Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

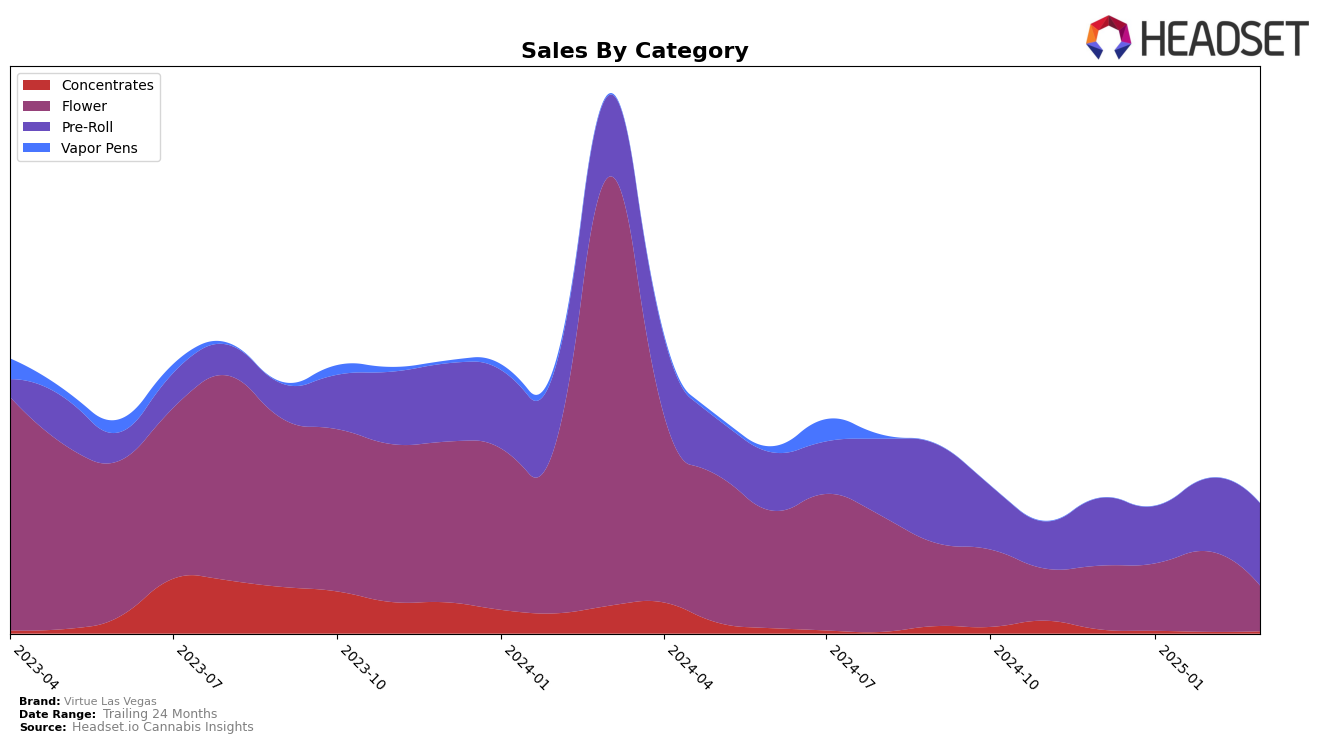

Virtue Las Vegas has shown varied performance across different product categories and states. In the Nevada market, the brand's Flower category experienced some fluctuations in rankings, starting at 48th place in December 2024 and improving to 34th by February 2025, before dropping to 55th in March 2025. This indicates a competitive and volatile market environment for this category. Despite these ranking changes, the sales figures for Flower saw a peak in February 2025, suggesting a temporary surge in demand or effective promotional strategies during that period. However, the brand was not in the top 30 for Flower in any month, highlighting a challenging landscape for maintaining a strong market position.

In contrast, the Pre-Roll category for Virtue Las Vegas in Nevada demonstrated more consistent performance, maintaining a top 15 position throughout the observed months. Notably, the brand improved its ranking from 15th place in both December 2024 and January 2025 to 10th place by March 2025. This upward trend indicates a strengthening presence and possibly an increasing consumer preference for their Pre-Roll products. The steady rise in sales during this period further supports the notion of growing popularity or successful marketing efforts. These contrasting performances between categories underline the importance of strategic focus and adaptation to market dynamics for Virtue Las Vegas.

Competitive Landscape

In the competitive landscape of the Nevada Pre-Roll category, Virtue Las Vegas has demonstrated a notable upward trajectory in rankings and sales from December 2024 to March 2025. Initially ranked 15th in December 2024, Virtue Las Vegas climbed to the 10th position by March 2025, showcasing a significant improvement in market presence. This upward movement is particularly impressive considering the competitive pressure from brands like Nature's Chemistry, which maintained a relatively stable position, and Kynd Cannabis Company, which consistently ranked higher. The sales growth for Virtue Las Vegas is indicative of effective market strategies, as it surpassed The Grower Circle, which only reached the 12th position by March 2025. Despite the competitive environment, Virtue Las Vegas's ability to enhance its rank and sales suggests a robust brand strategy and growing consumer preference in the Nevada market.

Notable Products

In March 2025, the top-performing product for Virtue Las Vegas was the Orange Push Pop Pre-Roll (1g), which rose to the number one rank with notable sales of 3308 units. The Fig Bar Pre-Roll (1g) closely followed, dropping to second place after leading the previous two months. Diamond Dust Pre-Roll (1g) maintained a strong presence in the top three, although it slipped from second to third place compared to February. The Private Reserve Pre-Roll (1g) showed improvement, climbing to fourth place from fifth in February. Meanwhile, Diamond Bar Pre-Roll (1g), which was once the leader in December, saw a drop to fifth place in March.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.