Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

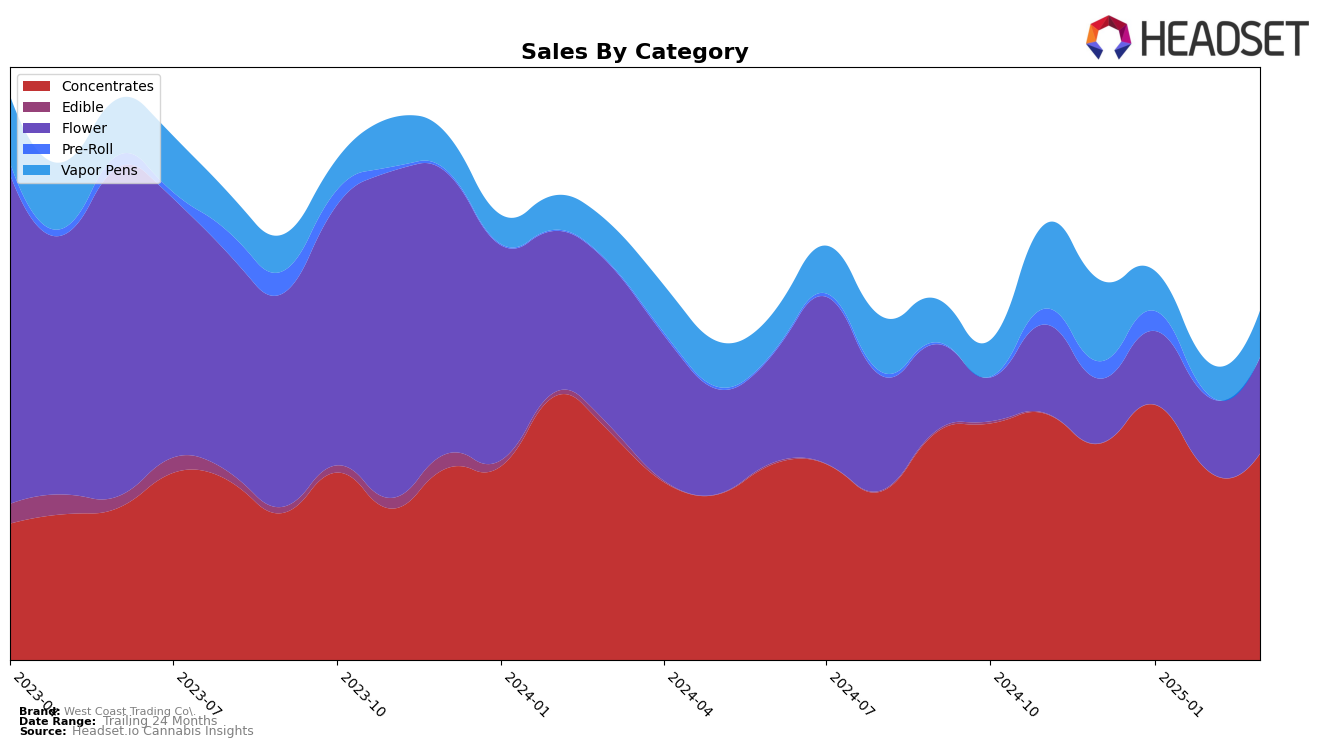

West Coast Trading Co. has shown a relatively stable performance in the California concentrates category, maintaining a consistent presence in the top 15 rankings from December 2024 through March 2025. Starting from the 11th position in December, the brand improved slightly to the 10th spot in January but then settled at 13th place for both February and March. This indicates a strong foothold in the concentrates market, though the slight dip in ranking during the latter months might suggest increased competition or seasonal fluctuations. Notably, the brand's sales in this category peaked in January 2025, suggesting a successful strategy or product launch during that period.

In contrast, West Coast Trading Co.'s performance in the vapor pens category in California reveals challenges, as the brand only appeared in the rankings during December 2024, at the 93rd position. This absence from the top 30 in subsequent months highlights a potential area for improvement or a shift in consumer preferences that the brand might need to address. The lack of a consistent presence in the vapor pens category could indicate either a strategic focus on other product lines or difficulties in maintaining market share against competitors. Understanding these dynamics could be key for stakeholders looking to capitalize on emerging trends or rectify current shortcomings in the vapor pens segment.

Competitive Landscape

In the competitive landscape of California's concentrates category, West Coast Trading Co. has experienced notable fluctuations in its market positioning. From December 2024 to March 2025, West Coast Trading Co. saw a brief improvement in rank from 11th to 10th in January, only to drop to 13th in both February and March. This shift highlights the dynamic nature of the market and the intense competition from brands like ABX / AbsoluteXtracts, which maintained a relatively stable position, ranking 9th in December and January, and slightly dropping to 11th by March. Meanwhile, Roll Bleezy showed a significant upward trend, climbing from 17th in December to 12th by March, indicating a strong growth trajectory that could pose a challenge to West Coast Trading Co.'s market share. Additionally, Trilogy 710 displayed volatility, with a peak rank of 12th in February, suggesting potential opportunities for West Coast Trading Co. to capitalize on any inconsistencies from its competitors. As the market continues to evolve, West Coast Trading Co. must strategically navigate these shifts to enhance its competitive edge and sustain its sales momentum.

Notable Products

In March 2025, West Coast Trading Co.'s top-performing product was Maui Wowie Sugar Wax (1g) in the Concentrates category, leading the sales with 1,713 units sold. Following closely, Ghost Train Haze Shatter (1g) and Forbidden Fruit Badder (1g) secured the second and third ranks, respectively, in the same category. MK Ultra Sugar Wax (1g) maintained a strong position at fourth, while Northern Lights Smalls (3.5g) was the top performer in the Flower category, ranking fifth overall. Compared to previous months, the Concentrates category showed a consistent stronghold in the top ranks, with no significant changes in product rankings. This stability suggests a continued consumer preference for Concentrates, particularly the Maui Wowie Sugar Wax, which has maintained its top position.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.