Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

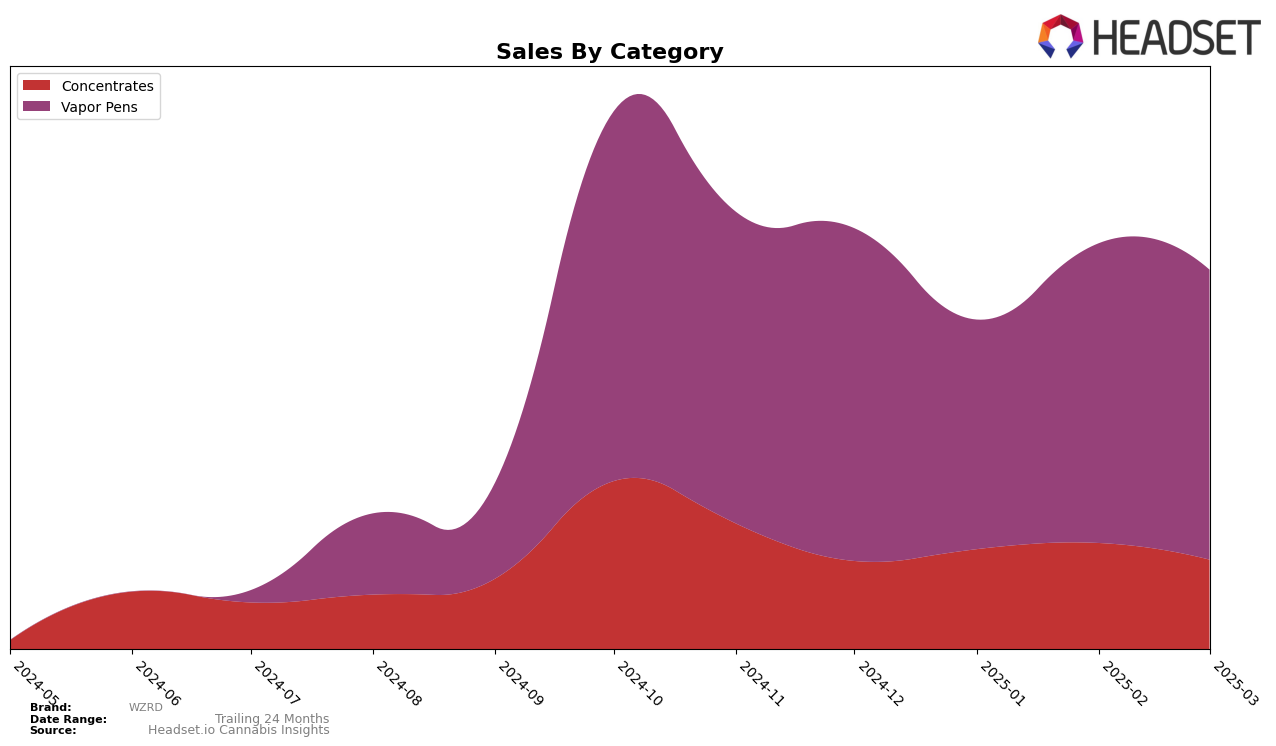

WZRD has shown varied performance across different categories and states, with notable fluctuations in its rankings. In the Arizona concentrates market, WZRD has maintained a presence within the top 30 brands, albeit with some shifts. Starting at 28th place in December 2024, the brand improved its rank to 24th by February 2025, only to drop back to 28th in March 2025. This oscillation could indicate a competitive landscape or changing consumer preferences in the concentrates market. On the other hand, the vapor pens category in Arizona saw WZRD fall out of the top 30 in January 2025, suggesting a struggle to maintain its footing in this category, though it managed to recover to 32nd place by March 2025.

The sales figures reflect interesting trends for WZRD. In the concentrates category, sales peaked in February 2025, corresponding with their highest rank of 24th, before declining in March. This suggests that while they can achieve higher sales, sustaining them poses a challenge. Conversely, in the vapor pens category, despite a drop in rank in January 2025, sales showed a resurgence in February, though they did not fully recover to December levels by March. This indicates potential volatility or seasonal demand shifts affecting their vapor pen sales. The fluctuations in both categories highlight the dynamic nature of the cannabis market in Arizona, where WZRD must navigate both competitive pressures and consumer trends.

Competitive Landscape

In the competitive landscape of Vapor Pens in Arizona, WZRD has experienced notable fluctuations in its market position from December 2024 to March 2025. Initially ranked 24th in December, WZRD saw a decline to 34th in January, before recovering to 27th in February, and settling at 32nd in March. This volatility contrasts with competitors like Session Farms, which consistently maintained a presence in the top 30 despite a downward trend, and TRIP, which remained relatively stable around the 28th to 38th rank range. Meanwhile, Sauce Essentials mirrored WZRD's pattern of fluctuations, albeit with a slightly more favorable trajectory in March. Notably, Cush made a significant leap from outside the top 20 to 30th place in March, indicating a potential emerging threat. These dynamics suggest that while WZRD has managed to regain some ground after a dip, the competitive pressure remains intense, with both established and emerging brands vying for market share, which could impact WZRD's sales and strategic positioning in the coming months.

Notable Products

In March 2025, Watermelon Splash Distillate Cartridge (1g) from WZRD topped the sales chart in the Vapor Pens category, maintaining its position from January and seeing a significant sales increase to 1198 units. Tiger's Blood Distillate Cartridge (1g) rose to second place from fifth in February, indicating a strong upward trend. Grape Galaxy Distillate Cartridge (1g) held steady in third place, despite a previous dip in January. Sweet Strawberry Distillate Cartridge (1g) entered the rankings in March at fourth place, showcasing notable sales performance. Electric Green Apple Distillate Cartridge (1g) rounded out the top five, experiencing a drop from second place in January, but maintaining a consistent presence in the rankings.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.