Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

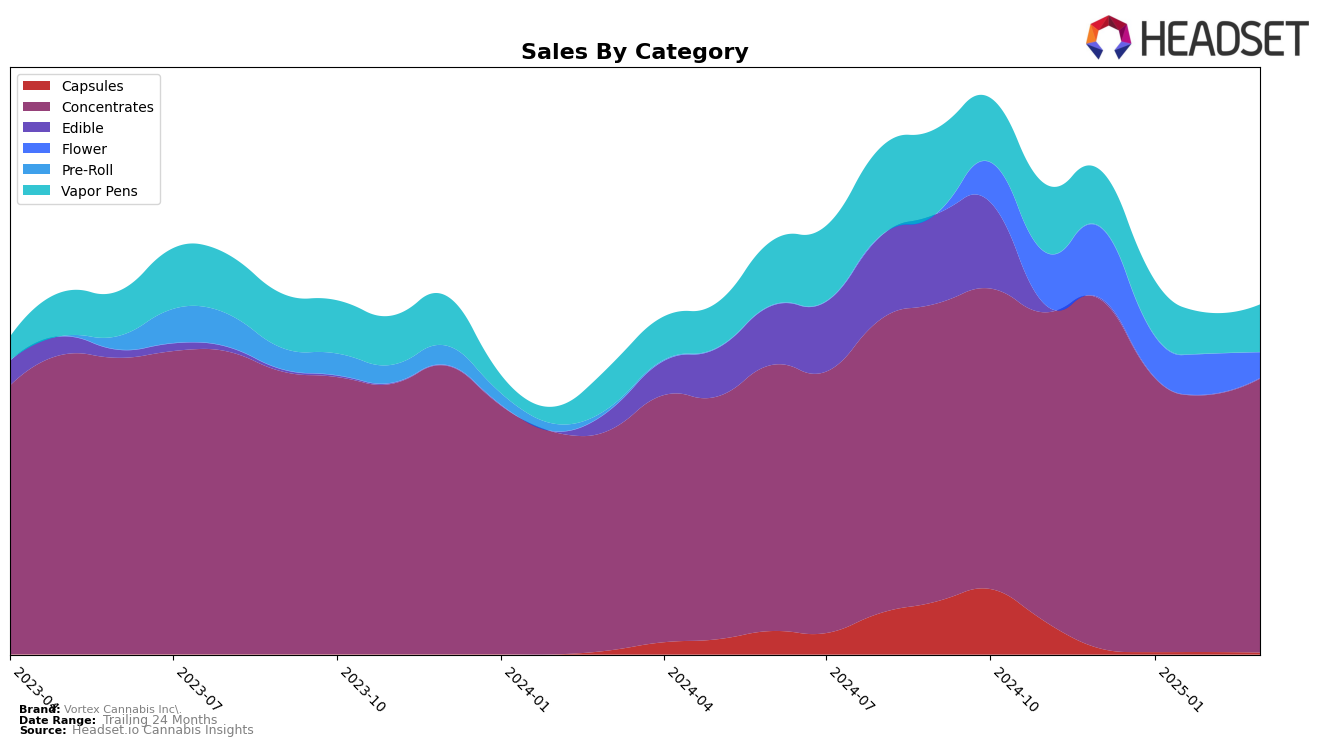

Vortex Cannabis Inc. has demonstrated notable performance across various categories and regions, with significant activity in the Concentrates category. In Ontario, Vortex Cannabis Inc. maintained a firm grip on the top position in the Concentrates category from December 2024 through March 2025, showcasing its dominance with consistent sales figures. In British Columbia, the brand held strong in the Concentrates category, ranking consistently at second place before a slight dip to third in March 2025. Meanwhile, in Alberta, the brand showed resilience, maintaining a top-five position throughout the same period. However, the Vapor Pens category in British Columbia presents a challenge, as Vortex Cannabis Inc. did not make it into the top 30 in recent months, indicating potential areas for growth or strategic realignment.

The performance in the Flower category in Arizona reveals a different narrative, with Vortex Cannabis Inc. dropping out of the top 30 by January 2025 and remaining outside this group in subsequent months. This indicates a significant opportunity for the brand to reassess its strategy in the Arizona Flower market. Conversely, the Vapor Pens category in Ontario shows a more promising trend, with Vortex Cannabis Inc. climbing from 35th to 32nd place between December 2024 and March 2025. This upward movement suggests a growing acceptance and potential for further market penetration. The varied performance across categories and regions highlights the dynamic nature of Vortex Cannabis Inc.'s market presence and underscores the importance of tailored strategies for each market segment.

Competitive Landscape

In the Ontario concentrates market, Vortex Cannabis Inc. has consistently maintained its position as the top-ranked brand from December 2024 through March 2025. This stability in rank highlights Vortex's strong market presence and consumer preference in the region. Despite a noticeable decline in sales from December 2024 to February 2025, Vortex Cannabis Inc. has managed to sustain its leadership, indicating a robust brand loyalty or possibly a lack of aggressive competition. Competitors like Endgame and Nugz have consistently held the second and third ranks, respectively, throughout the same period. Although Endgame shows a closer sales figure to Vortex than Nugz, neither has been able to surpass Vortex, suggesting that while they are formidable competitors, Vortex's brand strength and market strategies are effectively keeping them at bay. This analysis underscores the importance for Vortex Cannabis Inc. to continue innovating and maintaining customer loyalty to uphold its leading position in the Ontario concentrates market.

Notable Products

In March 2025, Afghan Black Hash (2g) from the Concentrates category maintained its top position as the leading product for Vortex Cannabis Inc., recording sales of $43,734. Zkittlez Pure Live Resin Disposable (1g) in the Vapor Pens category continued to hold the second spot for the third consecutive month. Gelonade (3.5g) in the Flower category remained steady at third place since February 2025. Vanilla Boba Live Resin Disposable (1g) also retained its position at fourth, showing consistent performance over the months. Alaskan Thunder Fuck Live Resin (1g) re-entered the rankings in fifth place, indicating a resurgence in popularity after being unranked in February.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.