Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

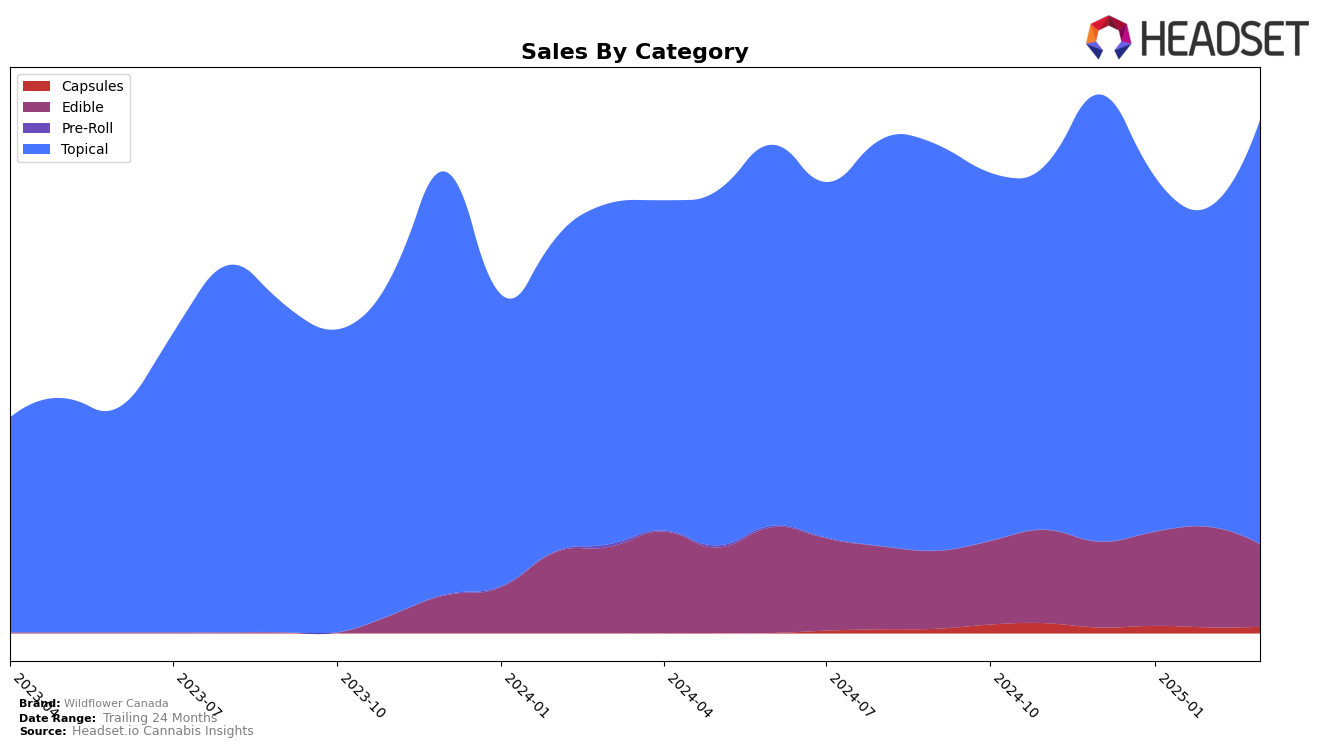

Wildflower Canada has shown a strong performance in the Topical category across multiple provinces. In Alberta, the brand consistently held the top position from December 2024 through March 2025, demonstrating a robust market presence despite fluctuations in sales figures. Similarly, in British Columbia, Wildflower Canada maintained a strong position, moving from third place in January 2025 to reclaiming the top spot by March 2025. This indicates a resilient demand for their topical products in these regions. However, in Saskatchewan, the brand remained steady at the second position throughout the same period, suggesting a stable yet competitive market environment.

In the Edible category, Wildflower Canada's performance varies significantly across provinces. In British Columbia, the brand experienced an upward trend, improving its rank from 13th in December 2024 to 10th in February 2025, before slightly dropping back to 12th by March 2025. This upward movement suggests growing consumer interest in their edible products in this province. Conversely, in Ontario, Wildflower Canada struggled to break into the higher rankings, consistently hovering around the 26th and 27th positions. This indicates a challenging market landscape for their edibles in Ontario, where they are not within the top 25 brands, potentially reflecting either higher competition or differing consumer preferences.

Competitive Landscape

In the Alberta Topical category, Wildflower Canada has consistently maintained its top position from December 2024 to March 2025, demonstrating a strong hold on the market despite fluctuations in sales. This stability in rank suggests a loyal customer base and effective brand strategy. Competitors like Stewart Farms and Proofly have remained in the second and third positions respectively, indicating a stable competitive landscape. However, while Stewart Farms has shown a steady sales recovery from January to March 2025, Proofly's sales have been more volatile, which could present an opportunity for Wildflower Canada to further solidify its lead by capitalizing on any market gaps. Overall, Wildflower Canada's consistent top ranking amidst these dynamics highlights its strong brand presence and potential for continued dominance in the Alberta Topical market.

Notable Products

In March 2025, the top-performing product for Wildflower Canada was Sweet Dreams - CBD/CBN/THC 10:10:2 Goji Berry Gummies 5-Pack, maintaining its first-place rank for the fourth consecutive month with sales of 6133 units. The CBD Extra Strength Relief Stick held steady in second place, showing a significant increase in sales compared to the previous month. The CBD Relief Stick remained in third position, with a slight uptick in sales. The CBD:THC 1:1 Relief Stick also retained its fourth-place rank, although it experienced a minor decrease in sales from February. Notably, the CBD/CBN/THC 30:10:1 Sweet Dreams Softgels 30-Pack entered the rankings at fifth place, indicating strong initial sales performance.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.