Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

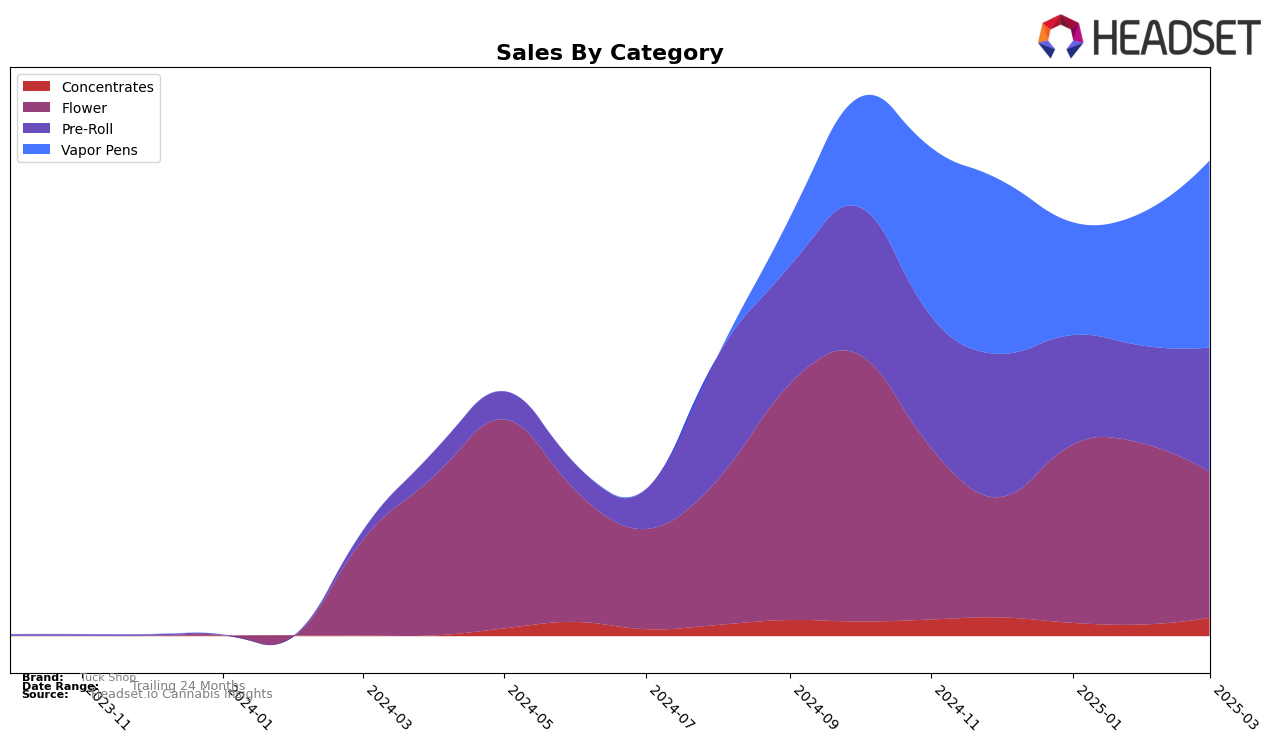

Tuck Shop has shown varied performance across different product categories and regions, reflecting a dynamic market presence. In Alberta, the brand's Flower category witnessed a significant climb from a rank of 85 in December 2024 to 39 in February 2025, before slightly dipping to 45 in March 2025. This indicates a strong initial growth phase followed by a stabilization period. On the other hand, in the Vapor Pens category, Tuck Shop maintained a more consistent upward trajectory, improving from rank 34 in December 2024 to 23 by March 2025, suggesting a sustained consumer interest and possibly effective marketing strategies or product innovations in this segment.

In Ontario, Tuck Shop's performance in the Concentrates category remained relatively stable, with a gradual improvement from rank 40 in December 2024 to 35 by March 2025. This steady climb, albeit slow, points to a consistent demand or a niche market appeal. However, the Flower category in Ontario experienced fluctuations, with ranks oscillating between 52 and 63 over the months, which might indicate competitive pressures or changing consumer preferences. Interestingly, the Vapor Pens category in Ontario also showed notable improvement, especially from February to March 2025, where the rank jumped from 47 to 33, possibly highlighting a rebound in consumer interest or strategic adjustments by the brand.

Competitive Landscape

In the competitive landscape of vapor pens in Ontario, Tuck Shop has experienced notable fluctuations in its market position from December 2024 to March 2025. Initially ranked 38th in December 2024, Tuck Shop saw a significant drop to 59th in January 2025, indicating a challenging start to the year. However, the brand demonstrated resilience by climbing back to 47th in February and further improving to 33rd in March. This recovery suggests a positive trend in sales performance, likely driven by strategic adjustments or new product offerings. In contrast, competitors like Trippy Sips maintained a more stable ranking, consistently hovering around the 30th position, which may reflect a steadier market presence. Meanwhile, Vortex Cannabis Inc. and Palmetto also showed some variability, but not as pronounced as Tuck Shop's. These dynamics highlight the competitive pressures and opportunities within the Ontario vapor pen market, emphasizing the importance of agility and innovation for Tuck Shop to sustain its upward trajectory.

Notable Products

In March 2025, Tuck Shop's top-performing product was the Ghost OG Pure Cured Resin Disposable (1g) in the Vapor Pens category, maintaining its consistent first-place ranking from previous months with sales of 8096 units. The Ghost OG Pre-Roll 7-Pack (3.5g) held steady in second place across all months, while the Simcoe Gas Pre-Roll 7-Pack (3.5g) remained in third place, except for a brief dip to fourth in January. The Ghost OG Pre-Roll (1g) showed a notable improvement, climbing from fifth place in February to fourth in March. Meanwhile, Zip (28g) in the Flower category experienced a slight decline, dropping from fourth in February to fifth in March.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.