Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

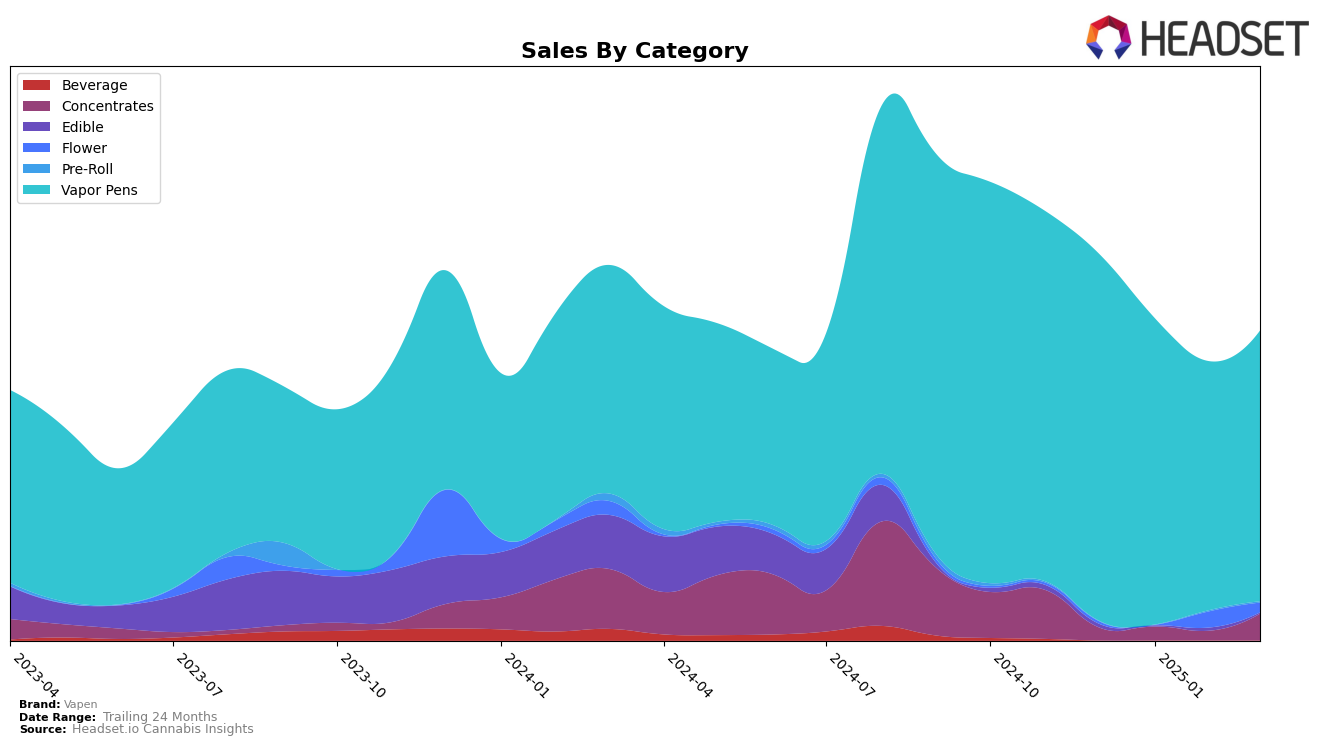

In Arizona, Vapen's performance in the Concentrates category has seen a decline, as it dropped out of the top 30 brands by March 2025, indicating a potential loss of market share. This contrasts with their performance in the Vapor Pens category, where Vapen maintained a presence in the rankings, although fluctuating between positions 67 in December 2024 and 70 in March 2025. The slight improvement from February to March suggests a potential recovery or stabilization in this segment. Despite these movements, the absence from the top 30 in Concentrates might be a strategic area for Vapen to focus on in the coming months.

