Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

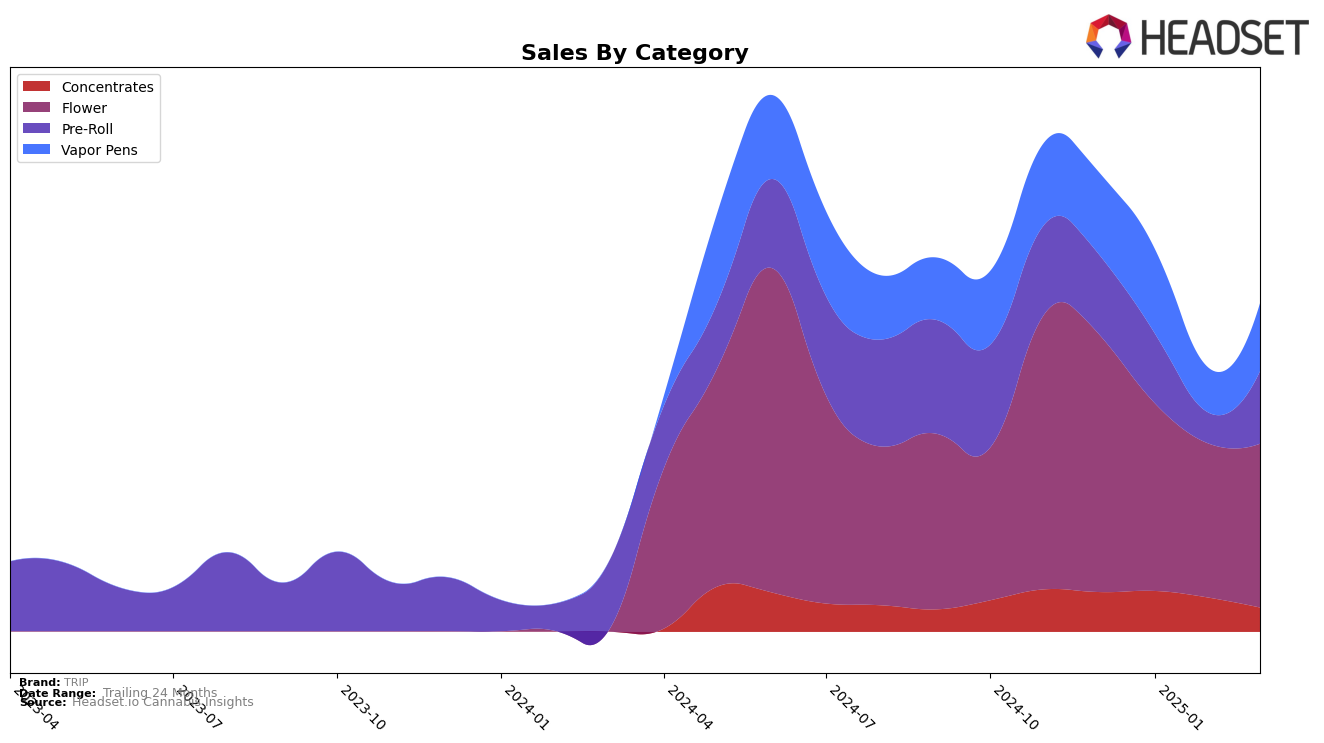

TRIP's performance across various categories in Arizona has shown some fluctuations over the months. In the Concentrates category, TRIP experienced a noticeable decline, dropping from the 16th position in December 2024 to 27th by March 2025. This downward trend is accompanied by a decrease in sales, with March figures significantly lower than those in December. The Flower category also saw a decline in rankings, though not as steep, moving from 15th to 25th over the same period. Interestingly, while the Vapor Pens category showed some improvement in March 2025, rising to 35th place from an earlier position of 38th in February, it remains outside the top 30, indicating a challenging market presence in this segment.

In Missouri, TRIP's performance in the Pre-Roll category has been mixed. The brand saw a dip in February 2025, falling to 44th place, but then recovered to 28th by March. This recovery suggests a potential rebound in consumer interest or market conditions that favored TRIP. Meanwhile, in Oregon, TRIP's presence in the Pre-Roll category was fleeting, with a ranking of 72nd in December 2024 and no subsequent appearances in the top 30, which might indicate a highly competitive market or limited brand recognition. These movements highlight the varying challenges and opportunities TRIP faces across different states and product categories.

Competitive Landscape

In the Arizona flower category, TRIP has experienced notable fluctuations in its market position from December 2024 to March 2025. Initially ranked 15th in December, TRIP saw a decline to 24th in January and further to 27th in February, before slightly recovering to 25th in March. This downward trend in rank corresponds with a decrease in sales from December to February, though March showed a slight rebound. In contrast, Daze Off demonstrated a consistent upward trajectory, improving its rank from 32nd in December to 23rd in March, accompanied by a significant increase in sales. Similarly, 22Red maintained a relatively stable position, with minor fluctuations in rank, but consistently higher sales than TRIP. Meanwhile, Elevate Cannabis Co and Tru Infusion both showed varying rank positions, with Tru Infusion experiencing a notable sales surge in February. These dynamics suggest that while TRIP faces competitive pressure, particularly from Daze Off, there are opportunities for strategic adjustments to regain market share in the Arizona flower market.

Notable Products

In March 2025, Island Maui Haze HTE Sauce Disposable (1.2g) emerged as the top-performing product for TRIP, climbing to the number one rank with sales of 1349 units, a slight increase from December 2024's fifth place. Blue Nana Muffin HTE Sauce Disposable (1.2g) secured the second position, improving from its third place in February 2025. Z Milk (14g) entered the rankings for the first time in March, achieving third place in the Flower category. Sensi Star HTE Sauce Disposable (1.2g) maintained a strong presence, ranking fourth after its debut at fifth in February. Lastly, Strawberry Headband HTE Sauce Disposable (1.2g) rounded out the top five, experiencing a drop from its previous third-place ranking in December 2024.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.