Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

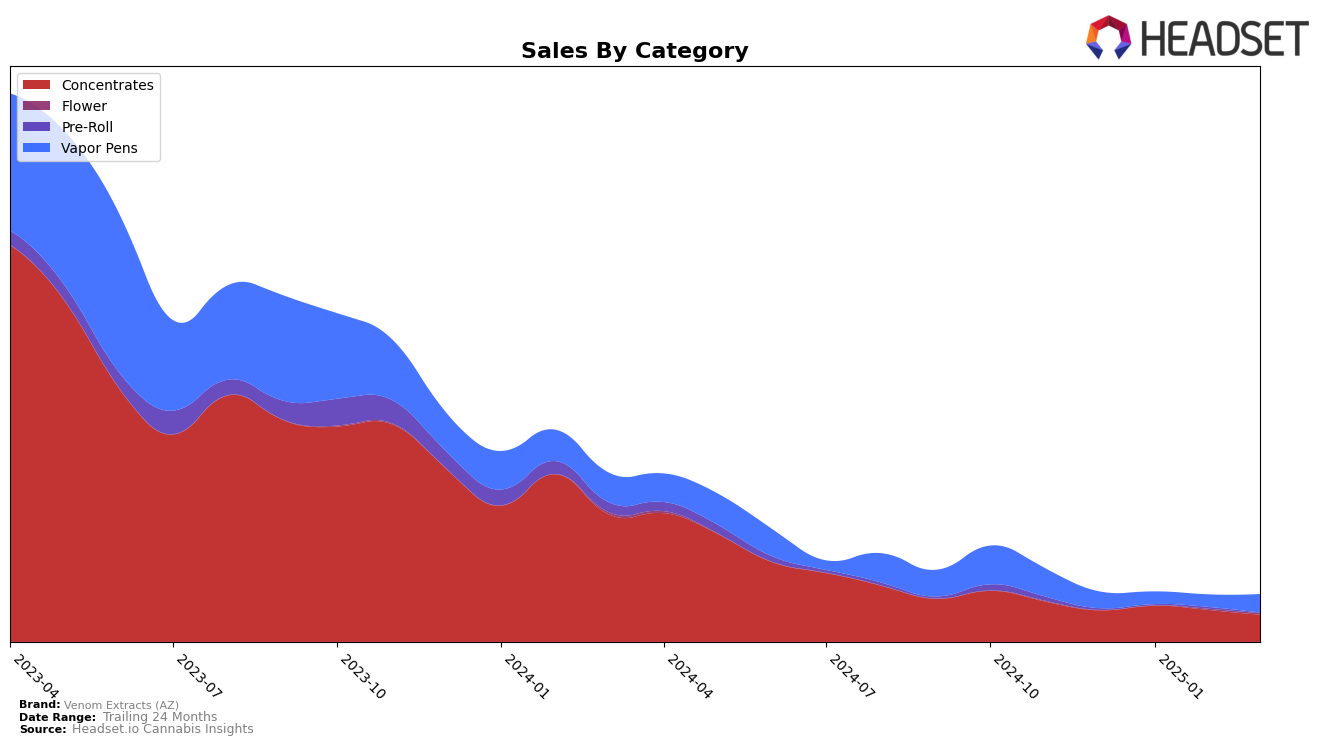

In the Arizona cannabis market, Venom Extracts (AZ) has shown a consistent performance in the Concentrates category. The brand maintained a steady presence within the top 15, with rankings fluctuating slightly from 14th in December 2024 to 15th by March 2025. This stability suggests a solid consumer base and consistent demand for their products. However, the sales figures indicate a downward trend from January to March, with a noticeable decline in March 2025. This could imply seasonal variations or increased competition, signaling a potential area for strategic focus to regain momentum.

Conversely, in the Vapor Pens category, Venom Extracts (AZ) experienced more volatility in their rankings, starting at 48th in December 2024, dropping to 56th in February 2025, and then recovering to 46th by March 2025. This fluctuation suggests a more competitive landscape or shifts in consumer preferences that the brand is navigating. Despite these movements, the brand recorded an increase in sales from February to March, indicating a positive response to potential adjustments in their marketing or product offerings. However, the fact that they were not in the top 30 brands during this period highlights room for growth and the need for targeted strategies to improve their standing in the Vapor Pens market.

Competitive Landscape

In the Arizona concentrates market, Venom Extracts (AZ) has experienced a slight decline in its ranking, moving from 13th in January 2025 to 15th by March 2025. This shift is notable as competitors such as Shango and Tru Infusion have shown fluctuations in their rankings, with Shango climbing from 21st in February to 13th in March, indicating a strong upward trend. Meanwhile, Tru Infusion maintained a relatively stable position, despite a slight dip from 11th in February to 14th in March. Goldsmith Extracts and Earth Extracts have also seen varied performance, with Goldsmith Extracts dropping to 18th in March and Earth Extracts improving to 17th. These dynamics suggest that while Venom Extracts (AZ) remains a key player, it faces increasing competition from brands that are either stabilizing or improving their market positions, which could impact its sales trajectory if the trend continues.

Notable Products

In March 2025, the top-performing product for Venom Extracts (AZ) was Bangers and MAC Shatter (1g) in the Concentrates category, achieving the number one rank with sales of 526 units. The SPK Distillate Syringe (1g), also in Concentrates, secured the second position. Laughing Gas Distillate Cartridge (1g) in Vapor Pens maintained a strong presence, ranking third, although it dropped from its second-place position in February 2025. Sex Panther Distillate Cartridge (1g) in Vapor Pens climbed to fourth place from its previous fifth-place position in December 2024. The Blueberry Blast Distillate Syringe (1g) entered the top five for the first time, highlighting a notable upward trend.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.