Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

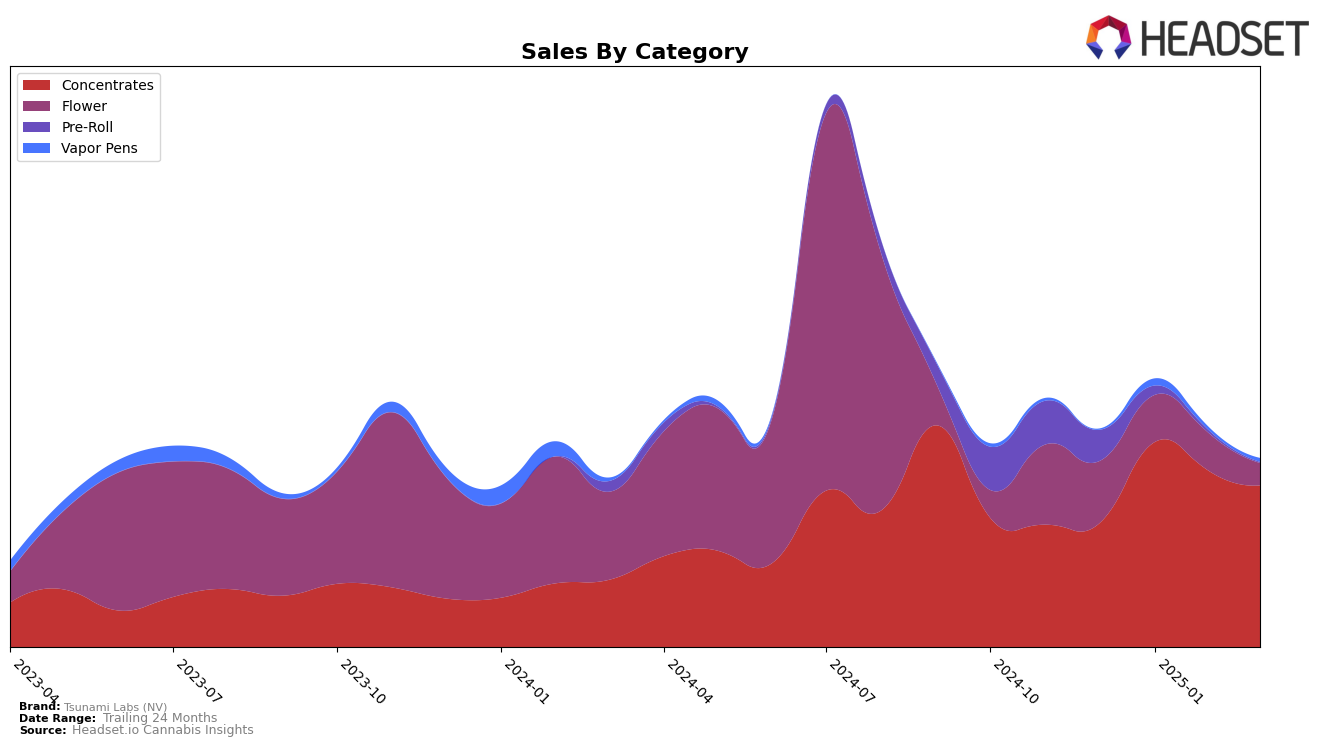

Tsunami Labs (NV) has demonstrated a solid performance in the Concentrates category within Nevada. The brand consistently maintained a top 10 position from December 2024 through March 2025, with its highest ranking at 6th place in January 2025. This upward movement from 10th in December 2024 suggests a strong market presence and consumer preference for their concentrate products. However, the brand's ranking experienced a slight decline to 8th place by March 2025, indicating a need to monitor competitive pressures or market dynamics that might be influencing these shifts.

In contrast, Tsunami Labs (NV) faced challenges in the Flower and Pre-Roll categories. Notably, their Flower products did not make it into the top 30 rankings in Nevada during the observed months, with their best position being 68th in December 2024. This suggests a significant gap in market penetration or consumer appeal in this category. Similarly, the Pre-Roll category saw a promising start with a 51st ranking in December 2024, but the absence of subsequent rankings indicates they did not maintain a competitive edge in this segment. This highlights potential areas for strategic improvement to bolster their market presence across these categories.

Competitive Landscape

In the competitive landscape of the Nevada concentrates market, Tsunami Labs (NV) has shown a dynamic performance, with its ranking fluctuating between 6th and 10th place from December 2024 to March 2025. This period saw Tsunami Labs (NV) climbing to 6th position in January 2025, indicating a significant boost in sales, although it slightly dropped to 8th by March 2025. Notably, Locals Only Concentrates emerged as a formidable competitor, jumping from 18th in December 2024 to 7th in January 2025, before stabilizing at 10th in March 2025. Meanwhile, TRENDI showed a consistent upward trajectory, surpassing Tsunami Labs (NV) in February 2025 by securing the 6th rank. Haze Cannabis Co. maintained a stronghold in the top 5 throughout the period, underscoring its dominance with consistently higher sales. The competitive shifts highlight the need for Tsunami Labs (NV) to innovate and strategize effectively to maintain and improve its market position amidst these dynamic competitors.

Notable Products

In March 2025, Moroccan Peaches Live Resin Badder (0.5g) emerged as the top-performing product for Tsunami Labs (NV), climbing from the second position in February to first place, with sales reaching 1126 units. Garlic Butter Live Resin Sugar (0.5g) debuted in the rankings at second place, indicating a strong market entry with 801 units sold. Kush Mints Live Resin Badder (0.5g) secured the third position after not being ranked in the previous months, showing a significant increase in popularity. Papaya Bomb (3.5g) saw a slight decline, moving from third in February to fourth in March, while Gelatti Live Resin Badder (0.5g) dropped to fifth place from its previous top position in December 2024. These shifts highlight a dynamic market for concentrates, with Moroccan Peaches Live Resin Badder (0.5g) leading the category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.