Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

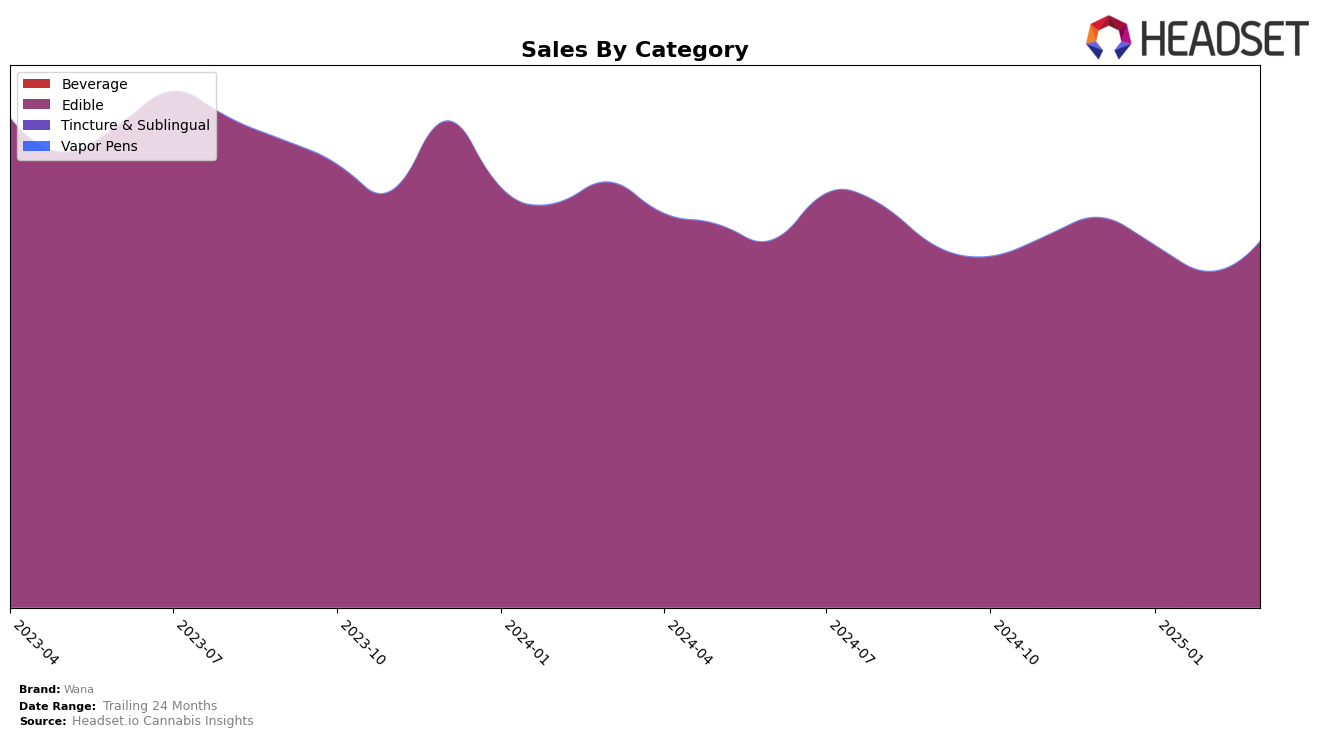

Wana has shown a varied performance across different states and provinces, with notable movements in rankings and sales trends. In Arizona, Wana improved its ranking from 6th to 5th place in the edible category by March 2025, indicating a positive trend in market penetration. Meanwhile, in Colorado, the brand maintained a steady 2nd place ranking throughout the reported months, despite a gradual decline in sales figures. This stability in ranking amidst declining sales suggests a strong brand presence and consumer loyalty. Conversely, in Illinois, Wana experienced fluctuations, dropping to 3rd place in January and February 2025 before regaining the 2nd position in March, highlighting a competitive landscape in the state.

In Massachusetts, Wana maintained a solid performance, consistently holding the 2nd place ranking in the edible category by March 2025. This consistency is mirrored in New Jersey, where the brand held a steady 3rd place throughout the period. However, in Nevada, Wana's rank dropped from 4th to 6th, reflecting potential challenges in maintaining its market share. In New York, Wana remained in the 12th position, indicating room for growth and expansion. Notably, in Maryland, Wana's rank fluctuated between the 6th and 7th positions, suggesting a competitive environment. These diverse performances across states highlight the brand's varying levels of market penetration and consumer engagement across different regions.

Competitive Landscape

In the competitive landscape of the Colorado edible market, Wana consistently holds the second rank from December 2024 to March 2025. Despite maintaining its position, Wana faces strong competition from Wyld, which leads the market as the top-ranked brand during the same period. Although Wana's sales show a gradual decline over these months, Wyld experiences a more volatile sales pattern, with a notable dip in February 2025 before rebounding in March 2025. Meanwhile, Dialed In Gummies and Ript consistently rank third and fourth, respectively, with Dialed In Gummies showing a positive sales trajectory, particularly in March 2025. This competitive environment suggests that while Wana maintains a strong position, it must strategize to counteract its declining sales and capitalize on opportunities to close the gap with Wyld.

Notable Products

In March 2025, Wana's top-performing product was the CBD/THC/CBG/CBN 4:2:1:1 Optimals Stay Asleep Dreamberry Gummies 10-Pack, maintaining its first-place ranking for four consecutive months with notable sales reaching 60,540. The CBD/CBN/CBG/THC 5:1:1:1 Optimals Fast Asleep Dream Berry Gummies 10-Pack held steady in the second position, consistently performing well across the months. Quick - Sativa Peach Bellini Gummies 10-Pack remained in third place, showing a slight increase in sales compared to February. Classic - Blueberry Gummies 10-Pack and Sour Mango Gummies 10-Pack also retained their fourth and fifth positions, respectively, with Classic - Blueberry Gummies experiencing a sales rebound in March. Overall, the rankings have remained stable from December 2024 through March 2025, indicating strong consumer loyalty and consistent demand for these products.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.