Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

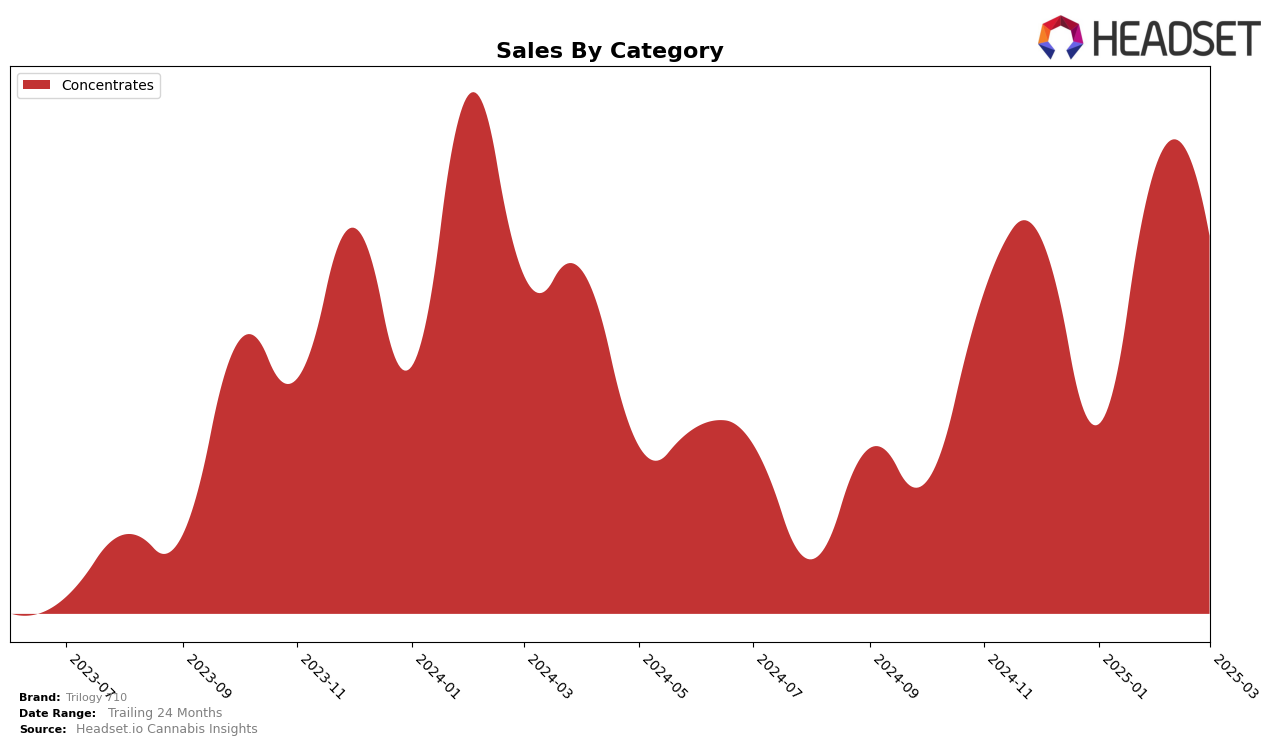

Trilogy 710's performance in the California concentrates category has shown notable fluctuations over the early months of 2025. In December 2024, the brand was ranked 16th, demonstrating a solid presence in the market. However, in January 2025, Trilogy 710 experienced a significant drop, falling out of the top 30, which could indicate challenges in maintaining consistent sales or shifts in consumer preferences. By February, the brand rebounded strongly to rank 12th, suggesting a recovery or successful strategic adjustments. This upward trend slightly tapered in March 2025, with the brand ranking 15th, indicating stabilization but also highlighting the competitive nature of the concentrates market in California.

Examining Trilogy 710's sales figures provides additional context to these rankings. The brand's sales peaked in February 2025, aligning with its highest rank of 12th, which suggests a correlation between increased sales and improved market position. Despite the dip in January, the overall trend from December to March shows a recovery trajectory, with sales in March 2025 nearly matching those of December 2024. This pattern indicates that Trilogy 710 is capable of bouncing back from setbacks, though the absence from the top 30 in January serves as a reminder of the volatility in the cannabis industry. The brand's ability to navigate these challenges will be crucial for sustaining its market presence in the future.

Competitive Landscape

In the competitive landscape of the California concentrates market, Trilogy 710 has experienced notable fluctuations in its ranking over the past few months. Starting from a rank of 16th in December 2024, Trilogy 710 saw a significant drop to 33rd in January 2025, before rebounding to 12th in February and slightly declining to 15th in March. This volatility contrasts with the more stable performance of competitors like West Coast Trading Co., which maintained a relatively consistent rank around the 10th to 13th positions during the same period. Meanwhile, Greenline Organics showed a gradual improvement from 20th to 17th, and Emerald Bay Extracts climbed from 22nd to 16th. Trilogy 710's sales mirrored its ranking volatility, with a notable dip in January followed by a strong recovery in February, suggesting a potential for growth if the brand can stabilize its market presence amidst the competitive pressures.

Notable Products

In March 2025, the top-performing product from Trilogy 710 was Grape Lyfe Live Rosin (1g) in the Concentrates category, securing the first rank with notable sales of 501 units. AMG Sour Live Rosin (1g) followed closely in second place, showing an impressive rise from its previous position, with sales increasing from 206 units in January to 430 units in March. Banana Zplit Live Rosin (1g) held the third rank, maintaining a steady position in the top ranks. Peach Bellini Live Rosin (1g) and Florida Pineapples Live Rosin (1g) rounded out the top five, indicating a strong preference for fruit-flavored concentrates. These rankings highlight a consistent demand for Trilogy 710's live rosin products, with some products experiencing significant shifts in popularity over the months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.