Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

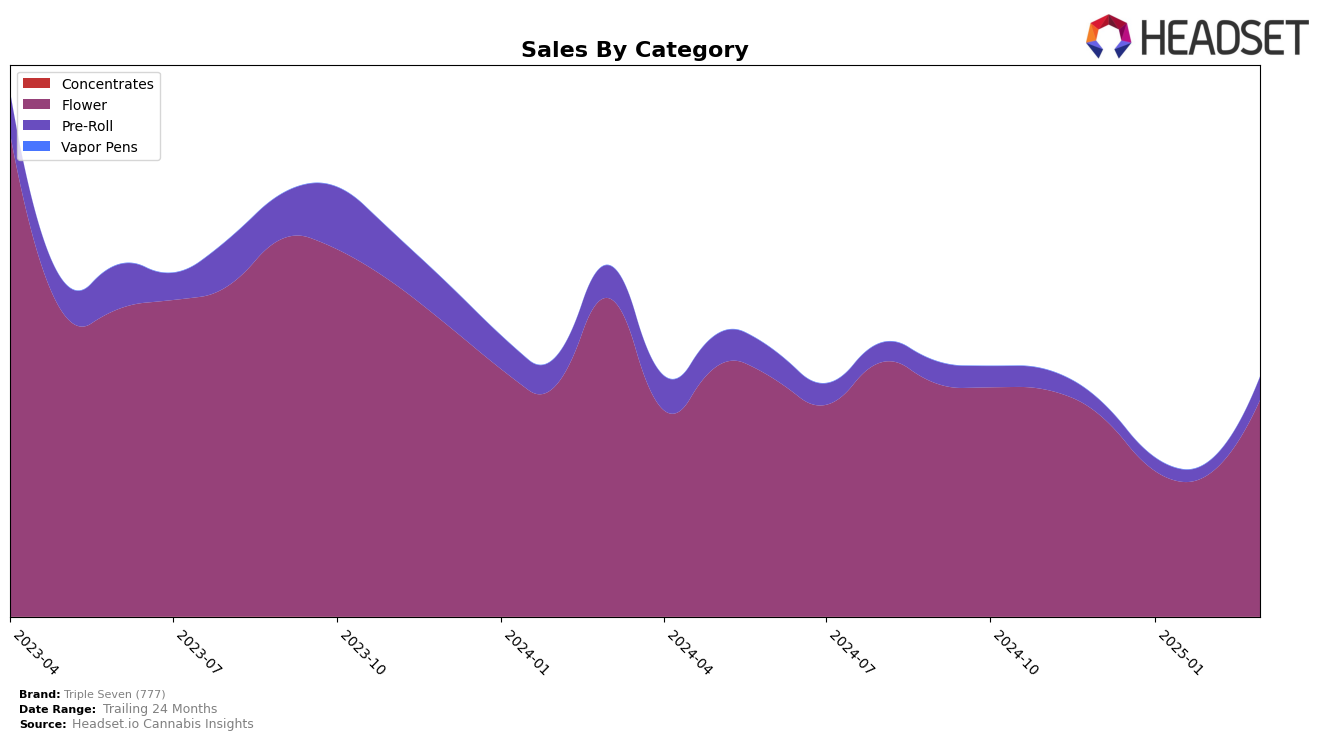

Triple Seven (777) has demonstrated consistent performance in the Flower category across several states, with notable rankings in Colorado and New Jersey. In Colorado, the brand maintained a steady third-place ranking from December 2024 through March 2025, showcasing strong market presence and consumer loyalty in this state. Meanwhile, in New Jersey, Triple Seven (777) showed resilience by climbing from 13th place in February 2025 to 10th in March 2025, indicating a positive trend in market acceptance and growth potential. Conversely, in Ohio, the brand improved its position significantly from 37th in February 2025 to 21st in March 2025, suggesting a strategic push or increased consumer demand in the Flower category.

In Illinois, Triple Seven (777) experienced fluctuating performance in both the Flower and Pre-Roll categories. The brand's Flower ranking oscillated, starting at 42nd in December 2024 and improving to 39th by March 2025, hinting at challenges in maintaining a top-tier position. The Pre-Roll category saw a more dramatic shift, with the brand absent from the top 30 in February 2025 but rebounding to 20th in March 2025. This recovery suggests a potential refocus or successful marketing efforts in the Pre-Roll segment. Additionally, in the New Jersey Pre-Roll category, the brand's ranking fell from 20th in February to 27th in March 2025, highlighting potential competitive pressures or shifts in consumer preference. These movements offer insights into the competitive dynamics and strategic adjustments within the cannabis market.

Competitive Landscape

In the competitive landscape of the Colorado flower category, Triple Seven (777) has maintained a consistent rank of 3rd place from December 2024 through March 2025. This stability in ranking reflects a strong market presence amidst fierce competition. Notably, Seed & Strain Cannabis Co. consistently holds the top position, indicating a robust lead in sales. Meanwhile, Good Chemistry Nurseries also maintains a steady 2nd place, suggesting a competitive edge over Triple Seven (777). Despite this, Triple Seven (777) demonstrates resilience with a notable recovery in sales from February to March 2025, closing the gap with its higher-ranked competitors. Brands like Classix and Green Dot Labs remain consistently below Triple Seven (777), indicating a solidified position in the upper tier of the market. This analysis underscores the importance of strategic positioning and market dynamics in maintaining and potentially improving Triple Seven (777)'s standing in the Colorado flower market.

Notable Products

In March 2025, Biscotti (3.5g) maintained its position as the top-performing product for Triple Seven (777) with sales reaching 10,504 units. The Dirty Squirt Pre-Roll (1g) emerged as the second best-seller, marking its first appearance in the rankings. Ky Jealous (3.5g) held steady at third place, consistent with its February ranking, despite a previous first-place position in December and January. Strawnana (3.5g) experienced a slight drop, moving from second in January and February to fourth in March. The Space Junkie Pre-Roll (1g) rounded out the top five, making its debut in the rankings this month.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.