Mar-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

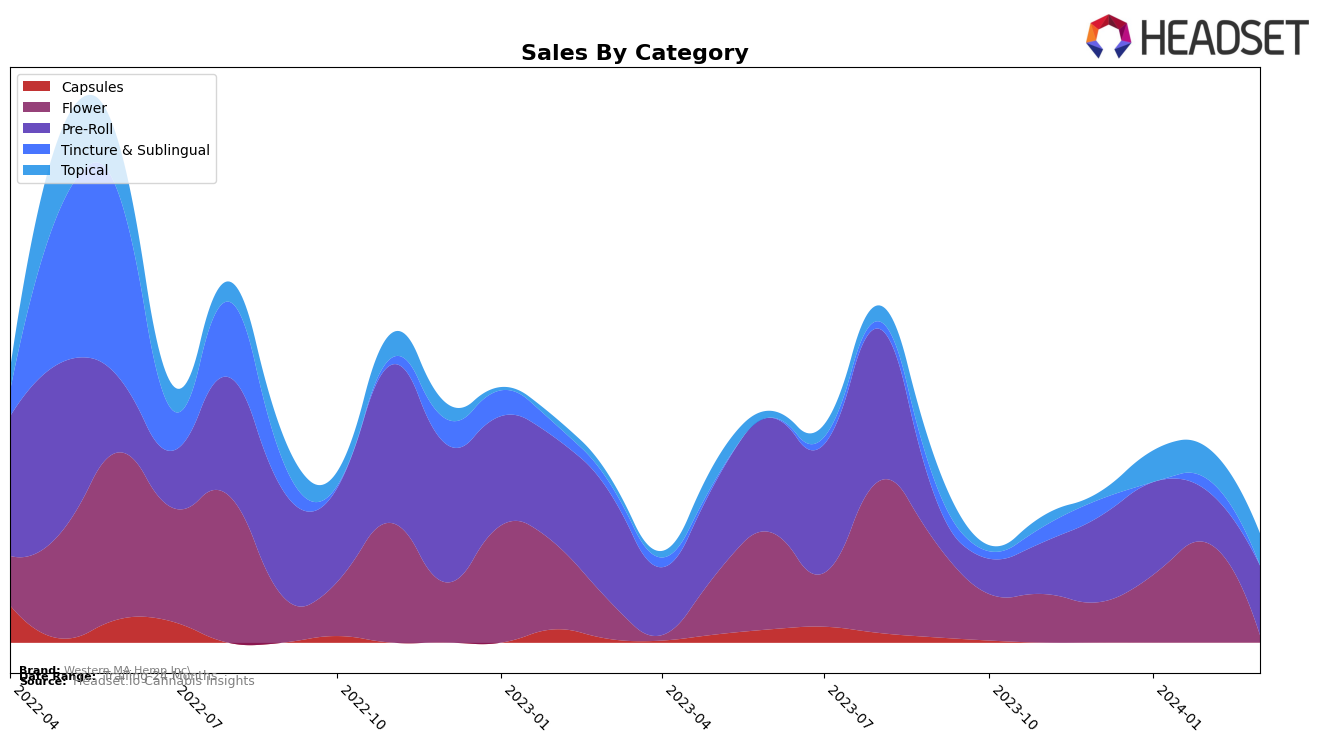

In the Massachusetts cannabis market, Western MA Hemp Inc. has shown a varied performance across different product categories. In the Tincture & Sublingual category, the brand experienced a drop-off in January 2024, not ranking in the top 30, which indicates a potential decrease in consumer demand or sales performance during that month. However, it managed to reclaim its position in February 2024, ranking 18th, albeit with a decrease in sales to 306 units from 448 units in December 2023. This fluctuation highlights the brand's struggle to maintain a consistent presence in this highly competitive category.

On the other hand, Western MA Hemp Inc.'s performance in the Topical category tells a more positive story. The brand consistently improved its ranking from 18th in December 2023 to 15th in both January and February 2024, before slightly dropping to 16th in March 2024. Notably, sales in this category saw a significant jump in January 2024 to 814 units, maintaining a steady performance with slight increases in the following months. This upward trend in the Topical category suggests a growing consumer interest or successful marketing efforts by Western MA Hemp Inc. to solidify its position within this segment of the Massachusetts market.

Competitive Landscape

In the competitive landscape of the topical category within the Massachusetts market, Western MA Hemp Inc. has shown a notable trajectory in terms of rank and sales over the recent months. Starting from December 2023, Western MA Hemp Inc. has seen a gradual improvement in its rank, moving from 18th in December 2023 to 16th by March 2024. This shift, although modest, is indicative of a positive trend in sales and market presence, with sales increasing consistently from December 2023 to March 2024. Competitors like Berkshire Roots and INSA have also experienced changes in their rankings, with Berkshire Roots experiencing a slight decline from 12th to 15th, and INSA moving from 13th to 14th in the same period. Despite the higher sales figures and more stable rankings of these competitors, the directional trend for Western MA Hemp Inc. suggests a growing foothold in the market. This analysis underscores the importance of monitoring both rank and sales performance to understand Western MA Hemp Inc.'s competitive position and potential growth within the Massachusetts topical category.

Notable Products

In March 2024, Western MA Hemp Inc. saw the CBD Frosted Kush Pre-Roll 5-Pack (5g) rise to the top spot in sales, marking a significant leap from its previous rank in January as the fifth most popular product, with sales figures reaching 25 units. The Suver Haze Pre-Roll 5-Pack (5g) followed closely behind, securing the second rank with a notable improvement from its previous positions, although specific sales figures are not disclosed. The CBD Full Spectrum Topical Salve (500mg CBD, 2oz) emerged as a new favorite, climbing to the third rank without having been ranked in the prior months. Meanwhile, the CBD Fruit Loops Pre-Roll 5-Pack (5.75g), which was the top product in December 2023, saw a decline to the fourth position by March 2024. Lastly, the CBD Lifter Pre-Roll 5-Pack (5g) also made it to the top five, indicating a diverse preference among consumers for pre-rolled products.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.