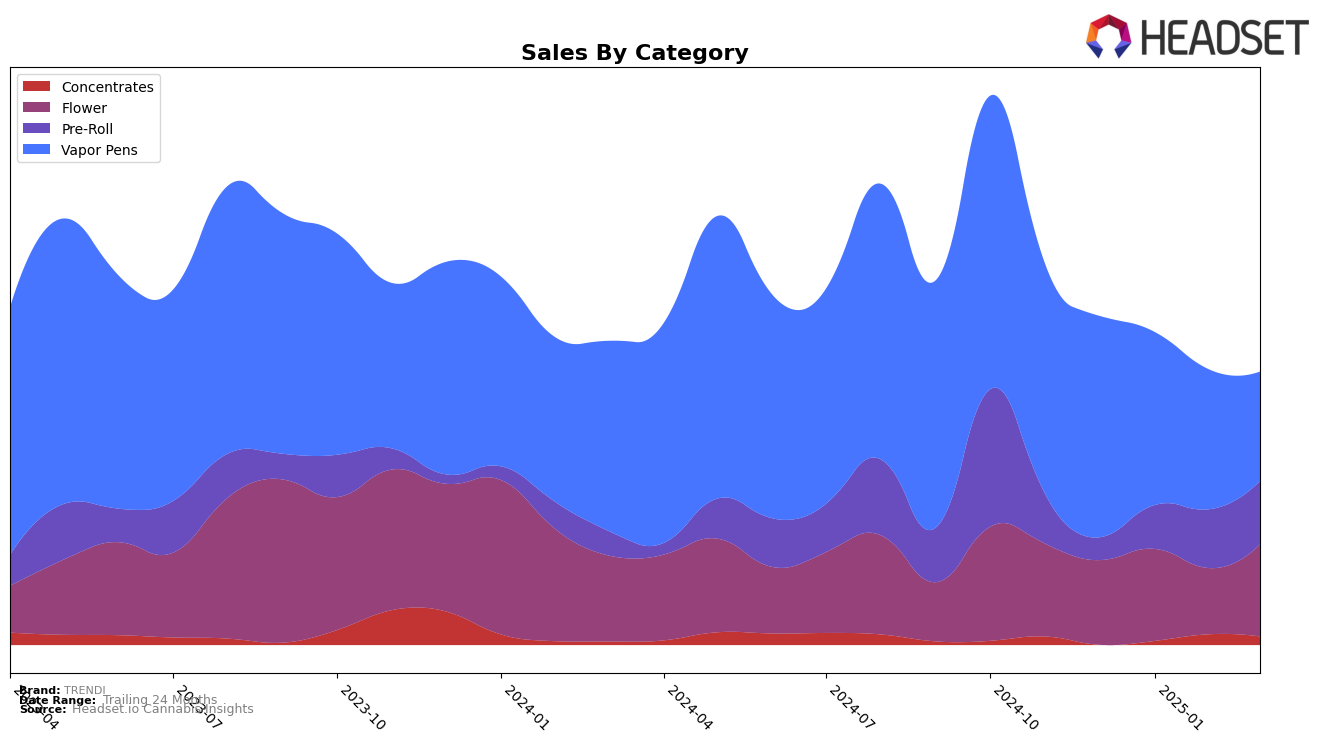

In California, TRENDI's performance in the Flower category has been notably absent from the top 30 rankings in the first quarter of 2025, indicating a potential challenge in maintaining a competitive position in this market. This absence from the rankings suggests that TRENDI needs to reassess its strategy in California to regain its footing. In contrast, the brand's performance in Nevada shows a more varied picture across categories. For instance, TRENDI's presence in the Pre-Roll category has been strong, maintaining a consistent top 10 ranking, which highlights a solid foothold in this segment.

Focusing on Nevada, TRENDI's performance in the Concentrates category has seen positive momentum, climbing from 11th in December 2024 to 6th in February 2025, before settling at 7th in March. This upward trend suggests a growing consumer preference for their concentrates. However, the Vapor Pens category tells a different story, with a decline from 5th in December 2024 to 13th by March 2025, reflecting a potential area of concern for the brand. TRENDI's Flower category in Nevada also faced challenges, slipping from 33rd in December 2024 to 51st by March 2025, which might indicate increasing competition or a need for product innovation. These mixed performances across categories and states underscore the need for TRENDI to focus on strategic adjustments to bolster its market presence.

Competitive Landscape

In the Nevada Vapor Pens category, TRENDI experienced a notable decline in rank from December 2024 to March 2025, dropping from 5th to 13th place. This shift indicates a significant competitive pressure and potential loss of market share. During this period, TRENDI's sales also decreased, reflecting a downward trend. Meanwhile, Alternative Medicine Association / AMA showed a consistent upward trajectory, improving its rank from 18th to 12th, with sales increasing significantly, especially in March 2025. AiroPro maintained a relatively stable position, though its rank slipped slightly from 8th to 11th, with a corresponding decrease in sales. Srene and BOUNTI also showed fluctuations in rank, with Srene improving slightly from 19th to 15th and BOUNTI maintaining a stable position around the 14th rank. These dynamics suggest that while TRENDI faces challenges, competitors like AMA are capitalizing on market opportunities, potentially at TRENDI's expense.

Notable Products

In March 2025, the top-performing product for TRENDI was Silver Reserve Infused Pre-Roll 3-Pack, leading the sales with a significant figure of 1127 units sold. Following closely, Mango Kush Pre-Roll 5-Pack secured the second position, while Detroit Muscle from the Flower category ranked third. Mango Kush Infused Pre-Roll 3-Pack maintained its fourth-place ranking from February, indicating consistent performance. GMO Infused Pre-Roll 3-Pack rounded out the top five, showing strong sales despite being a new entry in the rankings. Compared to previous months, most products have shown stability, with Silver Reserve Infused Pre-Roll 3-Pack emerging as a new leader.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.