Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

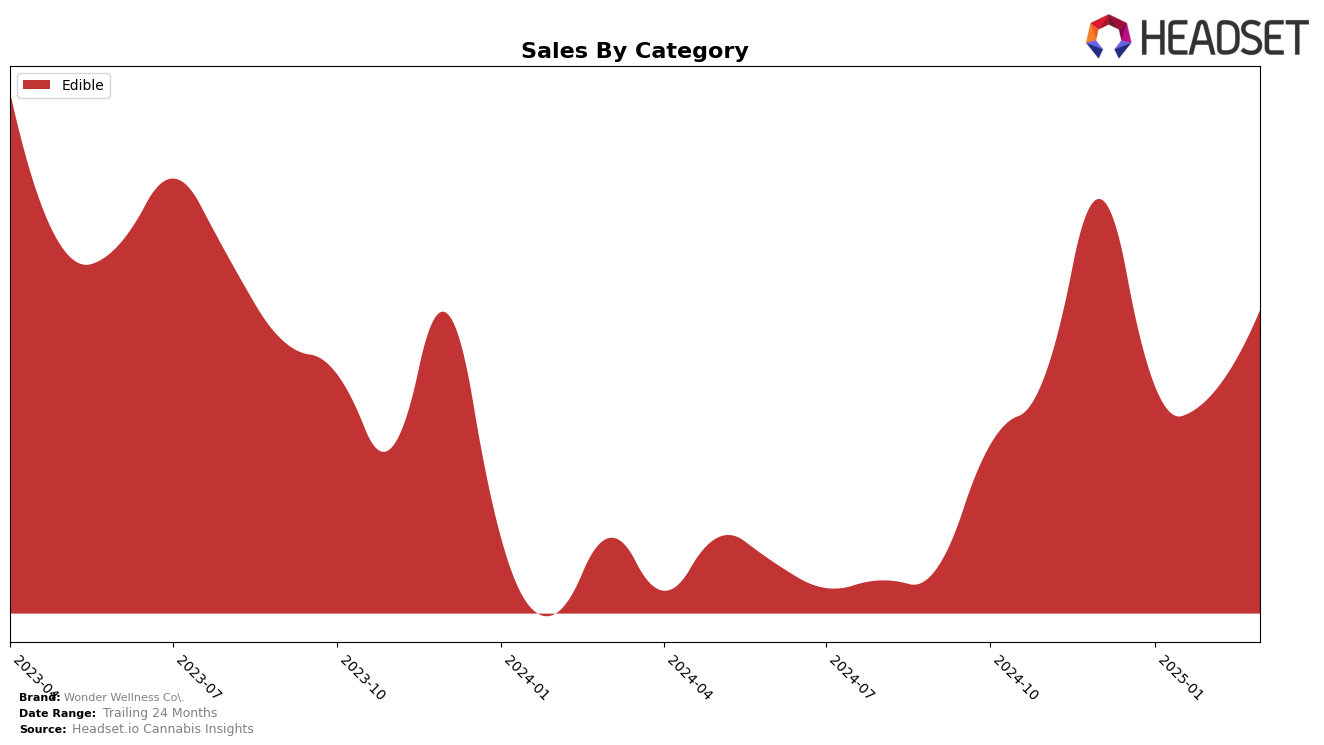

Wonder Wellness Co. has shown varied performance across different states and categories, with notable movements in the Edible category. In Illinois, the brand maintained a strong presence, consistently ranking within the top 10 from December 2024 to March 2025, although there was a slight dip in March. This indicates a robust market position in Illinois, despite fluctuations in sales figures. Meanwhile, their performance in Michigan was less impressive, as they did not break into the top 30, reflecting potential challenges in penetrating this market or increasing brand visibility.

In Ohio, Wonder Wellness Co. displayed some resilience, with rankings fluctuating between 25th and 33rd in the Edible category over the same period. The brand saw a notable improvement in January 2025, climbing to the 25th position from December's 33rd, before stabilizing around the 27th position in March. This suggests potential growth opportunities in Ohio, although they remain outside the top tier. Such performance variations across states highlight the differing market dynamics and the brand's varying levels of market penetration and consumer engagement.

Competitive Landscape

In the competitive landscape of the Illinois edible market, Wonder Wellness Co. has experienced notable fluctuations in its rank, reflecting the dynamic nature of consumer preferences and competitive pressures. As of March 2025, Wonder Wellness Co. saw a decline to the 10th position from its peak at 7th in February. This shift is indicative of increased competition, particularly from brands like Ozone, which climbed from 11th in February to 8th in March, showcasing a strong recovery. Meanwhile, Betty's Eddies maintained a consistent presence, fluctuating slightly but remaining a formidable competitor. Good News held steady at 12th, while Savvy made a significant leap from 14th to 9th, highlighting a potential shift in consumer loyalty or product innovation. These movements suggest that while Wonder Wellness Co. remains a strong contender, it must continue to innovate and adapt to maintain its market position amidst the evolving competitive landscape.

Notable Products

In March 2025, the top-performing product for Wonder Wellness Co. was the Laugh - Tumeric x Tangerine Gummies 20-Pack (100mg), maintaining its first-place ranking since December 2024, with sales of 11,946 units. The Sleep - THC/CBD/CBN 1:1:1 Plum Gummies 20-Pack (100mg THC, 100mg CBD, 100mg CBN) held steady in the second position, showing a slight increase in sales compared to the previous month. The Relax - CBD/THC 2:1 Blueberry Gummies 20-Pack (200mg CBD, 100mg THC) remained in third place, reflecting a consistent demand over the months. The Focus - CBG/THC 1:1 Prickly Pear Gummies 20-Pack (100mg THC, 100mg CBG) also kept its fourth-place ranking, with a noticeable sales uptick in March. Finally, the Laugh - Tumeric x Tangerine Mints 40-Pack (100mg) continued to hold the fifth spot, experiencing a slight increase in sales compared to February.

```Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.