Nov-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

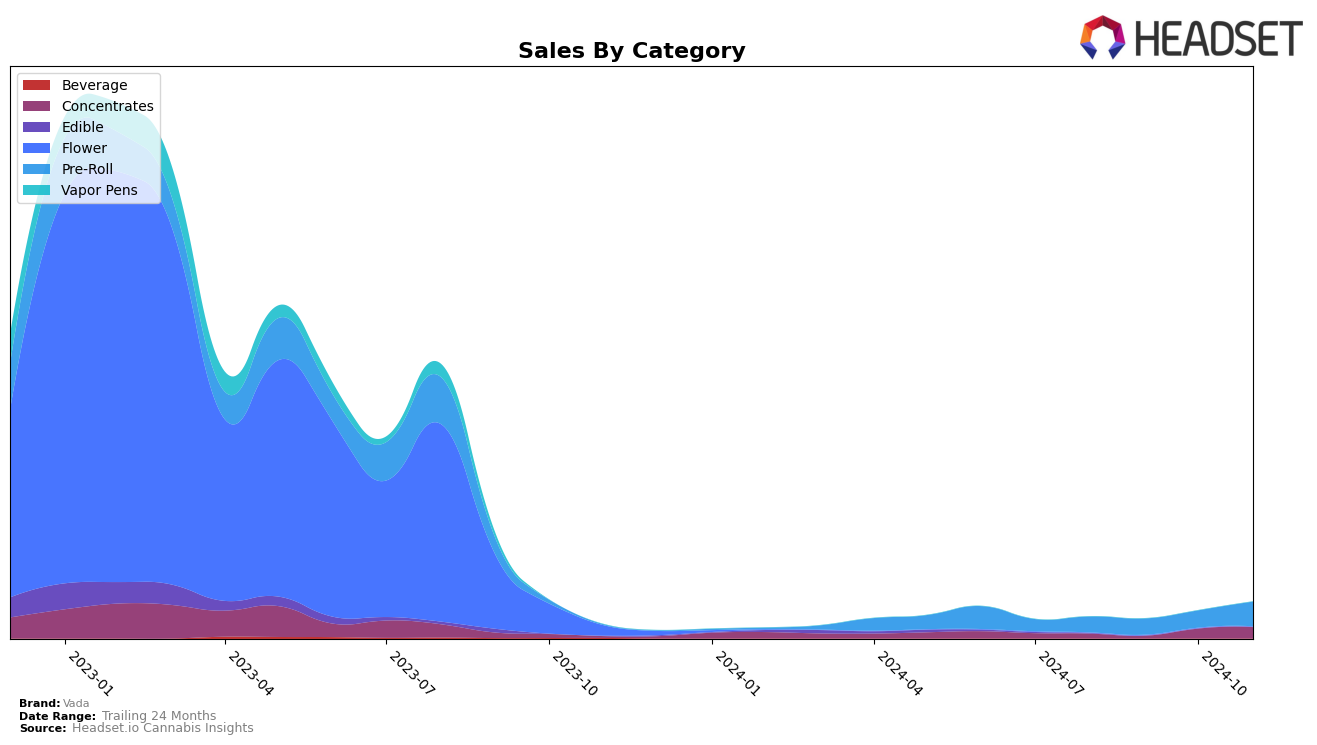

In the state of Nevada, Vada has shown noteworthy progress in the Concentrates category. After not ranking in the top 30 for August and September 2024, Vada made a significant entry at rank 25 in October and climbed further to rank 21 by November. This upward trajectory indicates a growing acceptance and demand for Vada's Concentrates products in the Nevada market. The sales figures support this trend, showing a positive increase over the months, suggesting that Vada is successfully capturing consumer interest and expanding its market share in this category.

In contrast, Vada's performance in the Pre-Roll category in Nevada has been more consistent with a steady climb in rankings. Starting at rank 52 in August, the brand improved its position to rank 33 by November. This consistent rise, coupled with an increase in sales, demonstrates Vada's strengthening presence in the Pre-Roll market. However, the fact that Vada was not in the top 30 in August highlights that while progress is being made, there is still room for growth and improvement to secure a more dominant position in this category.

Competitive Landscape

In the Nevada Pre-Roll category, Vada has shown a notable upward trend in its ranking and sales performance over the past few months. From August to November 2024, Vada improved its rank from 52nd to 33rd, indicating a significant climb in market position. This positive trajectory is further emphasized by a steady increase in sales, culminating in a substantial boost in November. In contrast, competitors such as Matrix NV and High Heads have experienced declines, with Matrix NV dropping from 31st to 43rd and High Heads falling from 13th to 38th. Meanwhile, Summa Cannabis maintained a stable position at 29th, and Spiked Flamingo saw fluctuations, peaking at 14th before descending to 28th. These dynamics suggest that Vada's strategic initiatives might be effectively capturing market share from its competitors, positioning it as a rising player in the Nevada Pre-Roll market.

Notable Products

In November 2024, Vada's top-performing product was Breakfast Cereal Pre-Roll 2-pack (1g) in the Pre-Roll category, which climbed to the number 1 rank with sales figures reaching 619 units. OG Nasty Badder (1g) in the Concentrates category made a significant entry into the rankings, securing the 2nd position. Space Admiral Crumble (1g) followed closely in the Concentrates category at rank 3. White Widow Pre-Roll 2-Pack (1g) saw a decline, moving from the top spot in October to 4th place in November. Meanwhile, Jack Herer Badder (0.5g) maintained its consistency, holding steady at the 5th rank for two consecutive months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.