Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

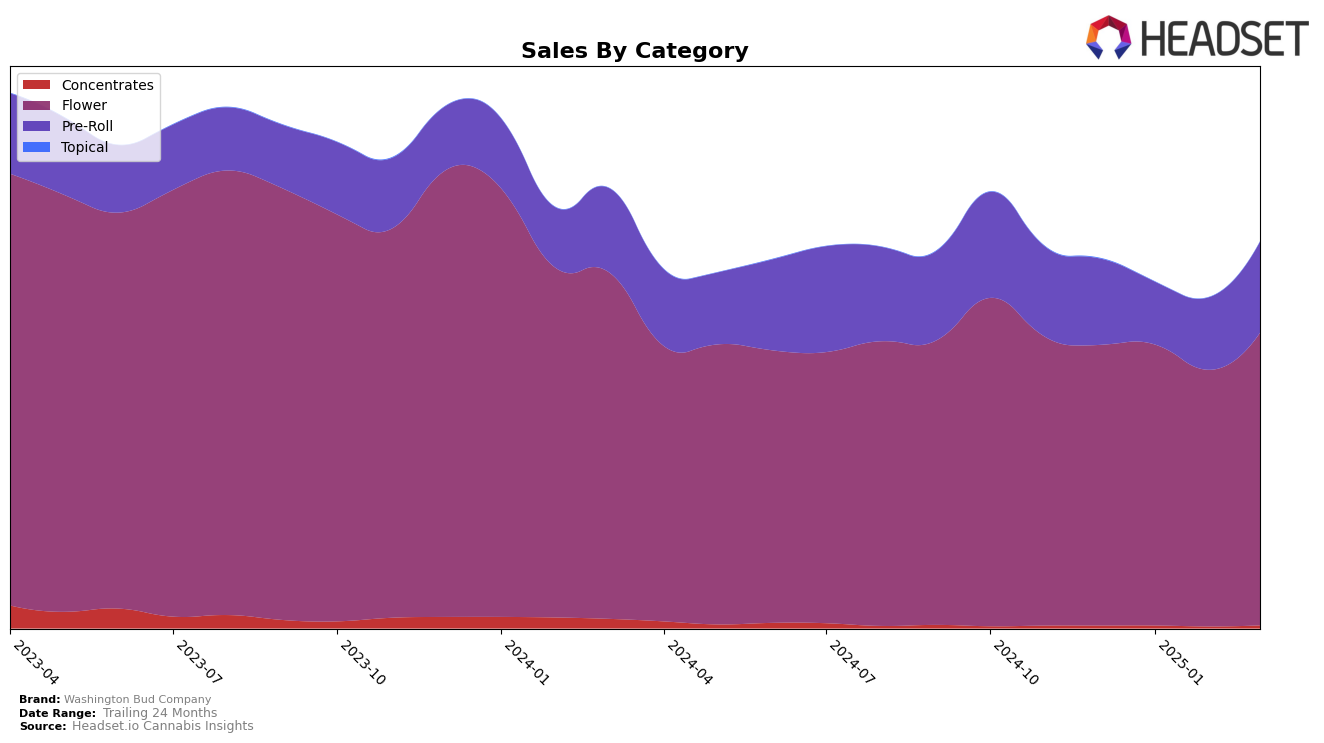

Washington Bud Company has shown notable performance in the Washington market, particularly in the Flower category. Over the months from December 2024 to March 2025, the brand has experienced a positive upward trend in its rankings, moving from 77th to 61st place. This indicates a strengthening position in the competitive Flower category, despite a slight dip in February. The brand's sales figures reflect this improvement, with a significant increase from February to March, suggesting a successful strategy to capture more market share. However, the brand has not yet reached the top 30, which means there is still room for growth and improvement in this category.

In the Pre-Roll category, Washington Bud Company has faced a more challenging landscape. The brand did not rank in the top 30 in January 2025, which highlights a potential area for concern or improvement. Despite this, the brand managed to climb back to 87th place by March, showing resilience and adaptability in a competitive market. The sales figures for March in this category show a recovery from February, signaling a possible turnaround. These movements suggest that while Washington Bud Company is gaining traction in some areas, there remains significant potential for growth and optimization in others, particularly in the Pre-Roll segment.

Competitive Landscape

In the competitive landscape of the Flower category in Washington, Washington Bud Company has shown a notable improvement in its market position from December 2024 to March 2025. Starting at rank 77 in December, the brand climbed to rank 61 by March, indicating a positive trend in its competitive standing. This upward movement is significant, especially when compared to competitors like The Happy Cannabis, which fluctuated in rankings, peaking at 53 in March after a dip to 72 in February. Meanwhile, Freddy's Fuego (WA) maintained a stronger position, consistently ranking in the top 50, though its sales saw a decline over the months. Equinox Gardens showed a similar ranking pattern to Washington Bud Company but remained slightly behind in sales. Notably, Plaid Jacket experienced a significant drop in rank from 27 in December to 64 in March, suggesting potential challenges in maintaining its market share. Washington Bud Company's ability to improve its rank amidst these fluctuations highlights its growing presence and potential in the Washington Flower market.

Notable Products

In March 2025, Washington Bud Company saw Afghani Hashplant 3.5g maintain its top position in the Flower category, with sales reaching 815 units. The Afghani Hash Plant Pre-Roll 2-Pack 1g rose to the second position in the Pre-Roll category, showing a notable increase from its third-place ranking in the previous two months. The Afghani Hashplant 1g experienced a slight drop, moving to third place in the Flower category, despite an increase in sales. Gorilla Girl 3.5g fell to fourth place in the Flower category, while Mimosa Pre-Roll 2-Pack 1g entered the rankings at fifth in the Pre-Roll category. These movements highlight shifting consumer preferences and the competitive nature of the market.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.