Oct-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

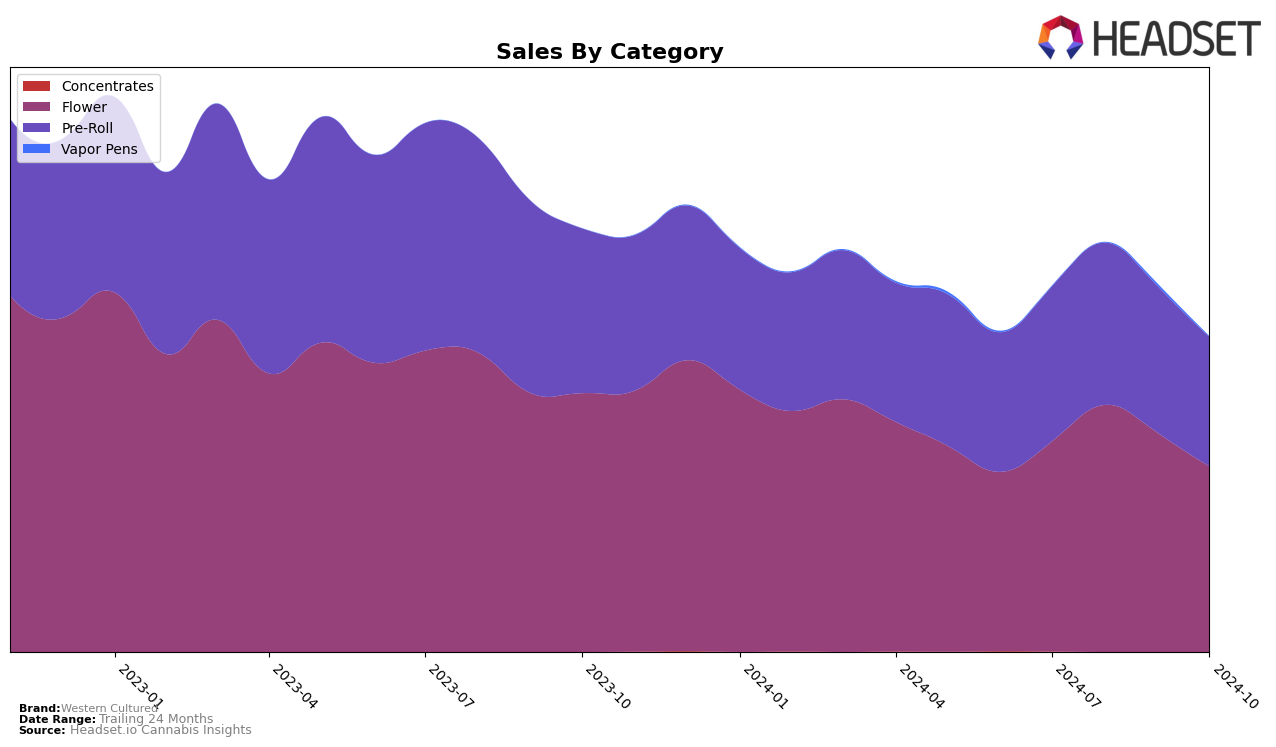

Western Cultured's performance across various categories in Washington has shown some fluctuations over the past few months. In the Flower category, the brand experienced a notable climb in rankings from 34th in July to 23rd in August, which was accompanied by an increase in sales from $227,320 to $267,526. However, this upward momentum was not sustained, as the brand dropped to 27th in September and further down to 38th in October, with sales declining to $200,879. This indicates a challenging market environment or increased competition in the Flower category for Western Cultured.

In the Pre-Roll category, Western Cultured maintained a more consistent presence within the top 30, though their ranking did see minor shifts. Starting at 27th in July, the brand improved slightly to 26th in August and 25th in September, before slipping back to 29th in October. Despite these fluctuations, it's noteworthy that they managed to stay within the top 30 throughout the months, unlike in the Flower category. However, a downward trend in sales from $167,688 in July to $140,147 in October suggests that maintaining their ranking might not fully reflect their market performance. This consistency in ranking, despite declining sales, might suggest a relatively stable but competitive positioning within the Pre-Roll category in Washington.

Competitive Landscape

In the competitive landscape of the flower category in Washington, Western Cultured experienced notable fluctuations in its ranking from July to October 2024. Starting at rank 34 in July, Western Cultured improved to 23 in August, indicating a positive reception and increased sales momentum. However, this upward trend was not sustained, as the brand slipped to rank 38 by October. This decline in rank coincides with a decrease in sales, suggesting potential challenges in maintaining customer engagement or market share. In contrast, Bondi Farms showed a consistent improvement, climbing from rank 43 in July to 35 in October, potentially capturing some of the market that Western Cultured lost. Meanwhile, Falcanna maintained a relatively stable position, hovering around the high 30s, while Passion Flower Cannabis experienced a similar decline as Western Cultured, dropping from rank 29 in July to 44 in October. These dynamics highlight the competitive pressures Western Cultured faces and underscore the need for strategic adjustments to regain its previous standing and boost sales.

Notable Products

In October 2024, Seatown Lemon Haze Pre-Roll 2-Pack (1g) continues to lead as the top-performing product for Western Cultured, maintaining its number one rank with sales of 3,131 units. Seatown Lemon Haze (3.5g) retains its consistent second place, showing a steady presence in the Flower category. Spiked Punch (3.5g) holds the third position, demonstrating stable performance over the past three months. Seatown Lemon Haze Infused Pre-Roll 2-Pack (1g) improved its rank from fifth to fourth, indicating a positive shift in consumer preference. Meanwhile, Spiked Punch Infused Pre-Roll 2-Pack (1g) emerges in the rankings for the first time in October, securing the fifth spot.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.