Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

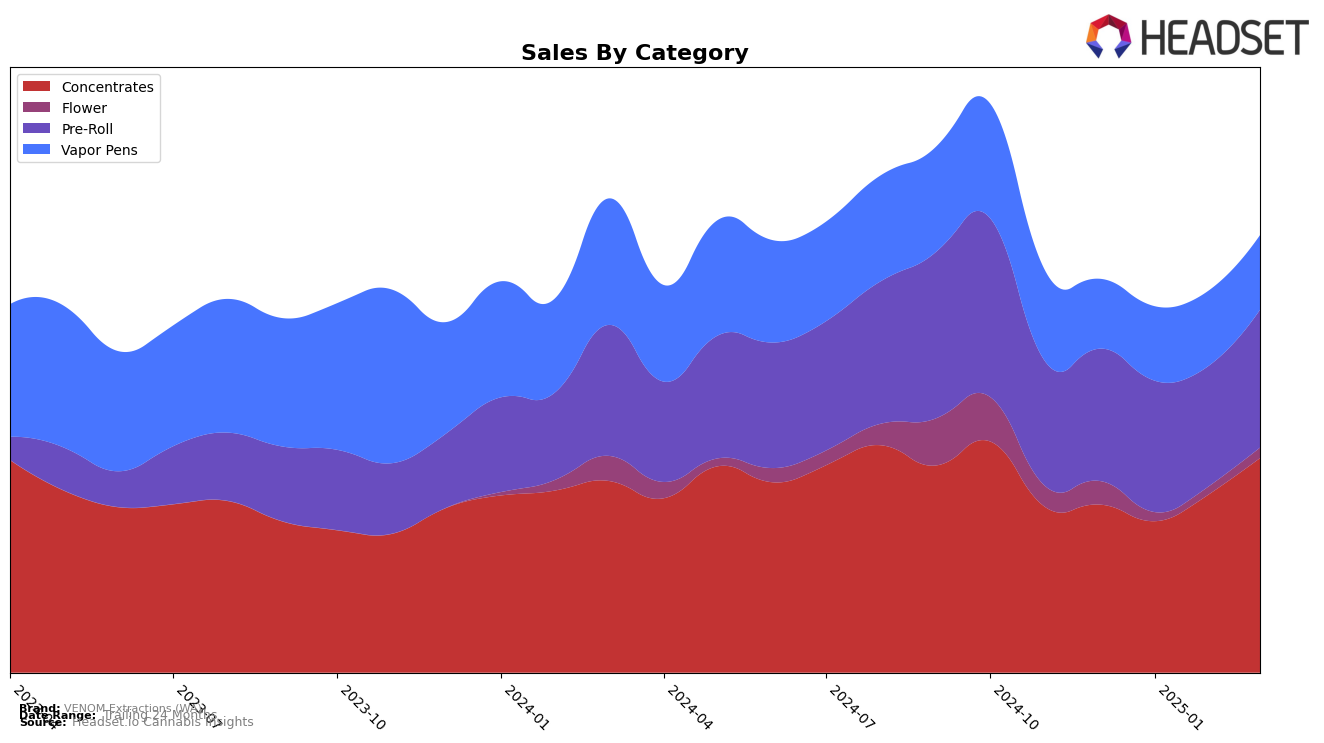

VENOM Extractions (WA) has shown a notable upward trend in the Washington market, particularly within the Concentrates category. Starting at rank 21 in December 2024, the brand improved its position to rank 15 by March 2025. This consistent climb in rankings suggests a strengthening presence and possibly an increased consumer preference for their products in this category. The sales figures reflect this positive trend, with a marked increase from December 2024 to March 2025, indicating a robust demand. In contrast, their performance in the Pre-Roll category has been relatively stagnant, maintaining a position outside the top 30 for the months analyzed, which may suggest a need for strategic adjustments or innovations to capture more market share.

In the Vapor Pens category, VENOM Extractions (WA) has not yet broken into the top 30 rankings in Washington, hovering in the lower tiers of the rankings. Despite this, there is a slight upward trajectory seen from December 2024 to February 2025, although it dipped slightly in March. This suggests a potential for growth if the brand can capitalize on market opportunities or enhance their product offerings. The sales figures in this category show a steady, albeit modest, increase, which could be an early indicator of future improvements in their market position. Overall, while VENOM Extractions (WA) has made significant strides in Concentrates, opportunities remain for growth in other categories, which could be pivotal for their broader market performance.

Competitive Landscape

In the Washington concentrates market, VENOM Extractions (WA) has shown a notable upward trajectory in its rankings from December 2024 to March 2025, moving from a position outside the top 20 to 15th place. This improvement is indicative of a positive trend in sales performance, as evidenced by a significant increase in sales from February to March 2025. Despite this progress, VENOM Extractions (WA) still faces stiff competition from brands like Bodega Buds, which surged to 13th place in March 2025, and Full Spec, which consistently maintained a higher rank, peaking at 14th place in March 2025. Meanwhile, Skagit Organics experienced a decline, dropping to 17th place, which could present an opportunity for VENOM Extractions (WA) to capture more market share if this trend continues. Overall, the competitive landscape is dynamic, with VENOM Extractions (WA) needing to sustain its growth momentum to climb further up the ranks.

Notable Products

In March 2025, Alaskan Thunder Fuck Cured Resin (1g) maintained its position as the top-performing product for VENOM Extractions (WA), with sales reaching an impressive 2432 units. 9lb Hammer Cured Resin (1g) climbed back to the second rank after briefly falling to third in February. Cereal Milk Cured Resin (1g) secured the third spot, showing consistent improvement in sales figures over the months. Crunch Berriez Cured Resin (1g) made its debut in the rankings at fourth place, indicating strong initial sales. Snoop's Dream Cured Resin (1g) remained steady at fifth, maintaining its rank from February.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.