Dec-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

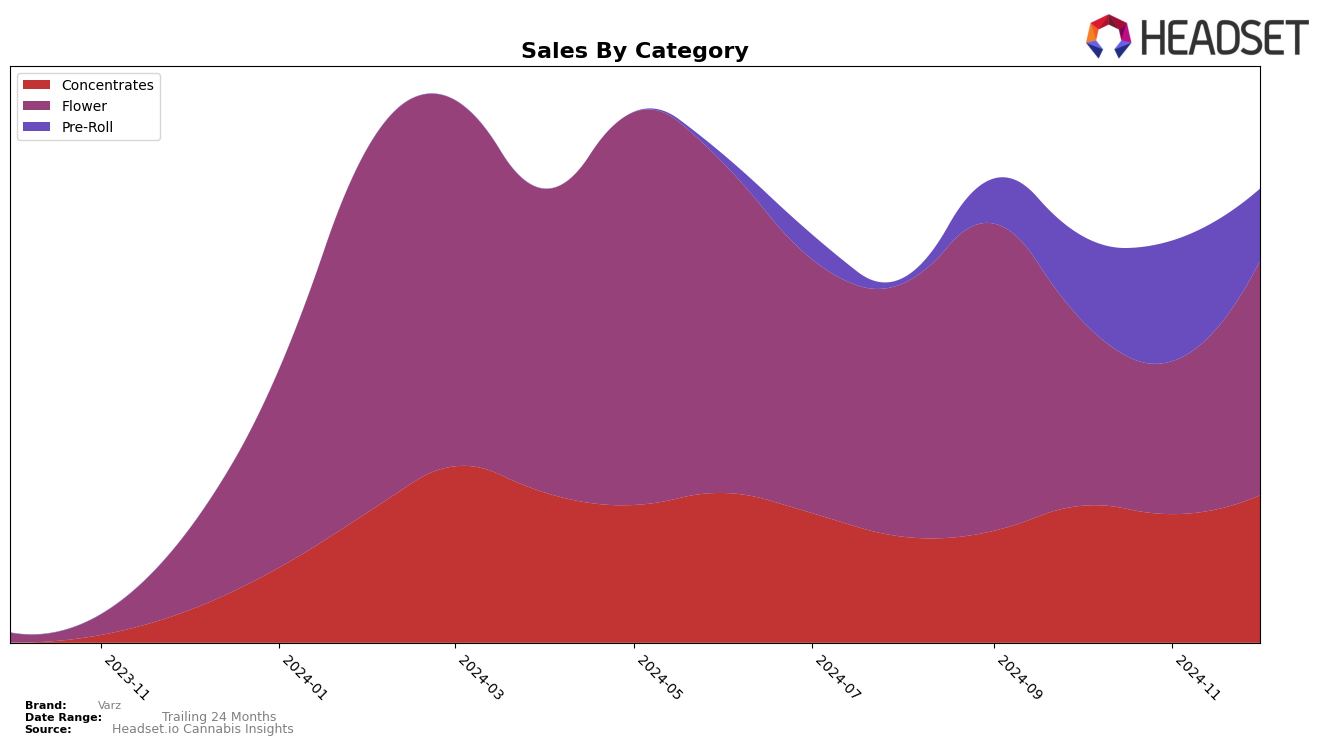

Varz has shown a noteworthy performance in the Arizona market across several categories. In the Concentrates category, Varz made a significant leap from rank 35 in September 2024 to rank 26 by December 2024, indicating a positive upward trend in sales and market presence. This improvement is reflected in their sales figures, which exhibit a steady increase over the months. However, the Flower category presents a more volatile performance, with Varz not making it to the top 30 in any of the months analyzed. The brand faced challenges in maintaining a stable rank, fluctuating from 44 in September to 45 in December, showing some recovery after a dip in October and November.

The Pre-Roll category in Arizona paints a different picture for Varz, where the brand made commendable progress initially, moving from rank 71 in September to 43 in November, before slipping back to 52 by December. This fluctuation suggests a competitive landscape in the Pre-Roll market, where Varz has managed to gain traction but faces challenges in sustaining its position. The brand's ability to climb into the top 30 in the Concentrates category, while not achieving the same in Flower and Pre-Roll, highlights areas of strength and potential growth, as well as opportunities for strategic focus to improve their standing in less dominant categories.

Competitive Landscape

In the competitive landscape of the Arizona Flower category, Varz has experienced notable fluctuations in its market position over the last few months. Starting at rank 44 in September 2024, Varz saw a decline to rank 65 in November before recovering to rank 45 in December. This trajectory suggests a volatile market presence, potentially influenced by competitive dynamics. For instance, iLava consistently improved its rank from 66 in October to 55 in December, indicating a steady upward trend in sales performance. Meanwhile, Triple Seven experienced a decline from rank 23 in September to 44 in December, reflecting a significant decrease in sales. Roll One and Best have shown more stability, with Roll One improving its rank to 41 in December and Best fluctuating slightly but maintaining a position around the mid-50s. These dynamics highlight the competitive pressures Varz faces, with its sales performance and rank closely mirroring the broader shifts among its competitors.

Notable Products

In December 2024, the top-performing product for Varz was Gorilla Dosha 3.5g in the Flower category, which ascended to the first rank with notable sales of 835 units. Detroit Muscle Pre-Roll 1g secured the second position, marking its debut in the rankings with impressive sales figures. Yahemi Pre-Roll 1g, which was ranked second in November, fell to the third position in December with 491 units sold. Black Ice Pre-Roll 1g entered the rankings in fourth place, while Black Ice Live Hash Rosin 1g rounded out the top five. Notably, Gorilla Dosha 3.5g showed significant improvement from its fourth rank in September to the top spot in December, highlighting its growing popularity.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.