In Ohio, Vapen shows a more dynamic performance across categories. Notably, their Vapor Pens category maintained a steady position at rank 14 from January to March 2025, reflecting consistent consumer demand. Meanwhile, in the Concentrates category, Vapen improved its rank from being unlisted in February to 16th place by March, which marks a significant upward trajectory. However, in the Flower category, Vapen's rank slipped from 44 in February to 51 in March, indicating some competitive pressure or shifting consumer preferences. These mixed performances across the categories highlight the varying market dynamics Vapen faces in Ohio.

Competitive Landscape

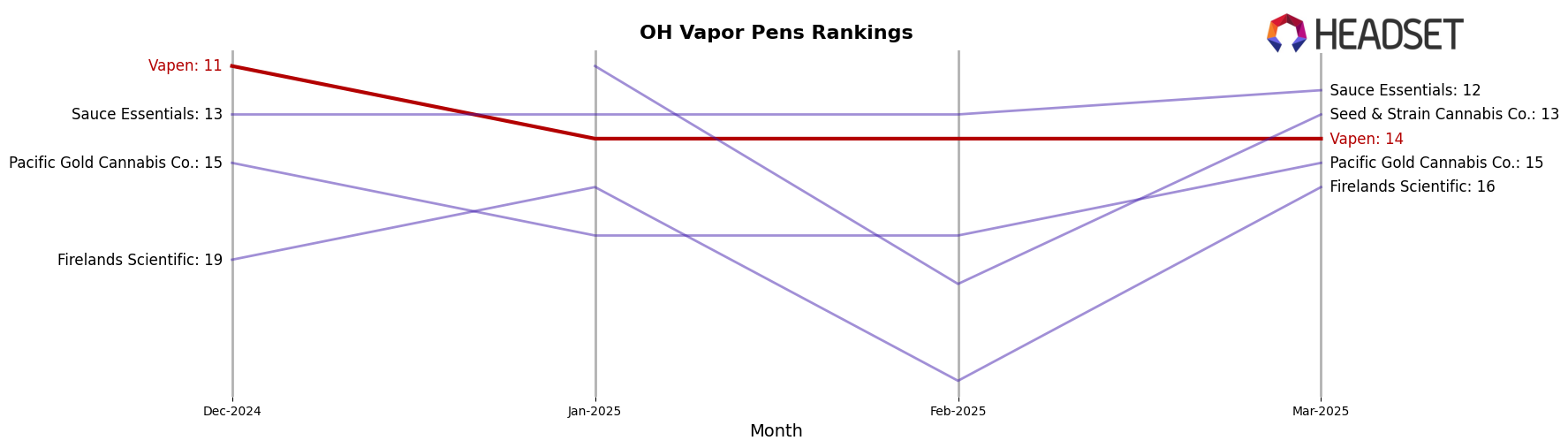

In the competitive landscape of vapor pens in Ohio, Vapen has demonstrated a relatively stable performance from December 2024 to March 2025, maintaining a consistent rank of 14th place for three consecutive months after slipping from 11th in December. This suggests a need for strategic adjustments to regain its earlier position. Notably, Sauce Essentials has shown resilience, consistently ranking just above Vapen and improving to 12th place by March 2025. Meanwhile, Seed & Strain Cannabis Co. experienced fluctuations, dropping out of the top 20 in December but recovering to 13th place by March, indicating potential volatility in their market strategy. Pacific Gold Cannabis Co. maintained a lower rank, oscillating between 15th and 18th, which might not pose an immediate threat to Vapen but highlights the competitive pressure in the middle tier of the market. These dynamics suggest that while Vapen holds a solid position, there is room for improvement to climb the ranks and increase sales amidst strong competition.

Notable Products

In March 2025, the top-performing product for Vapen was the Golden Snake Distillate Cartridge (1g), taking the first rank with notable sales of 1871 units. Following closely, the Peach Rings Distillate Cartridge (1g) secured the second position, maintaining its high rank from January 2025. The King Louis XIII Distillate Cartridge (1g) moved from fourth in January to third in March, showing consistent improvement in rankings. The Watermelon Splash Distillate Cartridge (0.5g) rose to fourth place, having been fifth in February. Lastly, the Blueberry Cookie Distillate Cartridge (0.84g) entered the rankings in March, securing the fifth spot.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.