Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

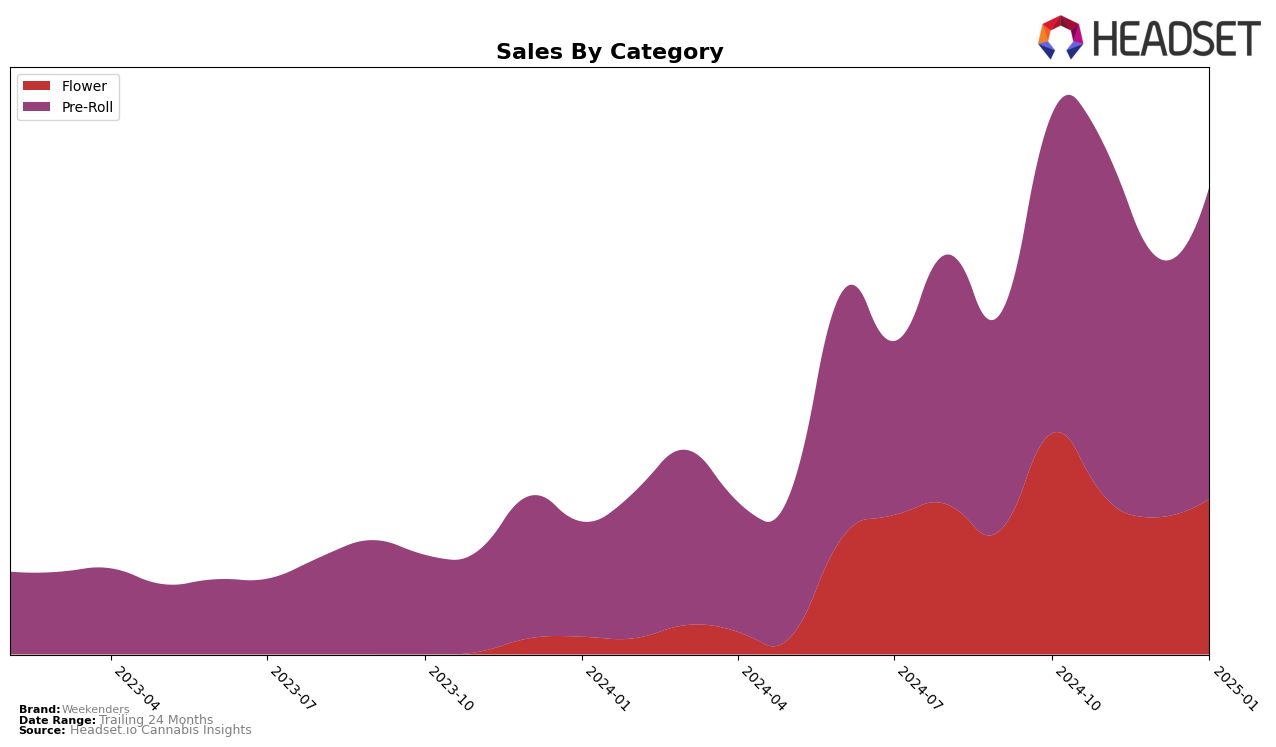

In the state of New York, Weekenders has shown varied performance across different cannabis categories. In the Flower category, the brand did not make it into the top 30 rankings from October 2024 through January 2025, indicating a potential area for growth or increased competition. Despite this, sales figures suggest a modest recovery in January 2025 after a dip in December 2024. On the other hand, the Pre-Roll category has been a stronger performer for Weekenders. The brand consistently stayed within the top 20 from October 2024 to January 2025, with a notable peak at the 17th position in December 2024. This suggests a stable demand for their Pre-Roll products, even as the Flower category lags behind.

Weekenders' performance in New York's Pre-Roll market highlights an interesting trend: despite a slight fluctuation in rankings, sales have remained relatively robust. The sales data for January 2025, for instance, shows a recovery to levels seen in November 2024, suggesting that any dips in the interim were temporary. This resilience in the Pre-Roll segment could be a key area for the brand to leverage its strengths. Meanwhile, the Flower category's absence from the top 30 rankings may require strategic adjustments to regain market presence. The contrasting performances across these categories underline the importance of targeted strategies to maintain and enhance brand visibility and sales in competitive markets like New York.

Competitive Landscape

In the competitive landscape of the New York pre-roll category, Weekenders has experienced fluctuations in its market standing, with its rank oscillating between 17th and 20th from October 2024 to January 2025. Despite these variations, Weekenders has maintained a consistent presence in the top 20, indicating a stable market position. Notably, KOA Exotics made a significant leap from being outside the top 60 in November and December 2024 to ranking 19th in January 2025, surpassing Weekenders. This suggests a potential threat to Weekenders' market share if KOA Exotics continues its upward trajectory. Meanwhile, Ayrloom consistently outperformed Weekenders, ranking as high as 15th in December 2024, though it fell to 21st in January 2025, temporarily dropping out of the top 20. Rolling Green Cannabis also showed resilience, improving its rank from 24th in October 2024 to 18th in January 2025, indicating a competitive edge over Weekenders. These dynamics underscore the importance for Weekenders to strategize effectively to maintain and enhance its market position amidst rising competition.

Notable Products

In January 2025, the top-performing product for Weekenders was Lift - AK Zkittlez Pre-Roll 7-Pack (3.5g), securing the number one rank with sales reaching 1705 units. Following closely was Lift - AK Zkittlez Pre-Roll (1g) at the second position, with Dream - Blueberry Muffin Pre-Roll (1g) and its 7-Pack variant taking the third and fourth spots, respectively. Notably, Glow - Candy Rain Pre-Roll (1g) rounded out the top five. Compared to previous months, these products consistently maintained high ranks, showcasing strong consumer preference for the Lift and Dream series. The steady ranking indicates a stable demand pattern for these pre-roll categories from Weekenders.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.