Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

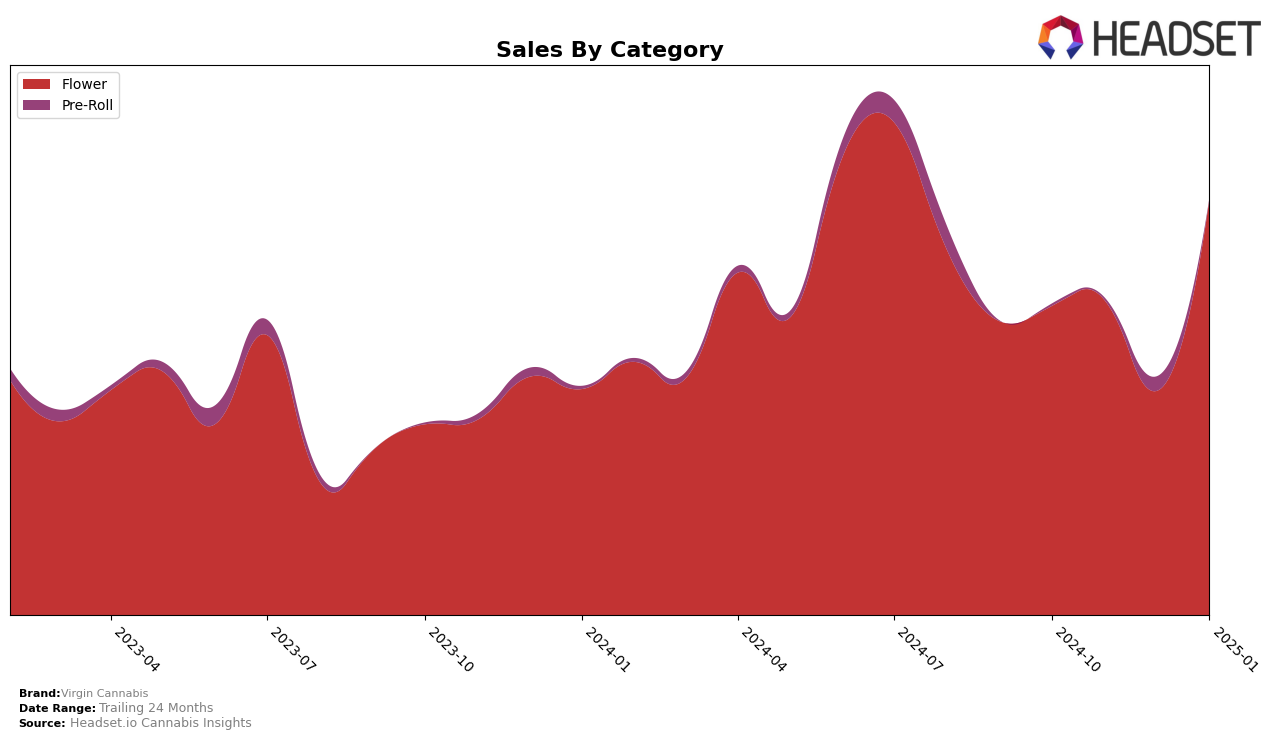

Virgin Cannabis has shown notable fluctuations in its performance across different states and categories. In Oregon, the brand's presence in the Flower category has been quite dynamic. Starting from October 2024, Virgin Cannabis was ranked 44th, and by January 2025, it had impressively climbed to 29th place. This upward movement indicates a significant improvement in market penetration or consumer preference for their products. However, the brand was absent from the top 30 rankings in November and December 2024, which suggests a period of underperformance or increased competition during those months. This volatility might reflect seasonal trends or strategic shifts by Virgin Cannabis that could be explored further.

Despite the fluctuations in rankings, Virgin Cannabis's sales figures in Oregon reveal a positive trajectory, particularly in January 2025, where sales reached an impressive $201,312. This suggests that the brand may have implemented successful strategies to boost its market share or introduced popular new products. The absence from the top 30 in certain months could indicate challenges faced by the brand in maintaining consistent consumer engagement or competition from other brands. These insights into Virgin Cannabis's performance in Oregon highlight the dynamic nature of the cannabis market and the brand's ability to navigate it, albeit with some challenges along the way.

Competitive Landscape

In the competitive landscape of the Oregon flower category, Virgin Cannabis has shown a notable improvement in its market position, climbing from a rank of 59 in December 2024 to 29 in January 2025. This upward trajectory suggests a positive shift in consumer preference or strategic adjustments that have resonated well with the market. In contrast, Chalice Farms, a leading competitor, experienced a significant drop from rank 9 in December 2024 to 37 in January 2025, indicating potential challenges in maintaining its market dominance. Meanwhile, Excolo and Earl Baker have maintained relatively stable positions, with Excolo slightly improving from rank 34 to 28, and Earl Baker showing a minor decline from 19 to 27. Interestingly, JD Grown has also seen a rise in rank, moving from 40 to 30, closely trailing Virgin Cannabis. These dynamics highlight a competitive environment where Virgin Cannabis's recent performance could signal a growing market presence, potentially attracting more consumers and increasing sales momentum in the coming months.

Notable Products

In January 2025, Virgin Cannabis saw Cap Junky (Bulk) leading the sales as the top-performing product in the Flower category. Following closely, Kona Gold (Bulk) secured the second position, showing a significant increase from 797 sales in December 2024 to 1267 sales in January 2025. Miracle Mintz (Bulk) climbed to the third spot, marking a notable rise from its previous absence in December rankings. Glitter Bomb (Bulk) experienced a drop, moving from third in December to fourth in January, indicating a decrease in sales momentum. Londonchello Pre-Roll (1g) entered the top five for the first time, securing the fifth position and marking its debut in the rankings.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.