Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

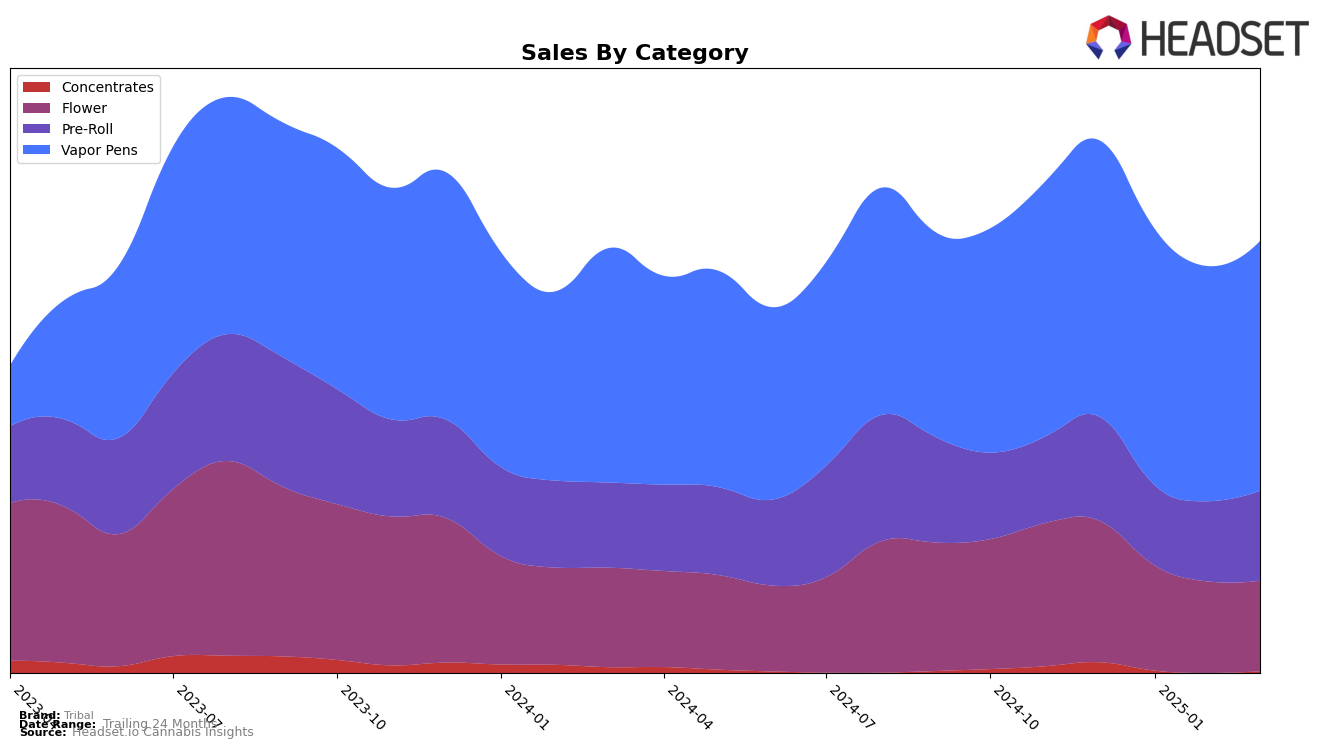

Tribal's performance across different categories and provinces reveals interesting dynamics, particularly in the Alberta market. In the Flower category, Tribal managed to break into the top 30 by March 2025, showing a positive trajectory from a rank of 31 in December 2024 to 28 by March 2025. However, the sales figures in this category have shown fluctuations, indicating a volatile market presence. In contrast, their performance in the Pre-Roll category in Alberta has been relatively stable, maintaining a mid-tier ranking with a slight improvement from 19th in January 2025 to 16th by March. The Vapor Pens category in Alberta remains a stronghold for Tribal, consistently holding a top 11 position, which indicates a solid consumer base and consistent demand in this segment.

In Ontario, Tribal's Vapor Pens have consistently been a strong performer, maintaining a top 7 position throughout the months under review. This suggests a robust market presence and consumer preference for their vapor products. However, in the Flower category, Tribal has seen a decline in ranking, dropping from 19th in December 2024 to 21st by March 2025, which might point to increasing competition or changing consumer preferences. Meanwhile, in British Columbia, Tribal's Vapor Pens have shown a promising upward trend, improving from 14th in December 2024 to 11th by March 2025, indicating growing popularity. Notably, in Saskatchewan, Tribal's presence in the Flower category was notable only in December 2024, after which it did not feature in the top rankings, suggesting a need for strategic adjustments to strengthen their market position there.

Competitive Landscape

In the competitive landscape of vapor pens in Ontario, Tribal has demonstrated a consistent performance, maintaining a steady rank among its peers from December 2024 to March 2025. Tribal's rank fluctuated slightly, moving from 7th in December 2024 to 6th in February 2025, before settling back to 7th in March 2025. This stability is noteworthy, especially when compared to brands like Spinach, which saw a more volatile rank change, dropping to 8th in January 2025 before climbing to 5th by March. Similarly, Weed Me experienced a rank drop to 8th in March from 6th in January. Despite these fluctuations among competitors, Tribal's sales figures remained relatively stable, indicating a loyal customer base. However, DEBUNK consistently outperformed Tribal, maintaining a higher rank and sales figures, which suggests a strong market presence that Tribal may need to strategize against to improve its position further.

Notable Products

In March 2025, Tribal's top-performing product was the Cuban Linx Live Resin Cartridge (1g) in the Vapor Pens category, maintaining its number one ranking from previous months with a sales figure of 16,413 units. The Cuban Linx Pre-Roll 5-Pack (3g) in the Pre-Roll category climbed to the second position, showing a notable increase in sales compared to February. Cuban Linx (3.5g) in the Flower category saw a slight dip, moving from second to third place. Bubble Up (3.5g) remained steady in fourth place, maintaining its position from February. A newcomer, Neon Sunshine Pre-Roll 5-Pack (3g), entered the rankings in fifth place, indicating a positive reception since its introduction.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.