Dec-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

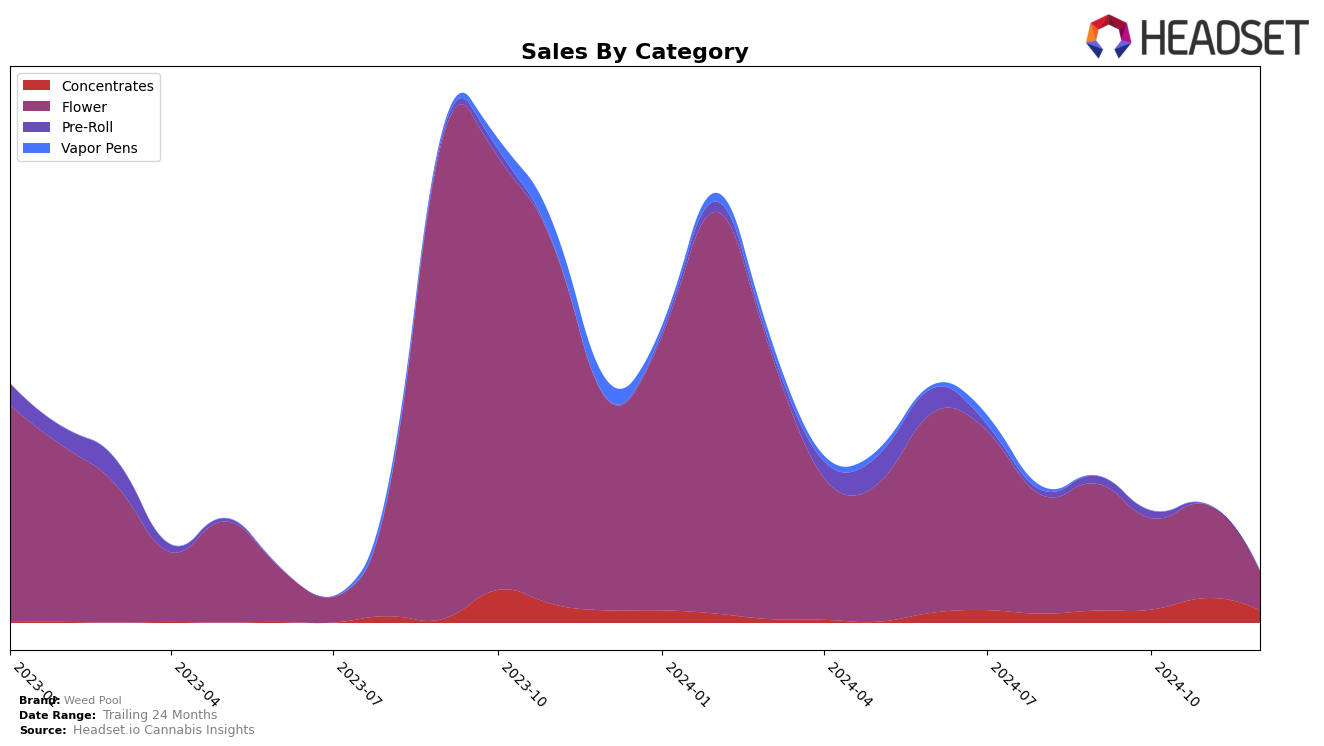

Weed Pool's performance in the Saskatchewan flower category has seen notable fluctuations over the last few months of 2024. The brand did not rank within the top 30 brands in any of these months, indicating a challenging market presence in this region. Their ranking slipped from 41st in September to 60th by December, showing a downward trend. This decline is further reflected in their sales figures, which dropped significantly from September to December. Such a trend could suggest increasing competition or possibly a shift in consumer preferences within the province.

Despite these challenges in Saskatchewan, Weed Pool's ability to maintain a position, albeit outside the top 30, suggests there may be underlying strengths or opportunities not fully captured by the ranking alone. The brand's movement in and out of the top 40 hints at potential for recovery or growth if strategic adjustments are made. Understanding the dynamics of local consumer behavior and competitor strategies could provide the insights needed for Weed Pool to enhance its market position in the coming months.

Competitive Landscape

In the competitive landscape of the flower category in Saskatchewan, Weed Pool experienced significant fluctuations in rank and sales from September to December 2024. Starting at 41st place in September, Weed Pool saw a decline to 46th in October, a rebound to 40th in November, and a drop to 60th by December. This volatility is contrasted by the performance of competitors such as QWEST, which improved its rank from outside the top 20 to 38th by December, indicating a strong upward trend. Meanwhile, North 40 Cannabis showed a similar pattern to Weed Pool, starting at 54th, slipping to 59th, and then recovering to 52nd by December. 18twelve and Virtue Cannabis both made appearances in the rankings, with 18twelve entering at 58th in December and Virtue Cannabis at 54th, indicating potential emerging threats. Weed Pool's sales trajectory, with a notable decline from September to December, suggests the need for strategic adjustments to maintain competitiveness in a dynamic market.

Notable Products

In December 2024, Garlic Dawg Pressed Hash 1g maintained its top position in the concentrates category, despite a decrease in sales to 174 units. Space Pie 7g held steady in second place within the flower category, although its sales continued to decline from previous months. Tropical Sherbet 7g rose to third place, showing a notable increase in sales to 80 units. Purple Diesel Milled 3.5g, which was previously ranked first in September, settled at fourth place in December with significantly lower sales. Premium Milled 14g rounded out the top five, dropping from its previous second place ranking in November.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.