Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

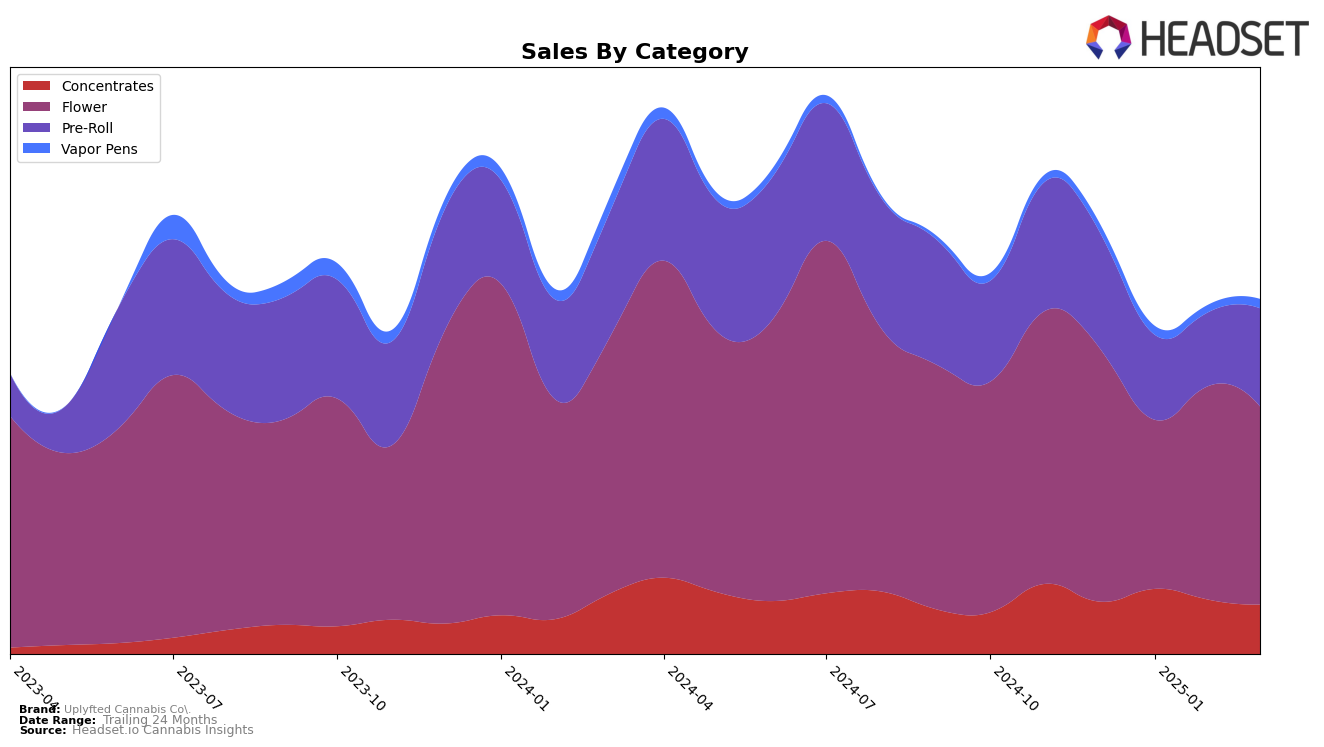

In the state of Michigan, Uplyfted Cannabis Co. has shown varied performance across different product categories. Notably, in the Concentrates category, the brand has managed to maintain its presence within the top 30 rankings, showing a slight improvement from 26th in December 2024 to 21st in January 2025, before slipping back to 29th by March 2025. This fluctuation indicates a volatile market position, yet the ability to stay within the top 30 suggests a degree of resilience. In contrast, the Flower category saw the brand fall out of the top 30 in January 2025, dropping to 51st, before recovering to 37th in February and then settling at 44th in March. This movement highlights potential challenges in maintaining a competitive edge in the Flower market.

The Pre-Roll category presents a different narrative, where Uplyfted Cannabis Co. has maintained a relatively stable ranking, hovering around the 28th to 32nd positions. This consistency suggests a steady demand for their Pre-Roll products, despite a dip in sales during February 2025. The brand's ability to remain in the top 30 throughout this period signifies a strong foothold in this particular category. However, the absence of rankings in other states or provinces could indicate areas for expansion or improvement. As Uplyfted Cannabis Co. navigates these market dynamics, understanding these trends will be crucial for strategic planning and growth.

Competitive Landscape

In the competitive landscape of the Michigan flower category, Uplyfted Cannabis Co. has experienced notable fluctuations in its ranking and sales performance from December 2024 to March 2025. Despite a dip in January 2025, where it fell to 51st place, Uplyfted Cannabis Co. managed to rebound to 44th place by March 2025. This recovery is significant when compared to competitors like Grown Rogue, which consistently remained outside the top 20, and North Cannabis Co., which saw a decline to 48th place in March 2025. Meanwhile, Garcia Hand Picked and Crude Boys showed a positive trend, with Garcia Hand Picked climbing to 43rd place and Crude Boys improving to 45th place by March 2025. These dynamics suggest that while Uplyfted Cannabis Co. faces stiff competition, its ability to bounce back in rankings indicates resilience and potential for growth amidst a challenging market environment.

Notable Products

In March 2025, Uplyfted Cannabis Co.'s top-performing product was Super Runtz Bulk in the Flower category, maintaining its number one rank from February with sales of 3019 units. Permanent Marker Pre-Roll 1g in the Pre-Roll category rose to the second position, improving from its third rank in February. Cap Junky Pre-Roll 1g entered the rankings at the third position, showcasing a strong debut. Banaconda Pre-Roll 1g, which previously held the top spot in December 2024, fell to fourth place by March. Canal St. Runtz Pre-Roll 1g debuted in the rankings in March, capturing the fifth position.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.