Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

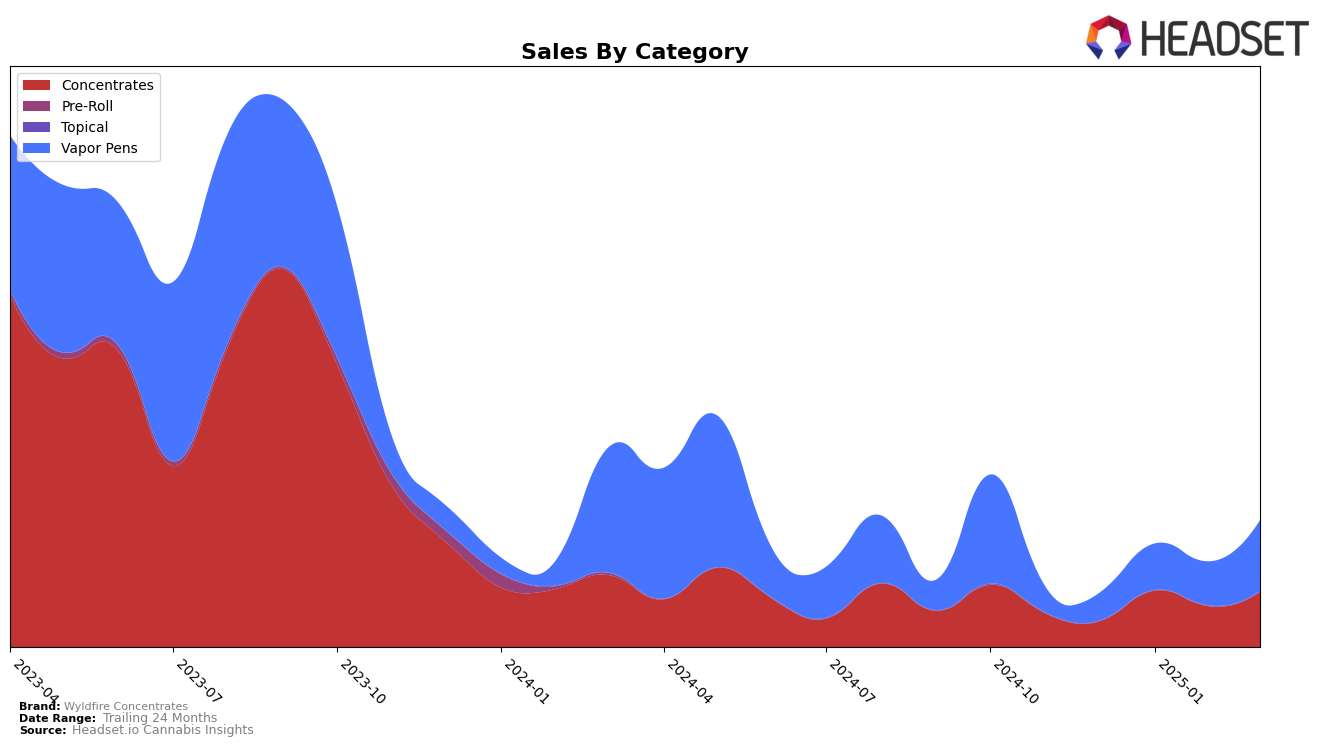

Wyldfire Concentrates has shown notable progress in the Colorado market, particularly in the Concentrates category. Starting from a rank of 65 in December 2024, the brand climbed to the 38th position by March 2025. This upward trajectory indicates a growing acceptance and demand for their concentrates in the state. The consistent improvement in rankings over the months highlights their strengthening market position, although they are still outside the top 30 brands, suggesting potential for further growth.

In the Vapor Pens category, Wyldfire Concentrates also experienced positive momentum in Colorado. Despite not breaking into the top 30, their rank improved from 85 in December 2024 to 66 by March 2025. This steady climb reflects an increasing consumer interest in their vapor pen offerings. While their sales figures in January and March 2025 show significant improvement, the fact that they remain outside the top 30 brands suggests that there is still room for capturing a larger share of the market.

Competitive Landscape

In the competitive landscape of vapor pens in Colorado, Wyldfire Concentrates has demonstrated a promising upward trajectory in recent months. Starting from a rank of 85 in December 2024, Wyldfire Concentrates climbed to 66 by March 2025, indicating a significant improvement in market position. This rise can be attributed to a consistent increase in sales, culminating in a notable peak in March. In comparison, Nuhi experienced fluctuating ranks, ending at 68 in March, while Kush Masters (Kush Master LLC) showed a remarkable jump from 86 in December to 58 in March, driven by a significant sales surge. Meanwhile, Summit maintained a relatively stable position, ending at 67, and Magnitude emerged in February with a strong entry, surpassing Wyldfire Concentrates by March. These dynamics highlight Wyldfire Concentrates' competitive edge in a rapidly evolving market, though the emergence of Magnitude as a strong contender suggests the need for strategic positioning to maintain its upward momentum.

Notable Products

In March 2025, Wyldfire Concentrates' top-performing product was Guava Melt Wax (1g) in the Concentrates category, securing the number one rank with sales of 309. Tally Man Live Resin Cartridge (1g) in the Vapor Pens category followed closely in second place. Trop Cherry Cured Wax (1g) and Rum Cake Sugar (1g), both from the Concentrates category, held the third and fourth positions respectively. Notably, Jordan's Pancakes Wax (1g) experienced a decline, dropping from the first rank in February to fifth in March. This shift indicates a dynamic change in consumer preferences within the product lineup from previous months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.