Jul-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

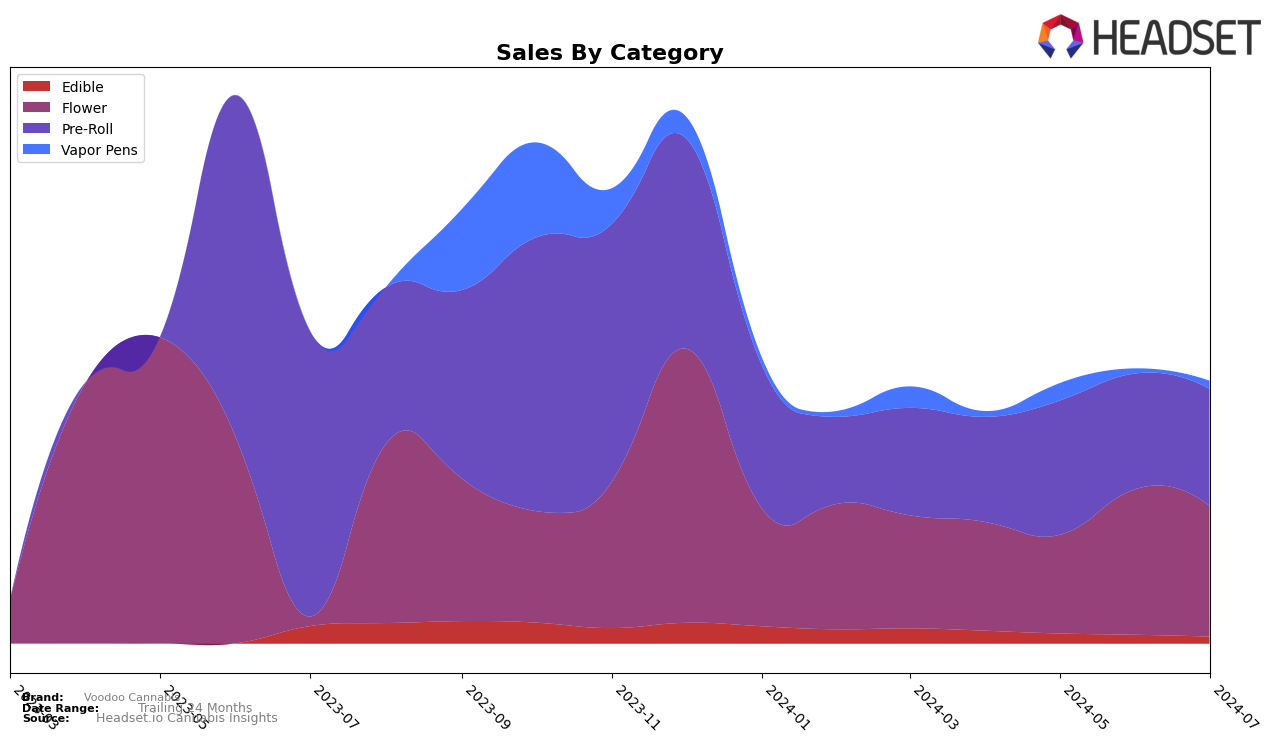

Voodoo Cannabis has shown varied performance across different states and categories, with some notable movements in recent months. In Alberta, the brand did not rank in the top 30 for the months of April, May, or June in the Flower category but made a significant leap to rank 94th in July. This upward movement suggests a positive trend, possibly indicating increased market penetration or a successful marketing campaign during that period. Despite not being in the top 30 for three consecutive months, the brand's sales figures in July were $24,069, a slight decrease from June's $24,797, which could be attributed to market saturation or increased competition.

While the details for other states and categories are not provided here, the performance of Voodoo Cannabis in Alberta offers a glimpse into the brand's potential and challenges. The lack of top 30 rankings in earlier months highlights areas for improvement, and the eventual entry into the rankings in July is a promising sign. This trend could be reflective of broader market dynamics or specific strategic initiatives by the brand. Monitoring these movements closely will be crucial for stakeholders to understand Voodoo Cannabis' positioning and growth trajectory in different regions and product categories.

Competitive Landscape

In the Alberta flower category, Voodoo Cannabis has shown a notable performance improvement, entering the top 100 brands in June 2024 and climbing to rank 94 by July 2024. This upward trend is significant given the competitive landscape. For instance, DOJA experienced a decline, dropping from rank 44 in April to 63 in both May and June, before falling out of the top 100 by July. Similarly, RIFF and Coterie have seen fluctuating ranks, with RIFF not making it into the top 100 since April and Coterie dropping from rank 71 in May to 92 in July. Meanwhile, JC Green Cannabis Company has shown a steady presence, improving from rank 100 in April to 84 by July. Voodoo Cannabis's recent entry and consistent climb suggest a growing market presence and potential for increased sales, positioning it as a brand to watch in the Alberta flower market.

Notable Products

In July 2024, the top-performing product for Voodoo Cannabis was Chem De La Chem Pre-Roll 2-Pack (2g), maintaining its first-place ranking from June with notable sales of 684 units. Double Kush Breath Pre-Roll 2-Pack (2g) held steady in second place, showing consistent performance across the months with 481 units sold in July. Double Kush Breath (7g) ranked third, continuing its steady rise from fourth place in April to third in July. Double Kush Breath Pre-Roll 10-Pack (3.5g) improved its position slightly, moving from fifth in June to fourth in July. Satan Cinnamon & Spice Milk Chocolate 4-Pack (10mg) experienced a decline, dropping from fourth place in June to fifth in July, with sales decreasing to 110 units.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.