Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

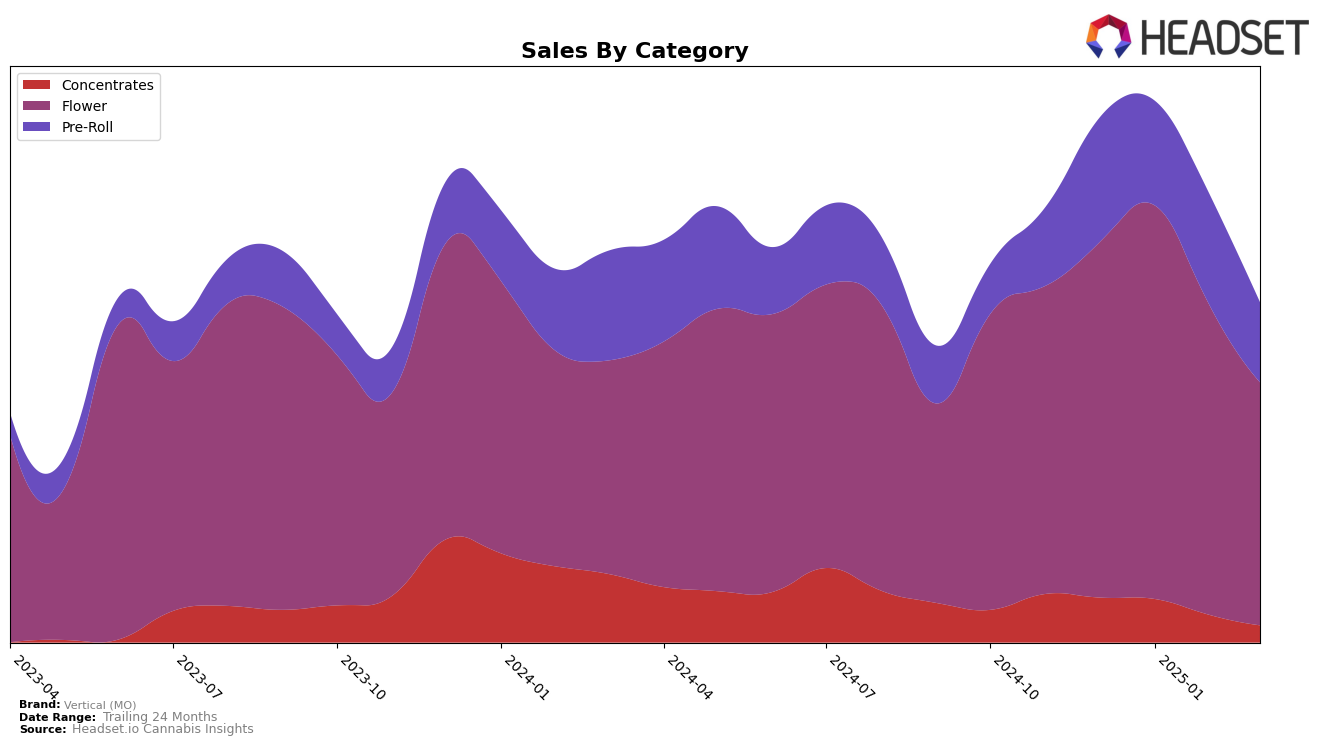

Vertical (MO) has experienced notable shifts in its performance across different product categories in Missouri. In the Concentrates category, the brand's ranking has seen a downward trajectory, moving from 24th in December 2024 to falling out of the top 30 by March 2025. This decline is mirrored in the sales figures, which show a significant decrease from December to March. In contrast, the Flower category witnessed a slight improvement early in the year, climbing to 24th in January 2025, before also dropping out of the top 30 by March. This indicates a competitive market environment where maintaining a stable position is challenging.

The Pre-Roll category presented a more stable performance for Vertical (MO) in Missouri, with the brand maintaining its position at 18th through January and February 2025, before eventually dropping to 30th by March. Despite this drop, the consistent ranking early in the year suggests a strong initial market presence in this category. However, the March rankings indicate that the brand may need to reassess its strategies to regain its footing. The fluctuations across these categories highlight the dynamic nature of the cannabis market in Missouri, where brands must continuously adapt to consumer preferences and competitive pressures.

Competitive Landscape

In the competitive landscape of the Missouri flower category, Vertical (MO) experienced fluctuating rankings from December 2024 to March 2025, with a notable peak at 24th place in January 2025 before dropping to 31st by March. This volatility highlights the competitive pressure from brands like Elevate Cannabis Co, which consistently maintained a higher rank despite a decline in sales, and Cookies, which made a significant leap from being unranked in January to 30th in March, indicating a strong sales recovery. Meanwhile, Cloud Cover (C3) and Packs Cannabis (MO) also showcased dynamic ranking changes, with Packs Cannabis (MO) experiencing a sharp decline in February, which could have provided an opportunity for Vertical (MO) to capitalize on market share. These shifts suggest that while Vertical (MO) has maintained a competitive presence, the brand faces significant challenges from both established and emerging competitors, necessitating strategic adjustments to enhance its market position.

Notable Products

In March 2025, Vertical (MO) saw a strong performance from its product LA Kush Cake 3.5g in the Flower category, which climbed to the top position with sales of $892. Meanwhile, Purple Churro 3.5g, also in the Flower category, secured the second spot, maintaining its high rank from previous months despite a slight decrease in sales. The Platinum Papaya Mimosa Pre-Roll 1g debuted impressively in the third position, marking its first appearance in the rankings. Jedi Fuel Pre-Roll 2-Pack 1g followed closely, achieving fourth place in its initial month of sales. Finally, the Purple Churro Pre-Roll 2-Pack 1g held steady at fifth place, consistent with its January 2025 ranking.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.