Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

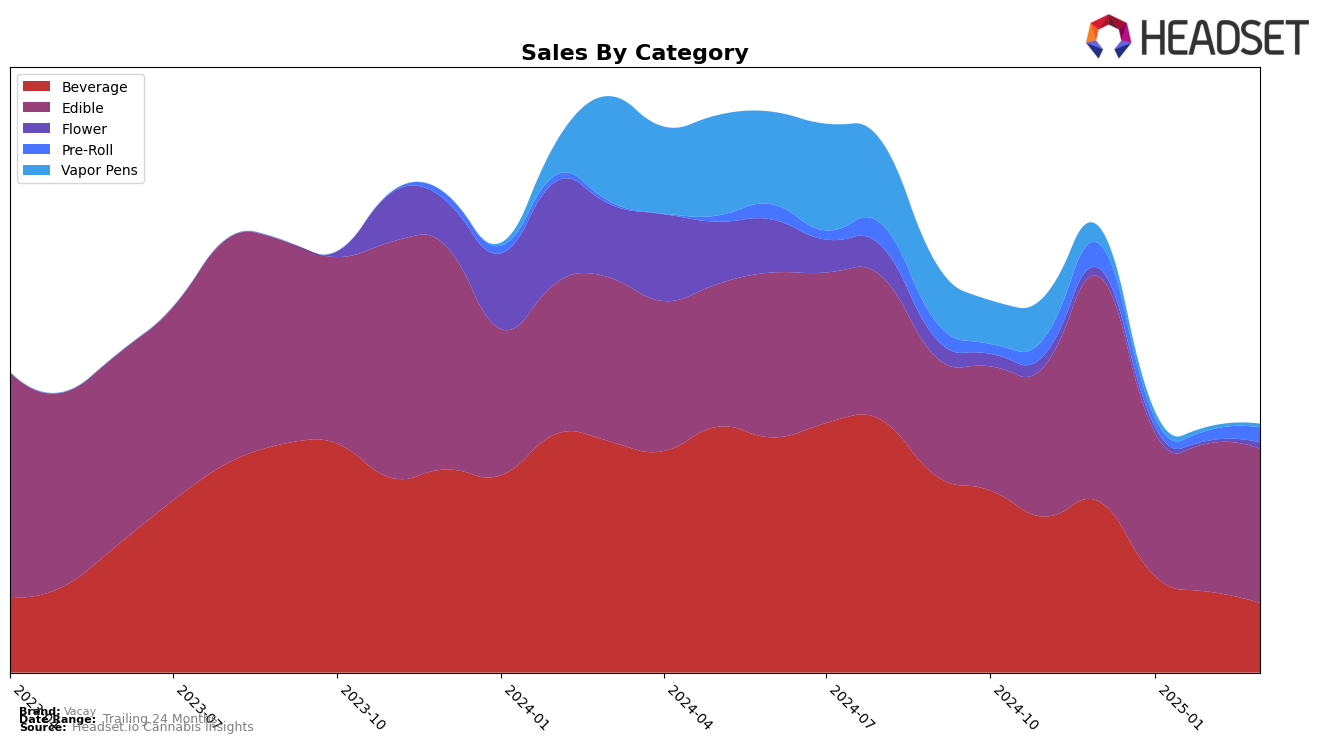

Vacay has shown varied performance across different Canadian provinces and product categories, signaling both opportunities and challenges. In Alberta, the brand has consistently maintained its position in the Edible category, holding the 24th rank from January to March 2025, a slight improvement from December 2024 when it was ranked 27th. This steady presence in the top 30 suggests a stable demand for their edibles in Alberta. In contrast, in British Columbia, Vacay experienced minor fluctuations in their ranking within the Edible category, moving from 16th in December 2024 to 18th in March 2025, indicating a slight decline in their competitive standing despite a peak in February 2025. This could be an area for potential strategic focus to regain their earlier position.

In Ontario, Vacay's performance has been mixed across categories. The Beverage category saw a notable decline, with the brand dropping from the 13th rank in December 2024 to the 22nd rank by March 2025. This downward trend could be indicative of increased competition or shifting consumer preferences. Meanwhile, in the Edible category, Vacay maintained a relatively stable ranking, fluctuating slightly between 21st and 22nd place over the same period. This consistency in the Edible category, despite the challenges in Beverages, suggests a loyal consumer base or effective product offerings that continue to resonate with Ontario consumers. Nonetheless, the absence from the top 30 in other potential categories could be seen as a missed opportunity for expansion.

Competitive Landscape

In the Ontario edible category, Vacay has experienced fluctuations in its competitive positioning from December 2024 to March 2025. Starting at rank 21 in December, Vacay slipped to 22 in January, briefly regained its position at 21 in February, and then fell back to 22 in March. This movement indicates a competitive struggle, particularly against brands like Lord Jones, which consistently maintained a solid rank of 20 throughout the period. Despite these rank changes, Vacay's sales showed resilience, with a notable increase in March 2025 compared to February, suggesting a potential recovery or strategic adjustment. Meanwhile, Kinloch Wellness displayed a similar rank fluctuation but ended March with higher sales than Vacay, indicating strong market performance. Brands like Spot and Indiva remained lower in rank but are still relevant competitors. These dynamics highlight the competitive pressure Vacay faces and the necessity for strategic initiatives to improve its market position and sales trajectory in the Ontario edible market.

Notable Products

In March 2025, Vacay's top-performing product was Peanut Butter Chocolate Cup (10mg), maintaining its consistent number one rank since December 2024, with sales reaching 7,594 units. The CBD:THC:CBG 3:1:1 Strawberry Pineapple Fizz Soda (7.5mg CBD, 2.5mg THC, 355ml) held steady at the second position, mirroring its rank from the previous two months. Pecan Cluster Chocolate Caramel (10mg) remained in third place, showing a slight increase in sales compared to February 2025. The CBD/THC 1:1 Island Punch Soda (10mg CBD, 10mg THC, 355ml) retained its fourth position, although its sales figures have significantly decreased since December 2024. The newly ranked CBD:CBN:THC 3:3:1 Blackberry Lavender Chews 4-Pack (30mg CBD, 30mg CBN, 10mg THC) entered the rankings in February and held the fifth position in March 2025.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.