Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

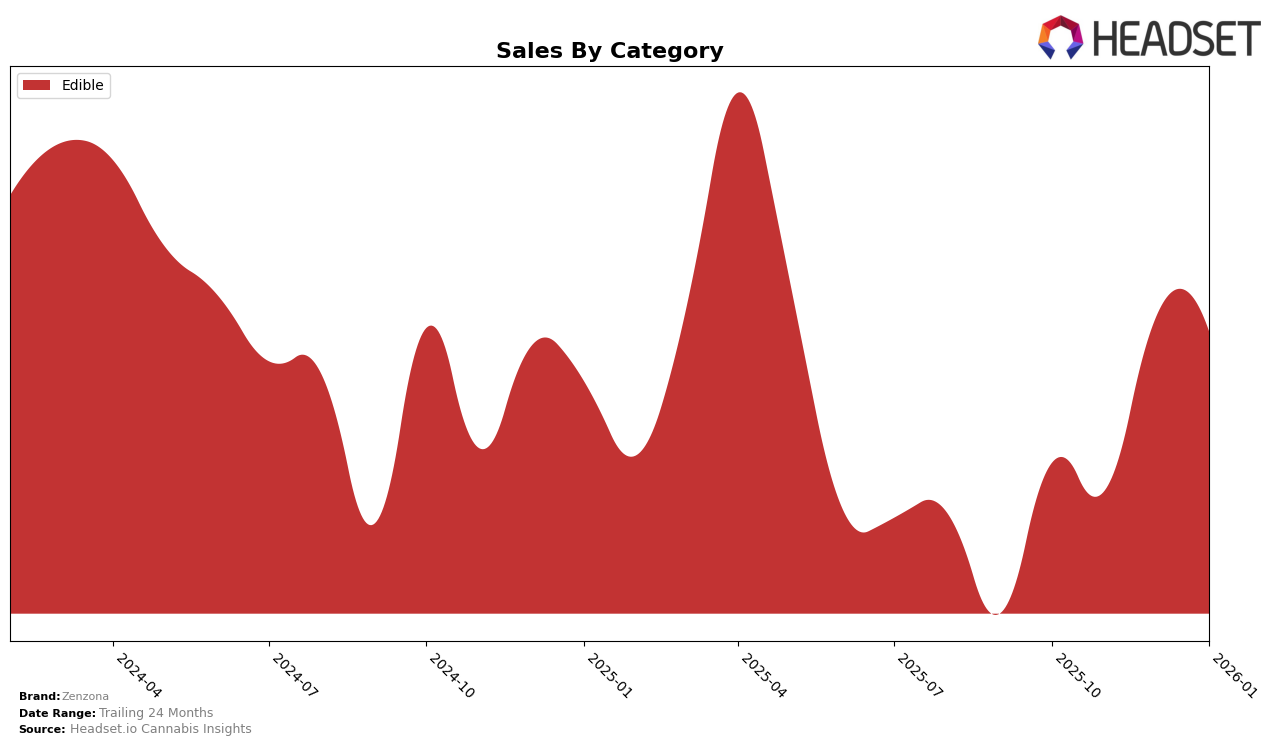

Zenzona has demonstrated a consistent presence in the Arizona market, particularly within the Edible category. Over the observed months from October 2025 to January 2026, the brand maintained a steady ranking, moving slightly from 15th to 14th position. This indicates a stable performance in a competitive market, suggesting that Zenzona's products resonate well with consumers in Arizona. The sales trend shows a significant increase from November to December 2025, where sales jumped from $151,095 to $179,139, reflecting a strong holiday season performance. However, the slight dip in January 2026 sales suggests a potential seasonal effect or market saturation that might need addressing.

Despite Zenzona's stable position in Arizona, the absence of rankings in other states or provinces implies that the brand is either not present or not performing within the top 30 in those regions. This could be seen as a limitation in their market reach or a potential opportunity for expansion. The lack of presence in other states might indicate that Zenzona is focusing its efforts on strengthening its foothold in Arizona before considering broader market penetration. Understanding the dynamics that contribute to their success in Arizona could provide valuable insights for future growth strategies in untapped markets.

Competitive Landscape

In the Arizona edible market, Zenzona has demonstrated a stable performance, maintaining a consistent rank between 14th and 15th from October 2025 to January 2026. This steadiness contrasts with competitors like Dialed In Gummies, which made a notable leap from being unranked to 15th in January 2026, and Mom & Pop, which improved from 16th to 13th over the same period. Despite Zenzona's stable ranking, its sales saw a significant increase in December 2025, surpassing Sofa King Tasty in sales, although it remained behind Good Tide, which consistently held a higher rank and sales volume. This suggests that while Zenzona's market position remains steady, there is room for growth in both rank and sales, especially given the dynamic movements of its competitors.

Notable Products

In January 2026, Zenzona's top-performing product was Pineberry Vegan RSO Gummies 10-Pack (100mg), maintaining its first-place rank from previous months with sales of 3341 units. Italian Zorbet RSO Vegan Gummies 10-Pack (100mg) secured the second spot, consistent with its ranking since October 2025, although sales dipped slightly from December. Hybrid Blackberries and Cream RSO Vegan Gummies 10-Pack (100mg) rose to third place, showing an improvement from fifth in December. The CBD/THC 2:1 Sativa Honeydew Vegan Gummies 10-Pack (200mg CBD, 100mg THC) dropped to fourth, despite a significant sales boost in November. Meanwhile, CBD/THC 1:2 Indica Blueberry Vegan Gummies 10-Pack (50mg CBD, 100mg THC) re-entered the top five at the fifth position, matching its rank from November 2025.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.