Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

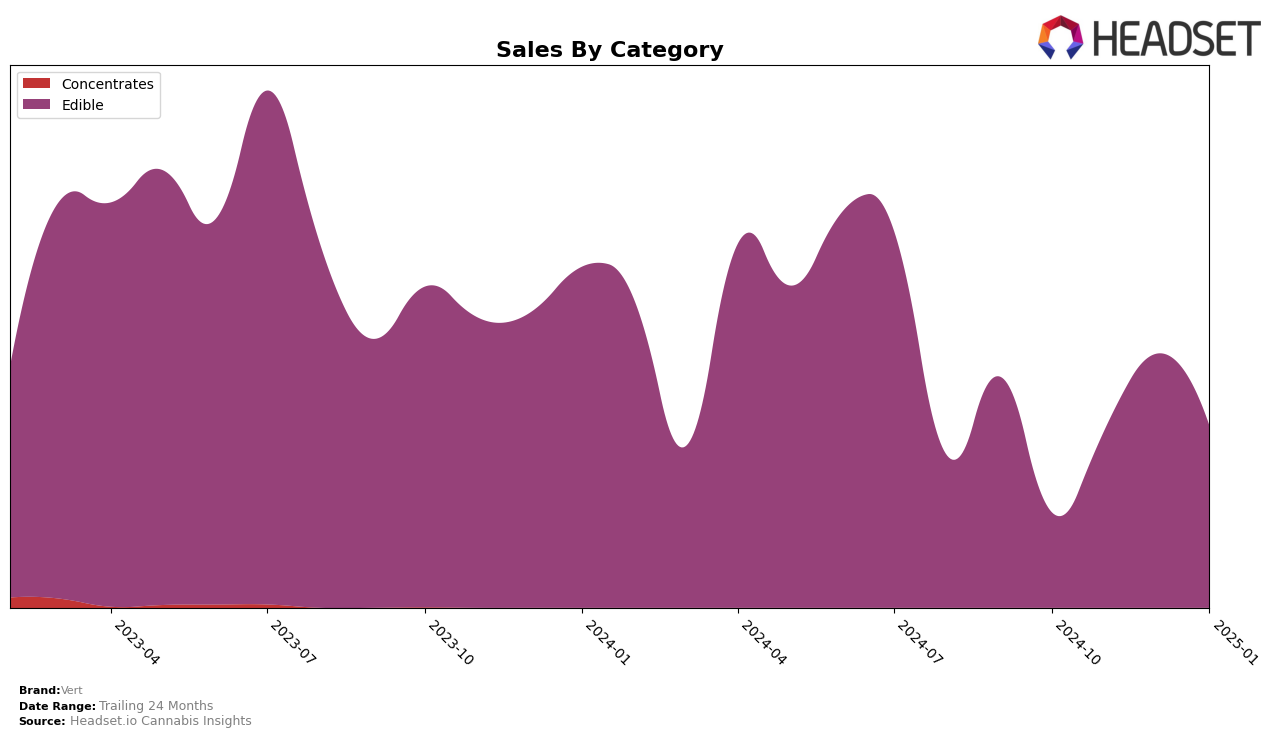

Vert has shown notable fluctuations in its performance across different categories and states. In the Edible category in Nevada, Vert was not ranked in October 2024 but made a significant entry into the top 30 by November, securing the 29th position. This upward trend continued as they climbed to 24th in December before slightly dropping to 28th in January 2025. This movement indicates a dynamic presence in the Nevada market, with potential growth opportunities despite the slight dip in the latest ranking. The variability in rankings suggests that Vert is actively competing in a challenging market landscape, where consumer preferences and market dynamics can shift rapidly.

While Vert's sales in the Edible category have shown some variability, the brand has managed to maintain a presence in the competitive Nevada market. The increase in sales from October to November 2024 suggests a successful strategy or product launch that resonated with consumers. However, the subsequent decrease in sales from December to January 2025 indicates there may be challenges that need to be addressed to maintain momentum. This pattern of performance highlights the importance of strategic planning and market adaptation for Vert to sustain its growth and improve its standings in the future.

Competitive Landscape

In the Nevada edible market, Vert has shown a fluctuating performance in recent months, which highlights the competitive nature of this category. In December 2024, Vert was ranked 24th, a slight improvement from its 29th position in November, but it slipped back to 28th by January 2025. This indicates a volatile market presence, possibly due to the dynamic strategies of competitors like Highly Edible and Chew & Chill (C & C), both of which have shown strong sales performances. Notably, Chew & Chill (C & C) experienced a significant sales increase in November, which may have contributed to Vert's challenges in maintaining a higher rank. Meanwhile, Hippies consistently stayed within the top 30, indicating a stable market presence that Vert could learn from. The entry of Chillers into the rankings in January 2025, debuting at 26th, further intensifies the competition, suggesting that Vert needs to innovate or adjust its strategies to regain and sustain a higher market position.

Notable Products

In January 2025, the top-performing product for Vert was the Chocolate Chip Brownie Cookie Square (100mg), maintaining its first-place rank from December 2024 with notable sales of 115 units. Chocolate Caramel Brownie Cookie Square (100mg) improved its position to second place, up from fourth in December 2024, with sales reaching 103 units. The Birthday Cake Cookie Square (100mg) entered the top three for the first time, securing the third rank. Nice Crispies Cereal Bar 10-Pack (100mg) saw a decline, dropping from third to fourth place compared to the previous month. Lastly, CBD:THC 1:1 Caramel Brownie Cookie Square (100mg CBD, 100mg THC) remained consistent at fifth place since its last ranking in October 2024.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.