Mar-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

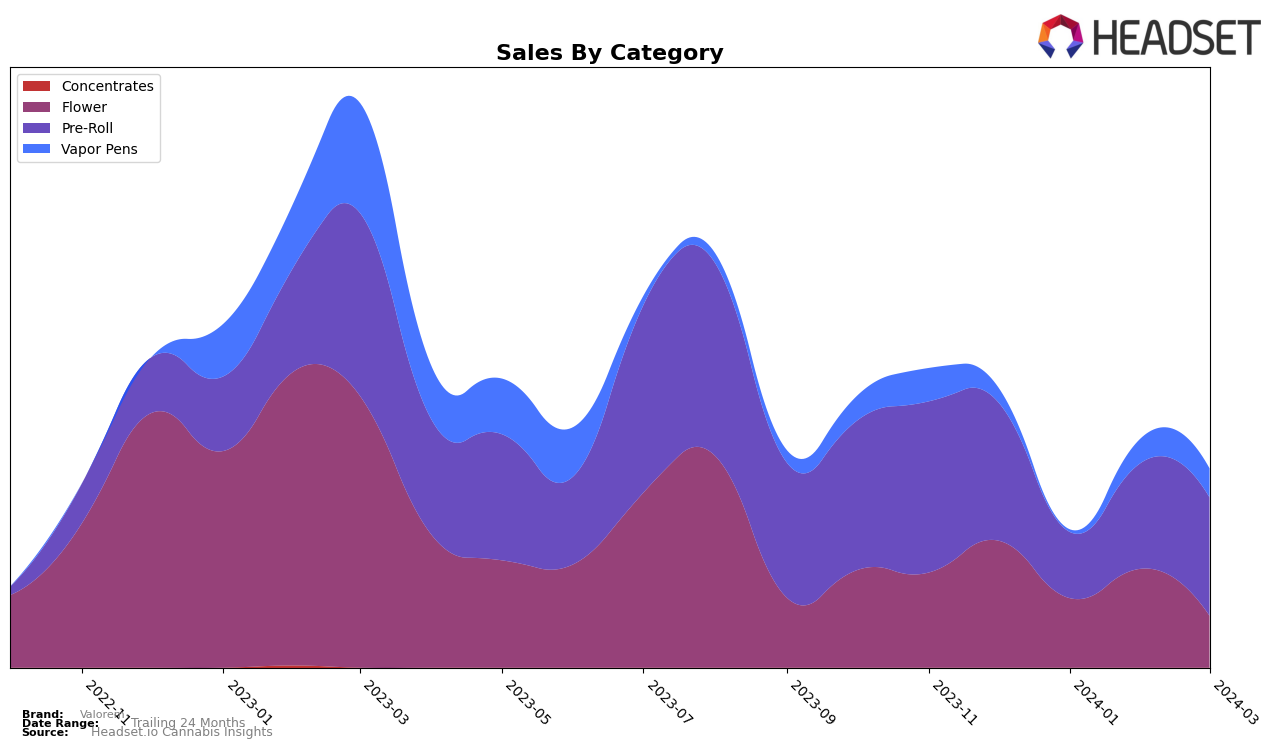

In Massachusetts, Valorem's performance across different cannabis product categories presents a mixed bag of results, indicative of fluctuating market dynamics and consumer preferences. The brand's Flower category witnessed a notable decline in rankings from December 2023 to March 2024, moving from 54th to 74th place, which might suggest a significant challenge in maintaining its market share amidst stiff competition or changing consumer tastes. This downward trajectory is mirrored in sales figures, with a peak in December 2023 at $181,145, followed by a substantial drop to $73,866 by March 2024. Conversely, the Pre-Roll category tells a different story; despite some volatility in rankings, Valorem managed to improve its position from 23rd in December to 28th in March, accompanied by a remarkable sales increase from $197,208 to $168,663 over the same period. This resilience in the Pre-Roll segment could indicate a solid consumer base and effective market strategies in that category.

However, the Vapor Pens category for Valorem in Massachusetts reveals an intriguing pattern of absence and recovery. The brand did not rank in the top 30 for January 2024, which is a significant concern as it implies a complete loss of market visibility during this period. Despite this setback, Valorem managed to claw back to the 56th position in both February and March 2024. This recovery, while still placing the brand in the lower tier of the market, demonstrates resilience and perhaps a strategic pivot that needs to be closely watched in subsequent months. Sales in this category saw an uptick from $20,962 in December 2023 to $41,167 in March 2024, suggesting that despite the ranking challenges, there is a growing consumer interest or effective promotional efforts that are translating into increased revenue. This dichotomy between ranking performance and sales growth in the Vapor Pens category could offer valuable insights into market dynamics and consumer behavior within the Massachusetts cannabis industry.

Competitive Landscape

In the competitive landscape of the Pre-Roll category in Massachusetts, Valorem has experienced notable fluctuations in its market positioning from December 2023 to March 2024, moving from 23rd to 28th rank. This shift indicates a challenging period for Valorem, especially when considering the performance of its competitors. For instance, Harbor House Collective showed a remarkable improvement, climbing from 21st to 13th rank before slightly dropping to 27th, yet still closing with higher sales in March compared to Valorem. Similarly, Garden Remedies and El Blunto maintained more stable rankings and sales figures, with Garden Remedies showing a consistent upward trend in sales despite a slight rank drop. Notably, RiverRun Gardens, despite starting from a lower base, demonstrated significant sales growth, surpassing Valorem in March 2024 sales. These dynamics suggest that while Valorem faces stiff competition, there are opportunities for recovery and growth if it can leverage market insights and adjust its strategies accordingly.

Notable Products

In March 2024, Valorem's top-performing product was the Runtz OG Pre-Roll (1g) in the Pre-Roll category, maintaining its number one position from February 2024 with impressive sales of 3986 units. Following closely, the Sherb Cream Pie Pre-Roll (1g) secured the second rank, marking its debut on the sales chart for the year. The Modified Grapes Pre-Roll (1g) came in third, also making its first appearance in the 2024 rankings. Notably, the Violet Vixen Pre-Roll (1g) held onto the fourth spot from February, showing consistent consumer preference. Lastly, Zweet Inzanity Pre-Roll (1g) saw a decline, dropping from the third position in December 2023 to fifth in March 2024, indicating a shift in consumer tastes within Valorem's Pre-Roll offerings.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.