Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

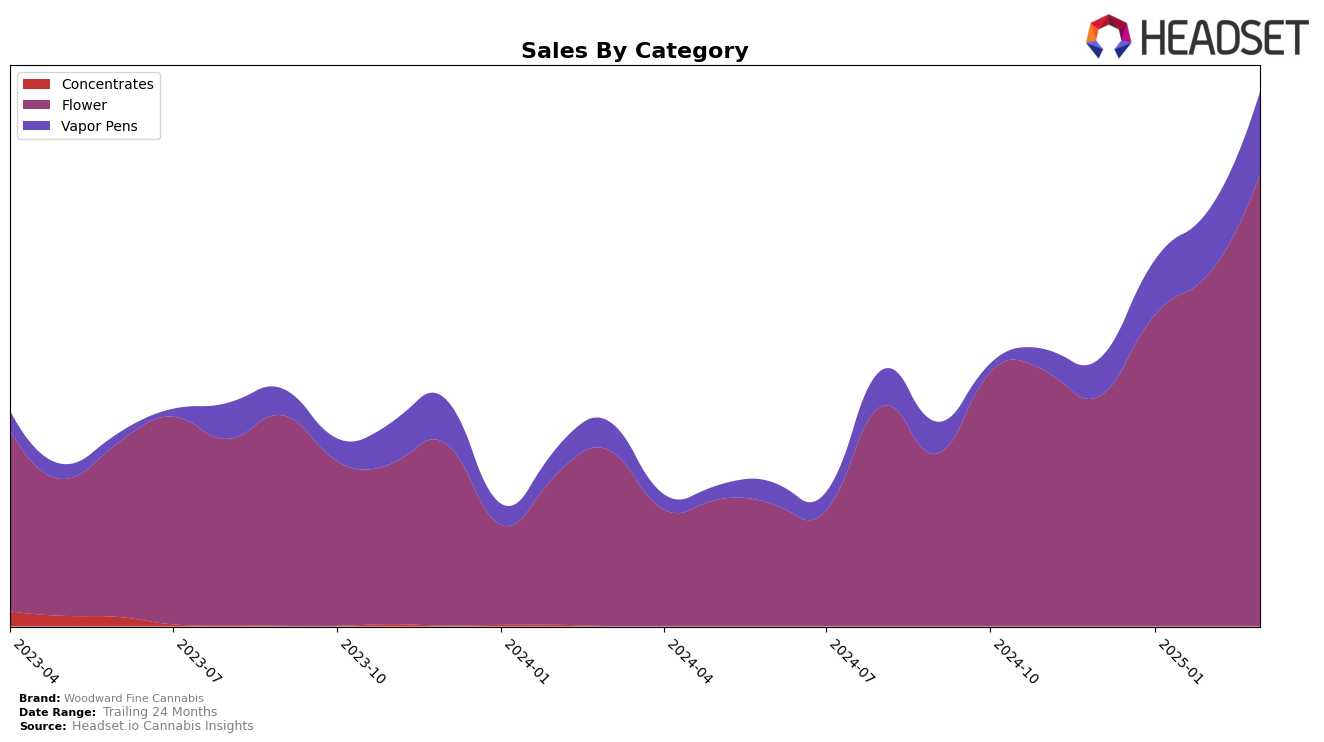

Woodward Fine Cannabis has shown a notable performance in the Ohio market, particularly in the Flower category. The brand has steadily improved its ranking from 15th in December 2024 to 12th by March 2025, reflecting a consistent upward trajectory. This movement is underscored by a significant increase in sales, suggesting a growing consumer preference for their products. However, it's worth noting that while their performance in the Flower category is commendable, they did not make it into the top 30 in other states or provinces, which could indicate a regional concentration of their market strength or a potential area for growth.

In the Vapor Pens category in Ohio, Woodward Fine Cannabis has also made strides, moving from 34th place in December 2024 to 24th by March 2025. This improvement indicates a positive reception in the market, although their initial position outside the top 30 highlights room for further expansion and brand recognition in this category. The consistent climb in rankings suggests strategic efforts in product development or marketing may be paying off. Despite these gains, their presence in the Vapor Pens category, like with Flower, is limited to Ohio, pointing to a potential opportunity for the brand to explore and expand into other regions.

Competitive Landscape

In the competitive landscape of the Ohio flower category, Woodward Fine Cannabis has shown a notable upward trajectory in recent months. Starting from a rank of 15th in December 2024, Woodward Fine Cannabis climbed to 12th by March 2025, demonstrating a consistent improvement in its market position. This positive trend is underscored by a significant increase in sales, with March 2025 figures nearly doubling those from December 2024. In contrast, Good Green experienced a decline in rank from 9th to 13th over the same period, alongside a drop in sales. Meanwhile, Meigs County Grown maintained a strong presence, improving its rank from 10th to 8th by February 2025 before slightly dropping to 10th in March, yet still boasting higher sales than Woodward Fine Cannabis. King City Gardens saw a decline from 5th to 11th, indicating potential challenges despite having higher sales figures. The data suggests that Woodward Fine Cannabis is effectively capturing market share, positioning itself as a rising competitor in the Ohio flower market.

Notable Products

In March 2025, the top-performing product from Woodward Fine Cannabis was Wedding Cake (5.66g) in the Flower category, which climbed from second place in February to secure the top spot. Grapehead (5.66g) maintained a strong performance, moving up from third place to second, with notable sales of 2039 units. Animal Face (5.66g) experienced a slight decline, dropping from first to third place compared to the previous month. Mushroom Cake (5.66g) made its debut in the rankings at fourth place, indicating a promising start. Blueberry Cheesecake (5.66g) consistently held its position at fifth place, showing stable sales performance over the months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.