Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

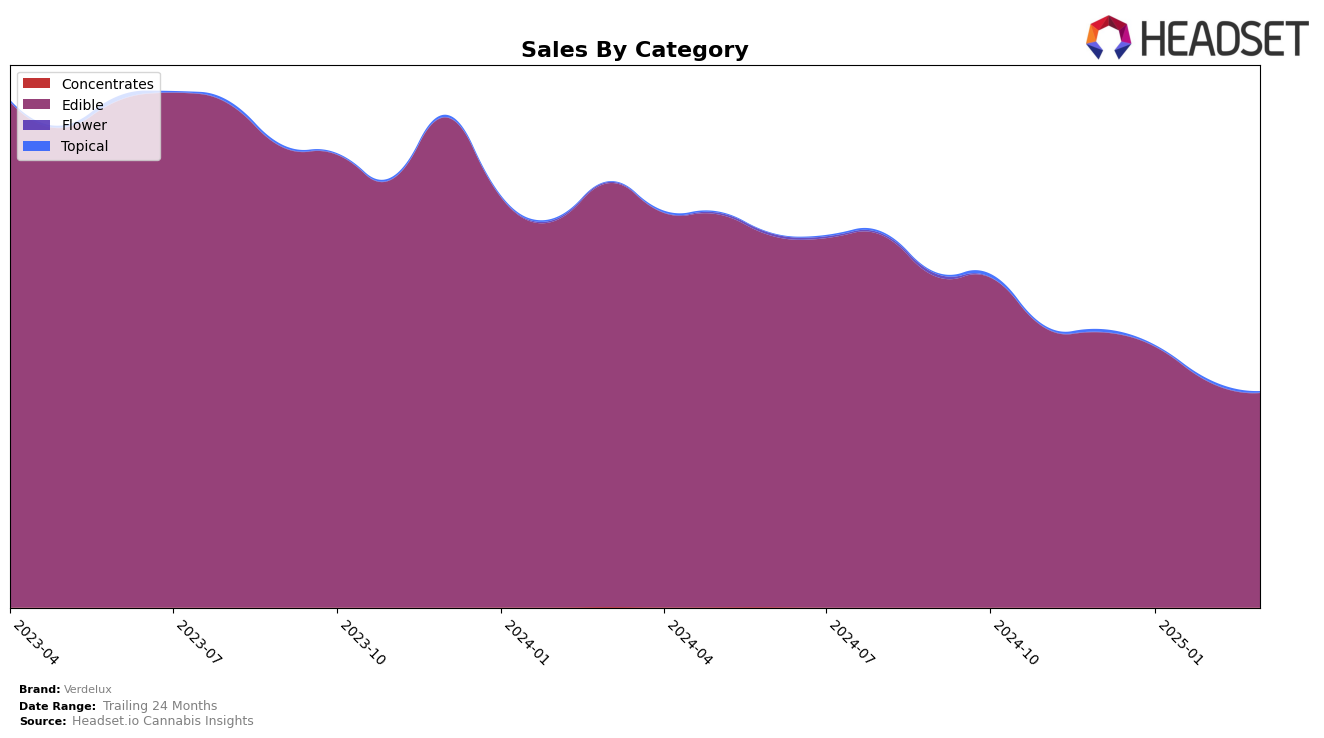

Verdelux has maintained a consistent presence within the edible category in Washington, although there has been a slight downward trend in their rankings over the past few months. Starting from a rank of 17 in December 2024, they have gradually moved to the 19th position by March 2025. This movement, although not drastic, indicates a need for strategic adjustments to regain or improve their standing within the state. Despite the drop in rankings, Verdelux's ability to stay within the top 20 suggests a strong brand presence and customer loyalty in the Washington market.

In terms of sales performance, Verdelux has experienced a decline in their monthly sales figures from December 2024 to March 2025 in Washington. The sales figures have decreased from $142,074 in December to $110,664 by March, which correlates with their slight drop in category ranking. This trend might raise concerns about market competitiveness or changes in consumer preferences. The absence of Verdelux in the top 30 brands in other states or categories during this period highlights the importance of focusing on their core market in Washington and exploring opportunities for expansion or diversification to improve their overall market position.

Competitive Landscape

In the competitive landscape of the Edible category in Washington, Verdelux has experienced a gradual decline in its rank from December 2024 to March 2025, moving from 17th to 19th place. This downward trend in ranking is mirrored by a decrease in sales over the same period, indicating potential challenges in maintaining market share. In contrast, Constellation Cannabis has shown resilience, maintaining a stronger position by consistently ranking higher than Verdelux, despite a similar sales decline. Cosmic Candy has shown an upward trajectory, surpassing Verdelux in March 2025, which could signal increasing consumer preference or effective marketing strategies. Meanwhile, Mari's and Happy Cabbage Farms have remained stable in their lower rankings, suggesting they are not immediate threats but highlight the competitive pressure in the market. This analysis underscores the need for Verdelux to innovate or enhance its marketing efforts to regain its competitive edge in the Washington Edible market.

Notable Products

For March 2025, the top-performing product from Verdelux was Lush - CBD/THC 1:1 Strawberry Chews 10-Pack (100mg CBD, 100mg THC), which climbed to the number one spot with notable sales of 602 units. Lush - CBN/THC 1:2 Cloudberry Fruit Chews 10-Pack maintained its second-place position from the previous months. Meltaway - CBD/THC 1:1 Peanut Butter Truffle Chocolate 10-Pack saw a decline, dropping to third place after leading for three consecutive months. Lush Hawaiian Mix re-entered the rankings at fourth place, while Meltaway - CBD/THC 1:1 Honey Caramelo Chocolate Truffle 10-Pack slipped to fifth. This shift in rankings highlights the growing popularity of the Lush Strawberry Chews among consumers.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.