Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

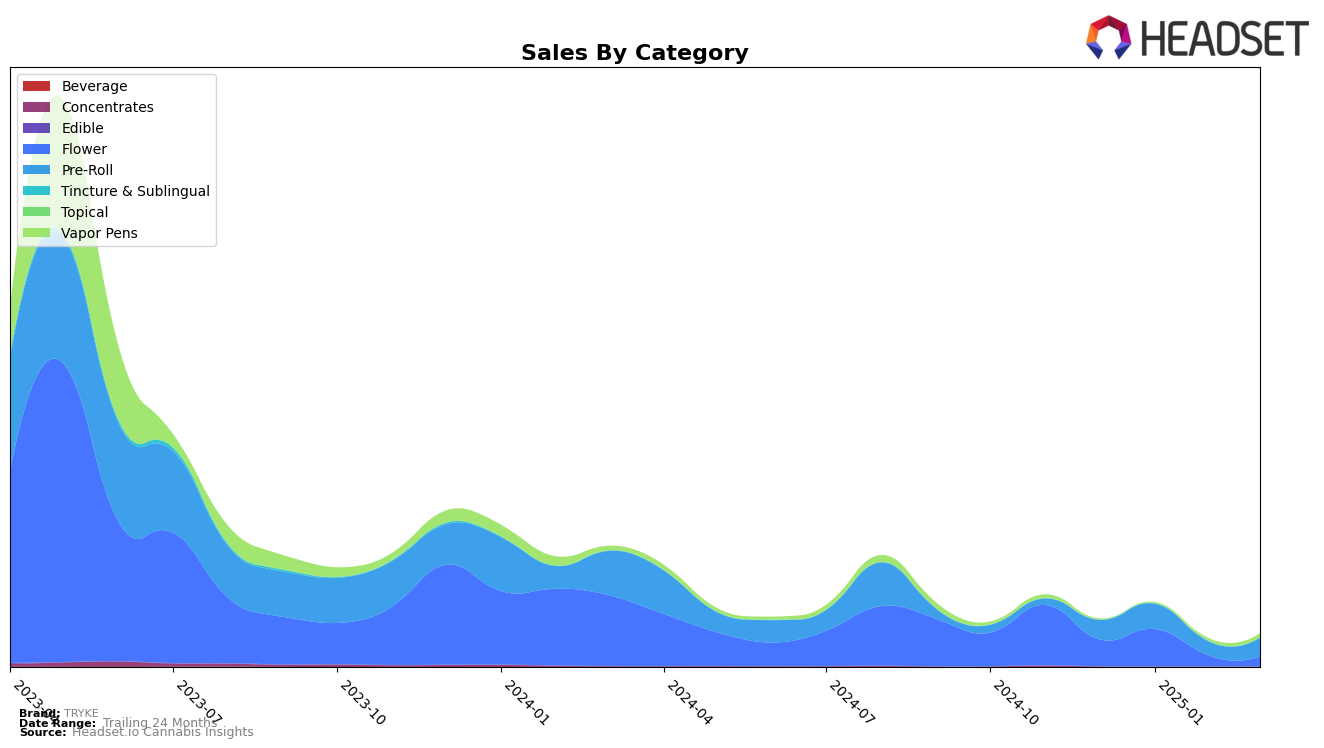

TRYKE's performance in the cannabis market shows varied results across different states and product categories. In Arizona, TRYKE's presence in the Flower category was not strong enough to secure a spot in the top 30 rankings from December 2024 through March 2025. This absence in the rankings could indicate a challenge in maintaining competitiveness in this specific market segment. On the other hand, in Nevada, TRYKE managed to stay within the top 30 in the Flower category in December 2024 and January 2025 but saw a notable drop out of the rankings by February 2025, before reappearing at rank 78 in March 2025. This fluctuation suggests a volatile market presence, potentially due to shifting consumer preferences or increased competition.

In Nevada's Pre-Roll category, TRYKE demonstrated a more consistent performance, maintaining a presence in the top 30 for most months, with a slight dip to rank 33 in February 2025 before recovering to rank 32 in March 2025. This indicates a relatively stable demand for TRYKE's Pre-Rolls, despite minor fluctuations. Conversely, TRYKE's entry into the Vapor Pens category in Nevada in March 2025 at rank 53 suggests an emerging presence that could be promising if the brand continues to focus on this segment. The data reflects TRYKE's strategic positioning in different categories and markets, highlighting areas of both strength and potential improvement.

Competitive Landscape

In the competitive landscape of Nevada's Pre-Roll category, TRYKE has experienced notable fluctuations in its ranking and sales, reflecting a dynamic market environment. Starting from December 2024, TRYKE was ranked 29th, showing a promising rise to 22nd in January 2025, before dropping to 33rd in February and slightly recovering to 32nd in March. This volatility contrasts with competitors like Pheno Exotic, which maintained a relatively stable position, peaking at 20th in February. Meanwhile, Doinks and Panna Extracts showed a downward trend in rankings, with Doinks falling from 25th in January to 37th by March, and Panna Extracts dropping from 28th to 35th in the same period. Notably, Lavi emerged in the rankings in February at 38th, climbing to 31st by March, indicating a potential new competitor on the rise. These shifts suggest that while TRYKE has faced challenges in maintaining its rank, the brand's sales performance, particularly the significant increase from December to January, indicates resilience and potential for growth amidst a competitive field.

Notable Products

In March 2025, TRYKE's top-performing product was Hasta Manana Infused Pre-Roll (1g), which climbed to the number one rank from a consistent second place in the previous months, with sales reaching 1427 units. Khalifa Kush Pre-Roll (1g) surged to second place from fourth in February, showing a significant increase in popularity. Purple Alien Infused Pre-Roll (1g) maintained a steady position, ranking third, down from its peak at the top in January. Khalifa Kush Distillate Cartridge (Half Gram) entered the rankings at fourth place, marking its first appearance. Lastly, Mr. Nasty Infused Pre-Roll (1g) rounded out the top five, debuting in the rankings this month.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.