Mar-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

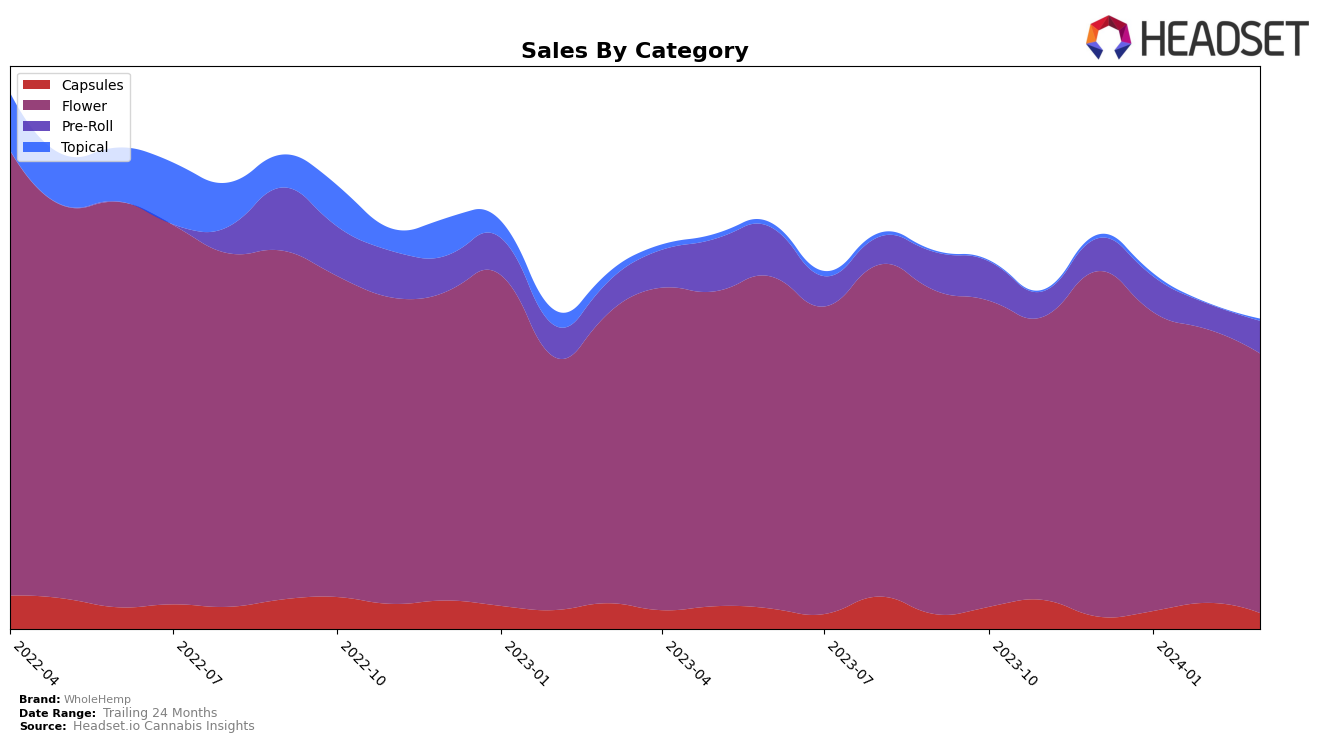

In the province of Ontario, WholeHemp has shown a notable performance in the Capsules category, with a gradual improvement in its ranking over the first quarter of 2024. Starting at the 27th position in December 2023 and peaking at the 21st position in February 2024 before slightly dropping to the 23rd position in March 2024. This upward trend, particularly the jump in ranking from December 2023 to February 2024, indicates a growing consumer interest or improved market strategies by WholeHemp. Although the sales figures fluctuated, with a peak in February 2024 at 4832 units, this volatility demonstrates the brand's dynamic presence in the market. The absence from the top 30 in certain months across different categories could imply room for growth or a strategic refocusing by WholeHemp.

Furthermore, WholeHemp's journey in the Topical category within Ontario presents a mixed bag of results. The brand managed to secure a place in the top 30 in December 2023 and January 2024, and after a missing rank in February 2024, it made a comeback in March 2024 at the 20th position. This inconsistency might suggest challenges in maintaining a steady market presence or could reflect the competitive nature of the Topicals market in Ontario. The absence in February 2024's rankings could be seen as a setback; however, the rebound in March indicates resilience and perhaps a successful adjustment in WholeHemp's market strategies or consumer engagement efforts. This analysis highlights the fluctuating yet promising nature of WholeHemp's market performance, with significant insights into potential growth areas and the need for strategic consistency.

Competitive Landscape

In the competitive landscape of the cannabis capsule market in Ontario, WholeHemp has shown a fluctuating performance in terms of rank and sales over the recent months. Initially not in the top 20, WholeHemp made a notable entry, moving from a rank outside the top 20 in December 2023 to 23rd by March 2024. This trajectory indicates a growing presence, albeit with a slight dip in rank from February to March 2024 despite an increase in sales in February. Competitors such as Daily Special and Briight have also experienced shifts in their rankings, with Daily Special showing a more volatile rank but maintaining a presence within the top 25, and Briight experiencing a slight decline in rank but still remaining more prominent than WholeHemp. Ollopa has seen a decline both in rank and sales, indicating potential opportunities for WholeHemp to capture a larger market share. Meanwhile, Dr. Well, a newer entrant like WholeHemp, has shown rapid improvement in rank, suggesting a competitive market with opportunities for growth and shifts in consumer preference. This dynamic ranking and sales performance across brands highlights the competitive nature of the Ontario cannabis capsule market and underscores the importance for WholeHemp to strategize effectively to improve its market position.

Notable Products

In March 2024, WholeHemp's top-selling product was Premium CBD (3.5g) from the Flower category, maintaining its number one position throughout the previous months with sales reaching 2385 units. Following closely was CBD Cherry Blossom (3.5g), also in the Flower category, securing the second rank consistently but experiencing a decrease in sales to 403 units. The Premium CBD Pre-Roll 10-Pack (7g) from the Pre-Roll category climbed to the third rank, showing a notable improvement from its previous positions. CBDA Capsules 15-Pack (300mg CBDA) in the Capsules category moved up to the fourth rank in March after not being ranked in December and showing variability in its position in the intervening months. Lastly, CBD Milled (14g) from the Flower category dropped to the fifth rank, highlighting a competitive shift within WholeHemp's product lineup.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.