Feb-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

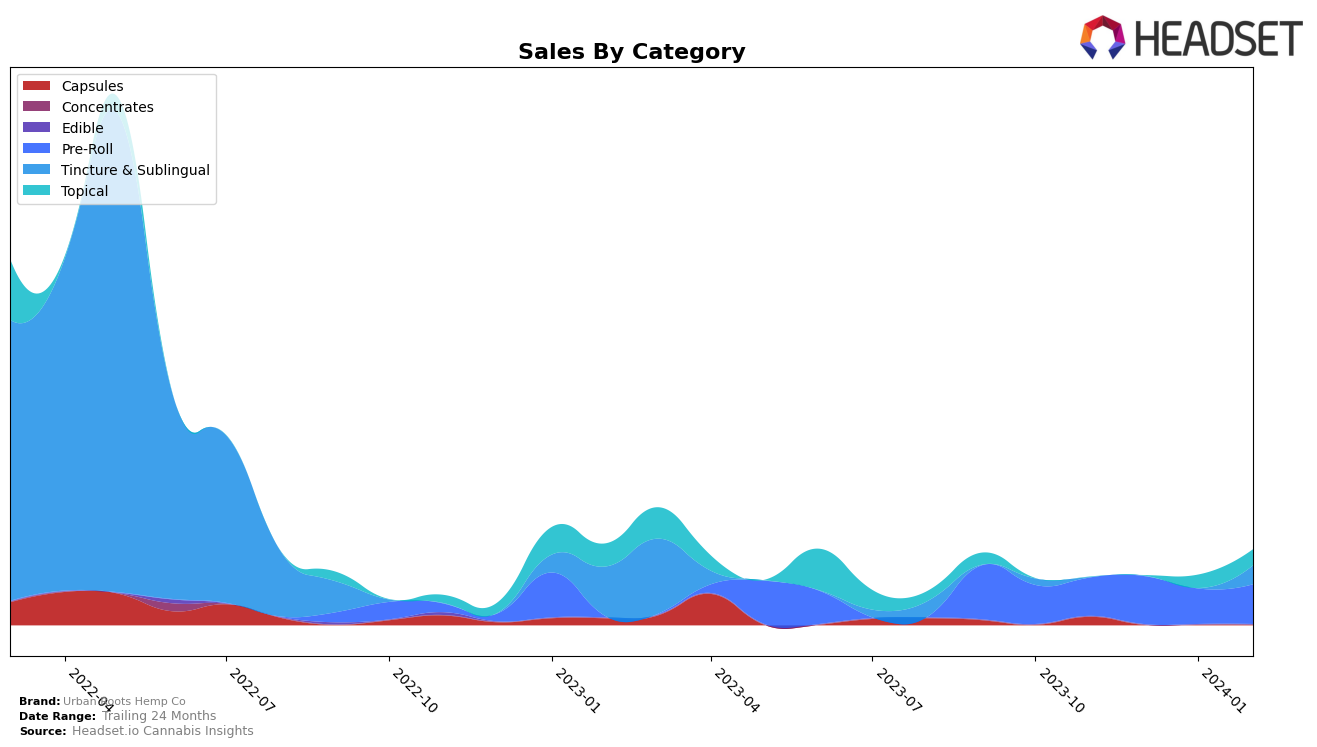

In Michigan, Urban Roots Hemp Co has shown a diverse presence across multiple cannabis product categories, indicating a broad market strategy. Notably, their Capsules category ranked 10th in November 2023, a position they did not maintain in the subsequent months, as evidenced by the absence of ranking data for December 2023 through February 2024. This drop-off could suggest a fluctuation in consumer demand or increased competition. However, their entry into the Tincture & Sublingual category in February 2024, securing the 23rd rank, alongside a notable sales figure of 465 units, indicates a strategic pivot or expansion in product offerings. This movement could be seen as an attempt to capture a wider market share or to compensate for the performance in other categories.

The performance of Urban Roots Hemp Co in the Topical category within Michigan illustrates a positive trajectory, improving from a rank of 31st in January 2024 to 27th in February 2024. This upward movement, coupled with an increase in sales from 327 to 393 units over the same period, suggests growing consumer interest or effective marketing strategies in this segment. The absence of ranking data for the Capsules category in the months following November 2023, juxtaposed with the successful introduction and ranking improvement in the Tincture & Sublingual and Topical categories, respectively, highlights a dynamic and potentially adaptive market strategy by Urban Roots Hemp Co. Such trends offer a glimpse into the brand's performance and strategic adjustments, though they represent just a fraction of the broader market dynamics at play.

Competitive Landscape

In the competitive landscape of the Tincture & Sublingual category in Michigan, Urban Roots Hemp Co has shown a notable entry into the market, securing a rank of 23rd in February 2024. This is a significant achievement considering the brand did not rank in the top 20 in the preceding months. Competitors such as CBD Living and Apothecare have shown fluctuations in their rankings, with CBD Living experiencing a notable drop from 14th in November 2023 to 22nd in February 2024, and Apothecare maintaining a more stable yet declining position from 15th to 21st over the same period. Another competitor, Bossy, has also seen a decline, barely maintaining its presence in the rankings from 22nd in November 2023 to 24th in February 2024. Urban Roots Hemp Co's entry and positioning indicate a potential shift in consumer preferences or effective market strategies that could disrupt the current standings if the trend continues. This dynamic suggests that Urban Roots Hemp Co, despite being a newer entrant, is positioned to challenge established brands if it continues to gain traction in the Michigan market.

Notable Products

In February 2024, Urban Roots Hemp Co.'s top-selling product was the CBD Runtz Pre-Roll 3-Pack (2g) within the Pre-Roll category, maintaining its previous month's rank with impressive sales of 79 units. Following closely was the CBD Sour Haze Pre-Roll 3-Pack (2g), also in the Pre-Roll category, which moved from the top position in January to second place in February, marking a notable shift in consumer preference within the same category. New entries into the top products list include the CBD Large Breed Peanut Butter Pet Tincture (600mg CBD, 30ml) and the CBD Freeze Cold Therapy Muscle Relief Lotion (500mg CBD, 150ml, 5oz), ranking third and fourth respectively, indicating a diversification in the types of products gaining popularity. The CBD Sleep Capsules 30-Pack (750mg CBD) dropped out of the top rankings since January, highlighting a shift in consumer focus towards other categories. This analysis underscores the dynamic nature of product popularity and the importance of monitoring sales trends across different categories for Urban Roots Hemp Co.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.