Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

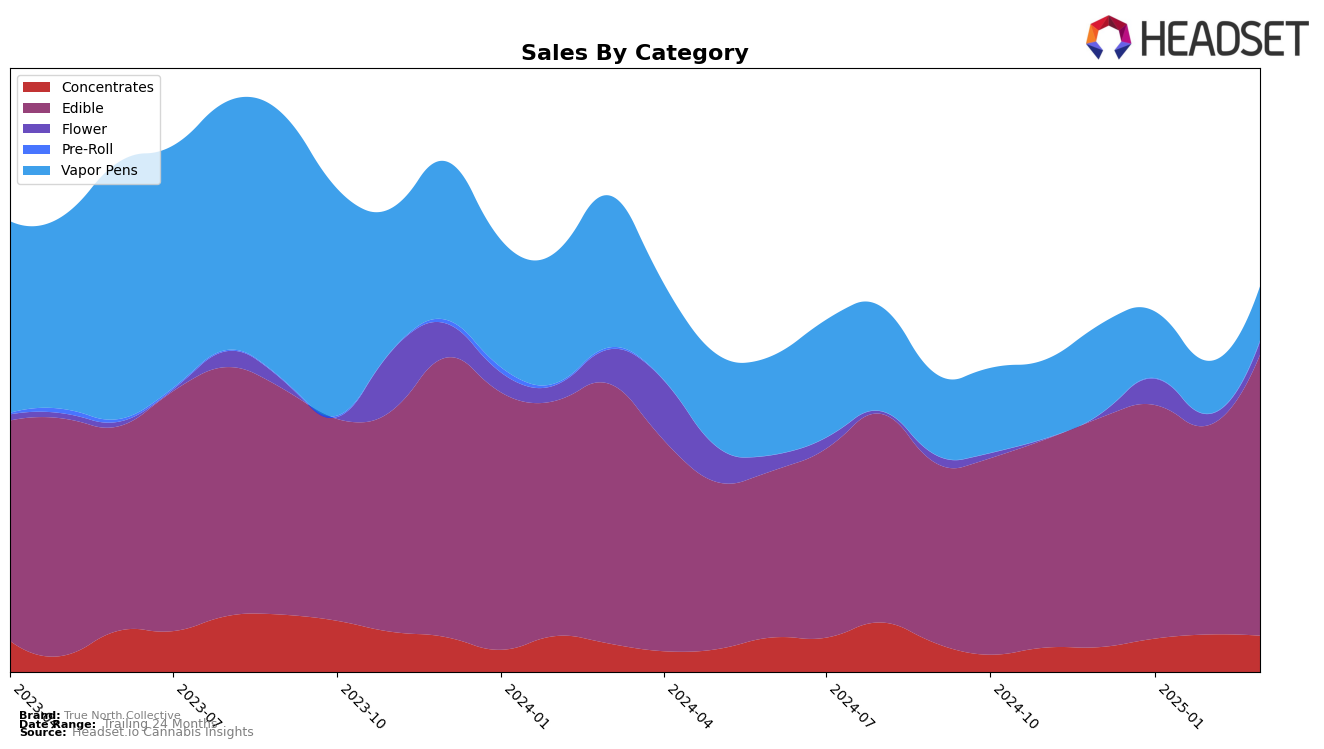

True North Collective has demonstrated varied performance across different product categories and regions. In the Michigan market, the brand's presence in the Concentrates category has seen a positive trend, climbing from a rank of 59 in December 2024 to 43 in February 2025, before settling back to 47 in March. This indicates a growing demand for their concentrates, although the slight dip in March suggests a competitive landscape. Meanwhile, their performance in the Edible category is particularly noteworthy, as they improved from a rank of 13 in December 2024 to 8 by March 2025, indicating strong consumer preference and effective market strategies in this category.

Conversely, True North Collective's trajectory in the Vapor Pens category in Michigan has been less favorable. The brand saw a decline from a rank of 42 in December 2024 to 55 by February 2025, where it remained through March. This suggests challenges in maintaining competitiveness or possibly a shift in consumer preferences away from their vapor pen offerings. Notably, their absence from the top 30 brands in certain categories in various states or provinces could be seen as a potential area for growth or a reflection of intense competition. Understanding these dynamics can provide valuable insights for stakeholders looking to navigate the evolving cannabis market.

Competitive Landscape

In the competitive landscape of the Michigan edible cannabis market, True North Collective has shown a notable upward trajectory in recent months. Starting from a rank of 13th in December 2024, the brand improved its position to 8th by March 2025, indicating a significant gain in market presence. This upward movement contrasts with brands like Play Cannabis, which experienced a decline from 5th to 9th place over the same period. Meanwhile, Wana maintained a relatively stable position, consistently ranking around 5th or 6th, while Detroit Edibles / Detroit Fudge Company fluctuated, ending at 10th in March. Interestingly, Good Tide also saw an improvement, rising from 9th to 7th. True North Collective's rise in rank is accompanied by a notable increase in sales, particularly in March, suggesting effective strategies in capturing consumer interest and expanding market share amidst a competitive environment.

Notable Products

In March 2025, the top-performing product from True North Collective was the One Hitter - Cherry Limeade Gummy, maintaining its lead from February with sales reaching 21,807. The One Hitter - Blueberry Lemon Haze Gummy secured the second spot, climbing up from its third-place position in February. The One Hitter - Orange Dreamsicle Gummy ranked third, dropping one position from the previous month. Notably, the One Hitter - Tutti Frutti Gummy entered the rankings for the first time, landing in fourth place. Electric Watermelon Gummies 4-Pack rounded out the top five, consistent with its February ranking.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.