Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

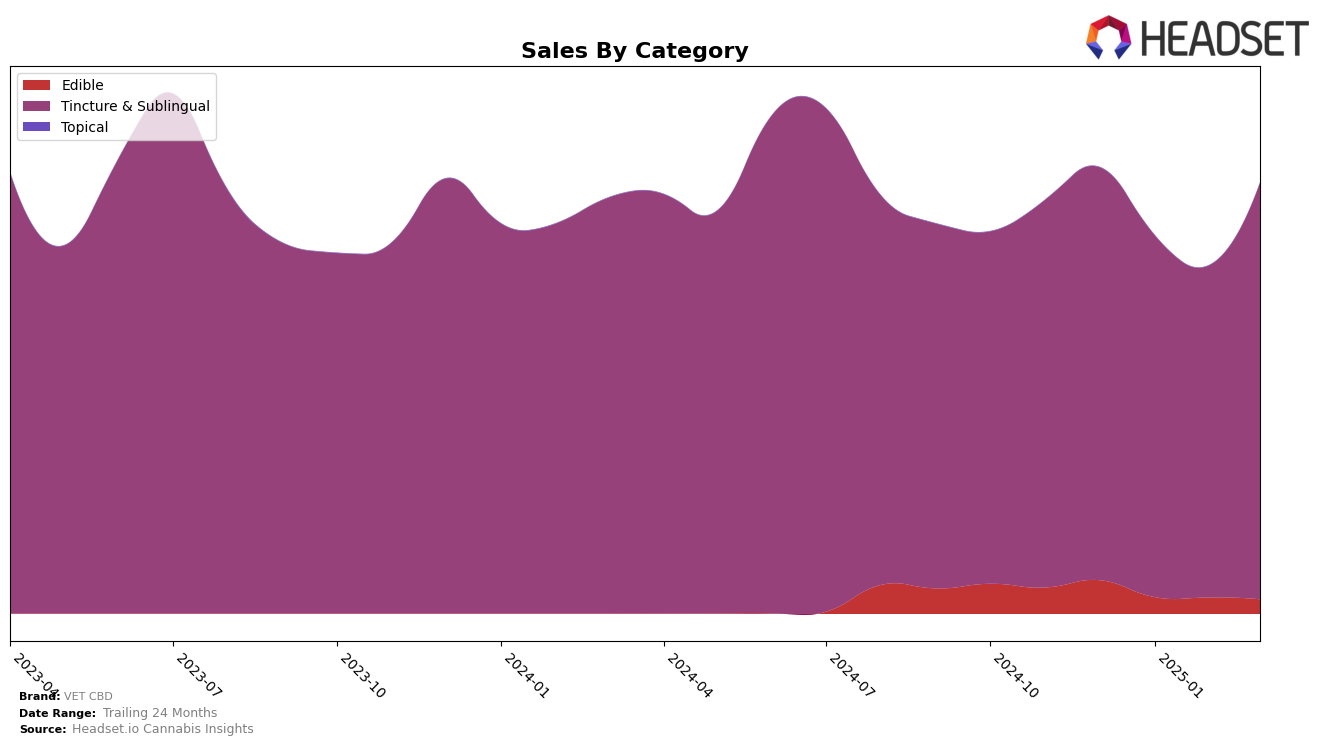

VET CBD has shown varied performance across different states and product categories, reflecting its strategic positioning in the cannabis market. In Arizona, the brand's presence in the Edible category has been inconsistent, as it did not make it into the top 30 rankings from December 2024 to March 2025. This absence indicates a challenging market environment or perhaps a need for strategic adjustments to regain competitive positioning. In contrast, the brand's consistent top 4 ranking in the Tincture & Sublingual category in California suggests a strong foothold and consumer preference in this category, highlighting a stable performance despite some fluctuations in monthly sales figures.

Examining the sales trends, VET CBD's sales in the Edible category in Arizona have seen a decline from December 2024 to February 2025, which might be indicative of competitive pressures or changing consumer preferences. However, the brand's performance in California's Tincture & Sublingual category has remained robust, with a slight rebound in March 2025, suggesting effective market strategies or seasonal demand peaks. This duality in performance between states and categories underscores the importance of localized strategies and the potential for growth in underperforming markets. Further analysis could provide deeper insights into the factors driving these trends and potential areas for improvement.

Competitive Landscape

In the competitive landscape of the Tincture & Sublingual category in California, VET CBD has maintained a consistent rank of 4th place from December 2024 through March 2025. This stability in ranking suggests a solid market presence, although it faces stiff competition from brands like Yummi Karma and Care By Design, which have consistently ranked higher. Notably, Care By Design has shown a strong upward trend, reaching the top rank in February 2025, which could indicate a growing preference among consumers. Meanwhile, Mary's Medicinals and Friendly Farms have fluctuated between 5th and 6th positions, suggesting they are less of a threat to VET CBD's current standing. Despite a dip in sales in January and February 2025, VET CBD's sales rebounded in March, indicating resilience and potential for growth amidst competitive pressures.

Notable Products

In March 2025, the top-performing product from VET CBD is the CBD/THC 20:1 Regular Strength Tincture (250mg CBD, 12.5mg THC, 60ml, 2oz), reclaiming the number one spot with sales of 1288 units. This product had previously dropped to second place in February but has shown a strong recovery. The CBD/THC 20:1 Regular Strength Tincture (125mg CBD, 6.25mg THC, 1oz, 30ml) retains its position as the second highest-selling product, consistently holding this spot for most of the past months. The CBD/THC 10:1 Extra Strength Pet Tincture (250mg CBD, 25mg THC, 60ml, 2oz) moves up to third place, showing improvement from its fourth-place ranking in February. Meanwhile, the CBD/THC 20:1 Regular Strength Tincture (1000mg CBD, 50mg THC, 2oz, 60ml) drops to fourth place, indicating a slight decline from its previous third-place position.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.