Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

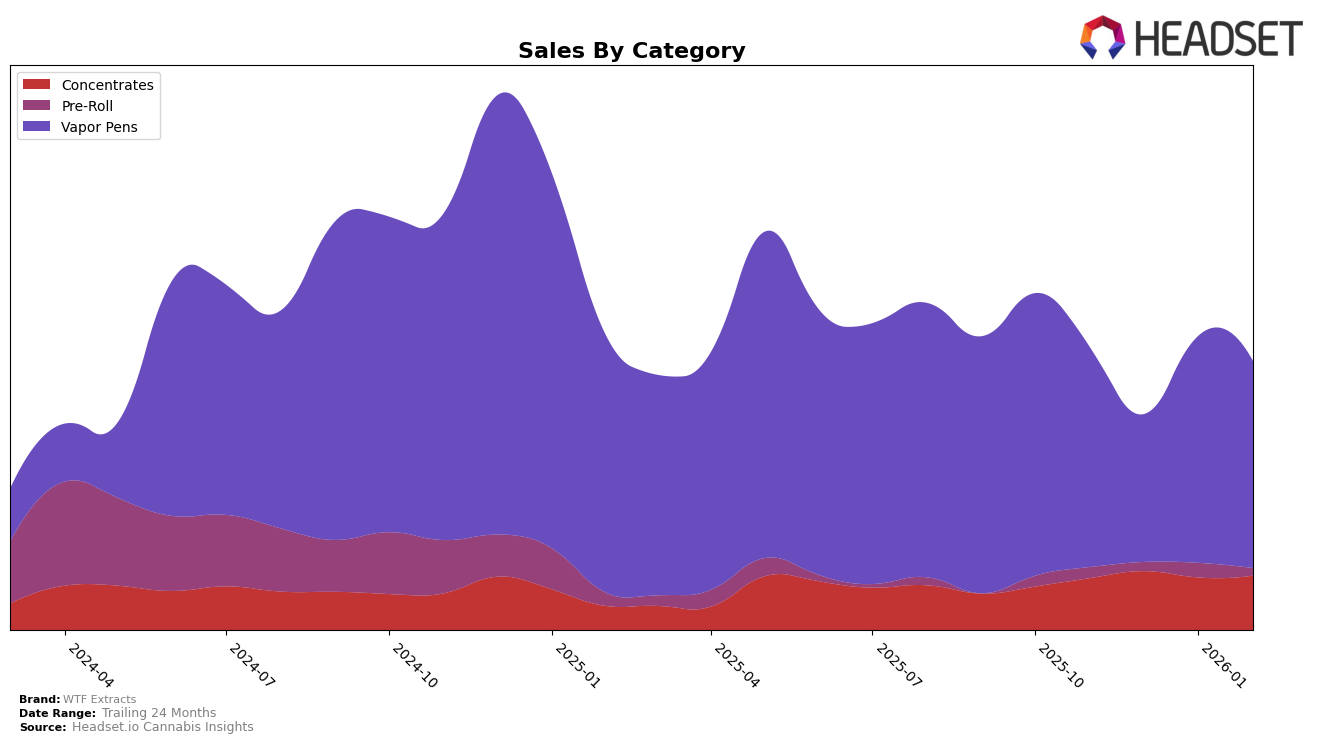

WTF Extracts has shown a consistent presence in the Arizona market, particularly in the Concentrates category where it maintained a stable ranking, holding the 4th position from December 2025 through February 2026. This steadiness is indicative of a strong foothold in the Concentrates market, despite a slight dip from November's 3rd position. In the Vapor Pens category, WTF Extracts demonstrated resilience by maintaining the 8th and 9th positions alternately over the same period, suggesting a competitive edge in this segment as well. The brand's ability to sustain its rankings in these categories highlights its strategic positioning and consumer loyalty within Arizona.

In contrast, the Pre-Roll category presents a more volatile picture for WTF Extracts in Arizona. While the brand improved its position to 18th in January 2026, it slipped back to 23rd in February. This fluctuation indicates potential challenges in maintaining a steady market share in the Pre-Roll category. The absence of top 30 rankings in other states or provinces in these categories could be seen as a missed opportunity for expansion or an area where the brand might focus its efforts for future growth. Despite these challenges, the overall sales trends across categories suggest a robust performance in Arizona, with room for strategic improvements in the Pre-Roll segment.

Competitive Landscape

In the competitive landscape of vapor pens in Arizona, WTF Extracts has shown a dynamic presence, consistently ranking within the top 10 over the past few months. Despite a dip in sales from November to December 2025, WTF Extracts managed to regain its position, ranking 8th in January 2026 before slipping back to 9th in February 2026. This fluctuation highlights the brand's resilience amidst strong competition. Notably, Jeeter has maintained a steady 7th place, with sales consistently outperforming WTF Extracts. Meanwhile, Session Premium Cannabis (AZ) has shown an upward trend, surpassing WTF Extracts in January 2026. Brands like Canamo and Savvy have not posed a significant threat, with rankings consistently below WTF Extracts. This competitive analysis suggests that while WTF Extracts is a strong contender, focusing on strategies to boost sales and regain higher ranks could be beneficial in maintaining its competitive edge in the Arizona vapor pen market.

Notable Products

In February 2026, the top-performing product for WTF Extracts was Shannanigans Diamond Infused Pre-Roll (0.5g) in the Pre-Roll category, ranking first with notable sales of 2153 units. Cherry Pie Hoe Distillate Disposable (1g) in the Vapor Pens category secured the second position, showing strong performance. Blue Raspberry Distillate Disposable (1g), previously ranked first in November 2025, slipped to third place. Blue Dream Distillate Cartridge (1g) dropped from its second-place position in January 2026 to fourth in February. Marshmallow Cured Resin Badder (1g), although leading in January, fell to fifth place, indicating a shift in consumer preferences.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.