Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

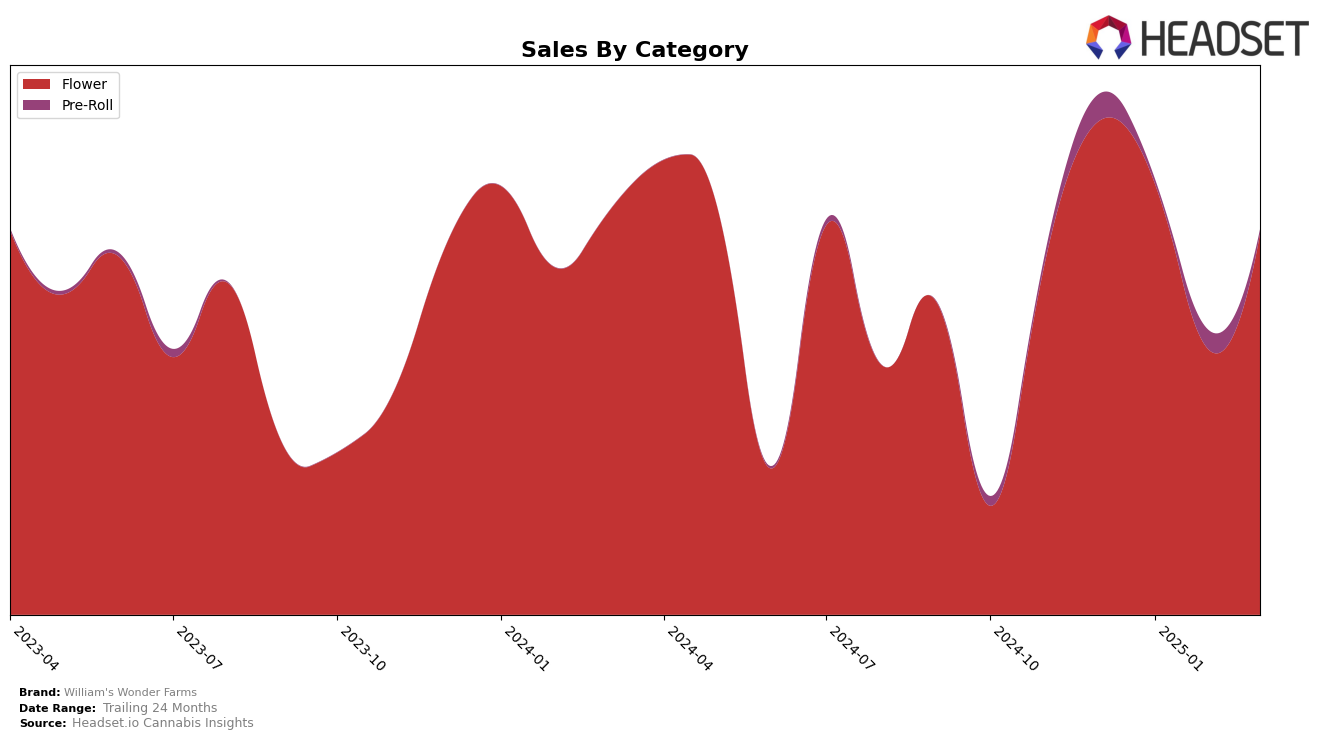

In the Oregon market, William's Wonder Farms has seen fluctuations in their performance across different product categories. For their Flower category, the brand experienced a decline in rankings from December 2024 to February 2025, dropping from 18th to 27th, before slightly recovering to 25th in March 2025. This movement indicates some volatility in their market presence, possibly due to competitive pressures or shifts in consumer preferences. The sales data also reflect this trend, with a noticeable dip in February followed by a recovery in March, suggesting potential seasonal influences or marketing adjustments that may have impacted their sales performance.

Meanwhile, in the Pre-Roll category, William's Wonder Farms did not make it into the top 30 rankings for January and March of 2025, highlighting a challenge in maintaining consistent market visibility in this segment. Their position was 76th in December 2024 and 84th in February 2025, indicating a struggle to capture a stronger foothold in this product line. The absence from the top 30 in certain months could imply either a need for strategic repositioning or increased competition within the category. These insights suggest that while the brand has a presence in Oregon, there are opportunities for growth and improvement, particularly in stabilizing their rankings and expanding their reach in less dominant categories.

Competitive Landscape

In the competitive landscape of the Oregon flower category, William's Wonder Farms experienced fluctuations in its market position from December 2024 to March 2025. Starting at 18th place in December, the brand fell out of the top 20 in January and February, before recovering slightly to 25th in March. This decline in rank coincided with a downward trend in sales, which dipped significantly from December to February before a partial recovery in March. In contrast, Midnight Fruit Company maintained a strong presence, consistently ranking within the top 10 until March, when it dropped to 24th, yet still managed to surpass William's Wonder Farms in sales. Meanwhile, Garden First showed a positive trajectory, climbing to 20th place in February, indicating a potential threat to William's Wonder Farms' market share. Additionally, Evan's Creek Farms made a notable leap from 52nd to 26th by March, suggesting an upward momentum that could further challenge William's Wonder Farms in the coming months. These dynamics highlight the competitive pressures that William's Wonder Farms faces, underscoring the need for strategic adjustments to regain and sustain its market position.

Notable Products

In March 2025, William's Wonder Farms saw Designer Runtz (Bulk) rise to the top as the best-selling product, achieving the number 1 rank with impressive sales of 8,323 units. The Vision B-buds (Bulk) maintained a strong performance, holding steady at the number 2 spot with consistent sales figures. Mimosa B-buds (Bulk), which had previously topped the rankings in February, fell to the 3rd position this month. GMO Candy (Bulk) entered the rankings at 4th place, while Jealousy (Bulk) rounded out the top 5. Notably, Designer Runtz (Bulk) made a significant leap from not being ranked in January and February to securing the top position in March.

```Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.