Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

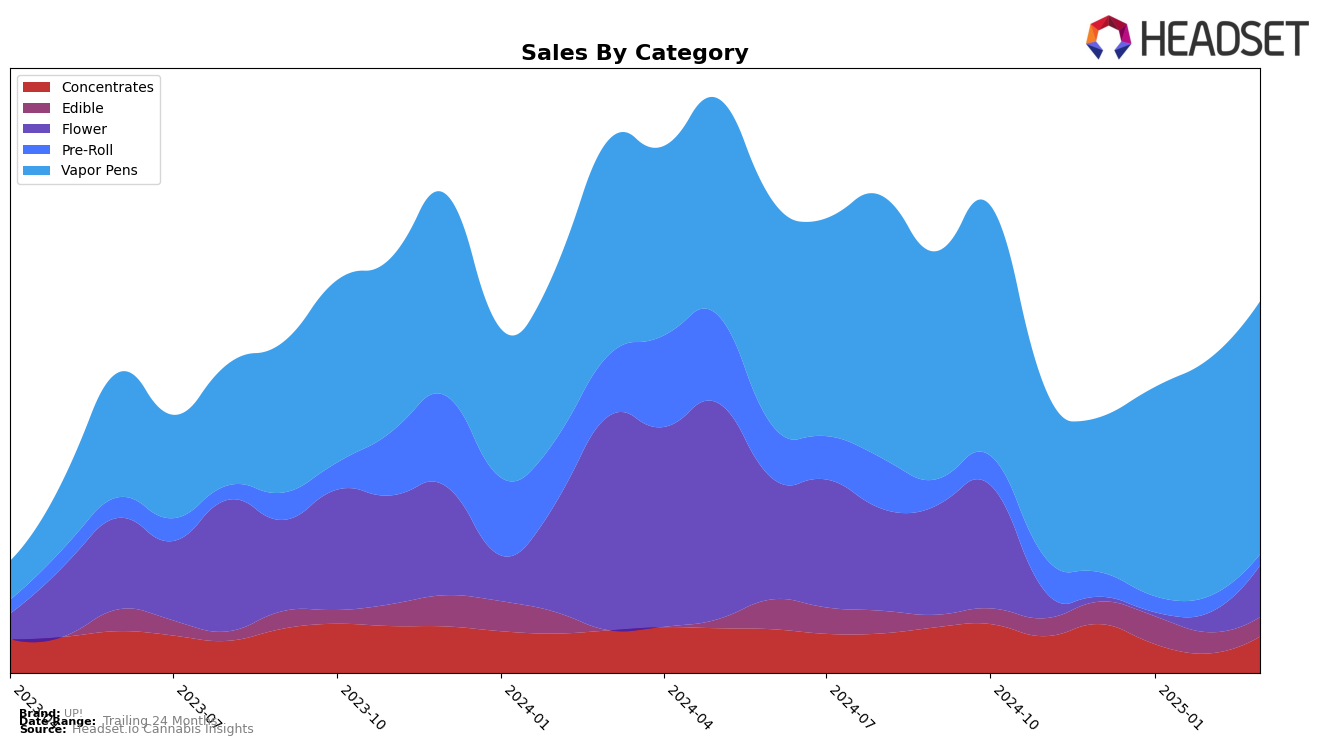

In the competitive landscape of California, UP! has demonstrated varying performance across different product categories. In the Concentrates category, UP! experienced a notable fluctuation in rankings, starting at 21st in December 2024, dropping out of the top 30 in January and February 2025, and rebounding to 27th in March 2025. This volatility suggests a challenging period for the brand in this segment, potentially driven by shifting consumer preferences or increased competition. Meanwhile, in the Edible category, UP! maintained a more stable presence, hovering around the 36th to 43rd positions from December 2024 to March 2025, indicating a consistent but modest market share. However, the Pre-Roll category paints a less favorable picture, where UP! was only ranked in December 2024 at 96th, failing to appear in the top 30 in subsequent months, which highlights a significant gap in market penetration or consumer interest.

Conversely, UP! has shown promising growth in the Vapor Pens category within California. The brand's ranking improved from 37th in December 2024 to 22nd by March 2025, reflecting a positive trajectory and possibly indicating successful marketing strategies or product innovations that resonate with consumers. This upward movement is further supported by a steady increase in sales over the same period, suggesting a strong demand for their products in this category. The contrasting performance across categories underscores the importance of strategic focus and market adaptation for UP!, as they navigate the diverse and evolving cannabis market landscape in California.

Competitive Landscape

In the California Vapor Pens category, UP! has shown a remarkable upward trajectory in the first quarter of 2025, moving from a rank of 37 in December 2024 to 22 by March 2025. This improvement in rank reflects a significant increase in market presence and consumer preference. Notably, UP! has surpassed Kurvana, which has been relatively stable but only reached the 20th rank in March 2025. Similarly, UP! has outpaced Punch Extracts / Punch Edibles and Micro Bar, both of which have not shown significant rank improvements. Although Sauce Essentials briefly overtook UP! in January and February, UP!'s consistent sales growth allowed it to reclaim a higher position by March. This competitive landscape indicates a positive trend for UP!, suggesting that its strategic initiatives in product development or marketing are effectively resonating with consumers, positioning it as a rising contender in the California Vapor Pens market.

Notable Products

In March 2025, the top-performing product for UP! was the Mango Kush Live Resin Cartridge (1g) in the Vapor Pens category, maintaining its position as the number one seller for three consecutive months with sales of 15,924 units. The SFV OG Live Resin Cartridge (1g) climbed to the second position from third place in February. The Skywalker OG Live Resin Cartridge (1g) secured the third spot, returning to the top three after being unranked in February. The Classic- Tropical Trainwreck Distillate Cartridge (1g) made its debut in the rankings, coming in at fourth place. Lastly, the Watermelon Z Live Resin Cartridge (1g) entered the rankings in fifth position, showing promising sales figures.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.