Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

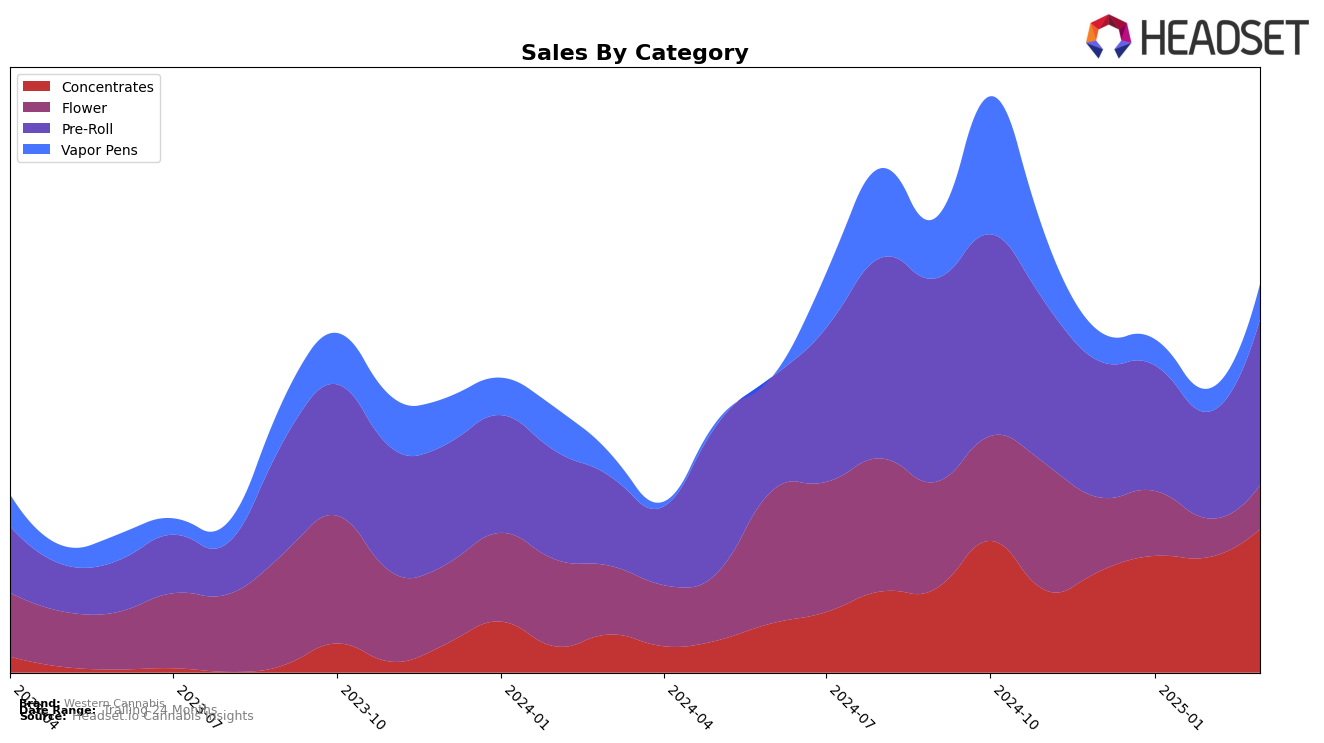

Western Cannabis has shown notable movements across different categories in both Alberta and Saskatchewan. In Alberta, the brand has made a significant climb in the Concentrates category, moving from 11th place in December 2024 to 8th place by March 2025, indicating a positive trend in consumer preference. However, the Vapor Pens category tells a different story, as Western Cannabis has been slipping in rankings, dropping from 60th in December 2024 to 76th by March 2025, suggesting challenges in maintaining market share in this segment. The Pre-Roll category also saw a positive shift, with the brand climbing from a non-top 30 position to 39th place by March 2025, a noteworthy improvement that could signal growing interest or strategic adjustments.

In Saskatchewan, Western Cannabis is performing well in the Concentrates category, consistently maintaining a top-three position from January to March 2025, which underscores their strong foothold in this market. The Flower category, however, presents a mixed picture, with rankings fluctuating between 22nd and 27th place, reflecting some instability or competitive pressure. The Pre-Roll category has shown a promising upward trajectory, moving from 37th in December 2024 to 23rd by March 2025, suggesting successful strategies or product acceptance. Notably, Vapor Pens, where the brand was initially absent from the top 30, have seen a steady rise to 25th place by March 2025, indicating a significant breakthrough in this category. These movements highlight Western Cannabis's dynamic positioning and the varying challenges and opportunities across different product categories and regions.

Competitive Landscape

In the Alberta Pre-Roll category, Western Cannabis has experienced a notable shift in its competitive standing from December 2024 to March 2025. Initially ranked 49th, Western Cannabis maintained this position through February 2025 before climbing to 39th in March. This upward movement contrasts with the performance of competitors such as Fuego Cannabis (Canada), which fluctuated between 28th and 41st, and Astro Lab, which showed a more consistent ranking improvement from 26th to 37th. Despite Western Cannabis's improved rank, its sales trajectory has been less stable, with a dip in January and February before a significant recovery in March. Meanwhile, Versus and The Original Fraser Valley Weed Co. have shown more consistent sales patterns, which may suggest stronger brand loyalty or market presence. These dynamics highlight the competitive pressures and opportunities for Western Cannabis as it seeks to enhance its market position in Alberta's Pre-Roll sector.

Notable Products

In March 2025, the top-performing product for Western Cannabis was the Matanuska Thunder Fuck Pre-Roll 3-Pack (1.5g), maintaining its number one rank from February, with sales reaching 3019 units. The Orange Creamsicle Pre-Roll 3-Pack (1.5g) climbed to second place after a fourth-place ranking in February, showing a strong recovery in sales. Meanwhile, Matanuska TF Shatter (1g) held steady in third place, having improved from fourth in January. The Orange Creamsicle Pre-Roll 12-Pack (6g) also showed progress, moving up to fourth place from fifth in the previous months. Take 5 (5g) experienced a decline, dropping to fifth place despite being consistently third from December to February.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.