Apr-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

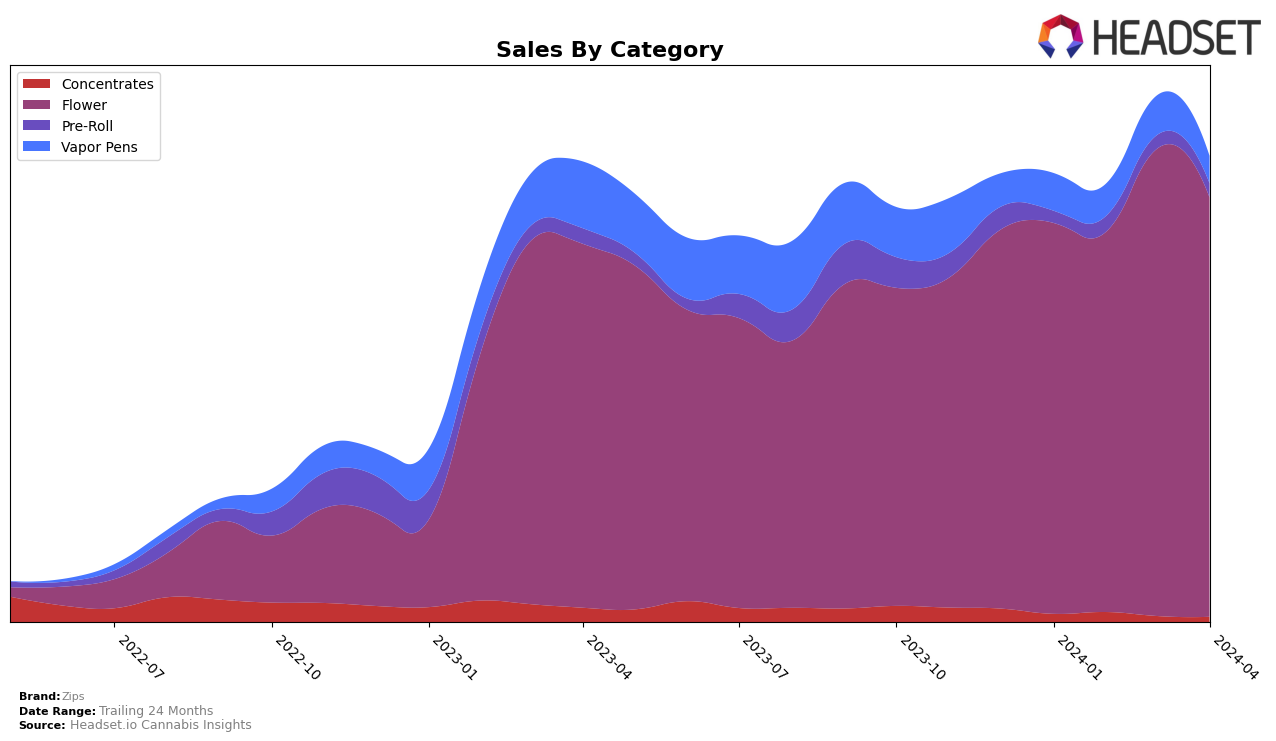

In the competitive cannabis markets of California and Michigan, Zips has shown a varied performance across different categories. In California, Zips has experienced fluctuations within the Concentrates, Flower, Pre-Roll, and Vapor Pens categories. Notably, their Flower category saw a significant drop from a rank of 37 in February 2024 to 68 in April 2024, indicating a potential challenge in maintaining their market position amidst stiff competition. Conversely, in Michigan, Zips' Flower category demonstrated remarkable growth, improving from a rank of 56 in January 2024 to 26 by April 2024, showcasing a strong upward trajectory in market penetration and consumer preference. This contrast highlights the brand's regional performance disparities and underscores the importance of strategic market engagement to sustain growth.

Furthermore, Zips' performance in the Ontario market presents an interesting case of volatility and recovery within the Flower category. Starting strong at rank 20 in January 2024, Zips experienced a significant dip, falling to rank 50 by March 2024, before partially recovering to rank 39 in April 2024. This fluctuation suggests challenges in sustaining their initial strong market presence, possibly due to inventory issues or competitive pressures. However, the recovery in April could indicate effective strategic adjustments or market dynamics favoring Zips' offerings. Such insights into Zips' performance across different states and categories can provide valuable lessons on the dynamics of brand positioning and market adaptation in the rapidly evolving cannabis industry.

Competitive Landscape

In the competitive landscape of the cannabis flower category in Michigan, Zips has shown a notable trajectory in terms of rank and sales over the recent months. Starting from a lower position at rank 56 in January 2024, Zips made a significant leap to rank 24 by March, before slightly dipping to rank 26 in April. This fluctuation in rank is mirrored by its sales performance, which saw a substantial increase from January to March, followed by a slight decrease in April. Competing brands such as Nature's Medicines, Glo Farms, and Uplyfted Cannabis Co. have also experienced shifts in rank and sales, but none have mirrored the rapid ascent of Zips. Notably, Glo Farms outperformed Zips in April, securing the 25th rank, one place above Zips. This competitive analysis highlights Zips's dynamic performance in the Michigan market, suggesting a brand on the rise, albeit facing stiff competition from established players like Glo Farms and emerging brands alike.

Notable Products

In April 2024, Zips saw Wookie Breath (28g) from the Flower category leading the sales chart, marking a significant rise to the top position from its previous rank of 5 in March, with sales reaching 2067 units. Following closely, Caffeine Pre-Roll (1g) from the Pre-Roll category secured the second rank, maintaining a strong presence in the top sales ranks across the months, albeit dropping from the top spot in March to second. The third position was taken by Ice Cream Cake Pre-Roll (1g), a newcomer in the rankings, indicating a growing preference for Pre-Roll varieties. Orange Soda Pre-Roll (1g) and Mint Whips (28g) also made their debut in the top sales, ranking fourth and fifth respectively, showcasing a diverse consumer interest in both Flower and Pre-Roll categories. This sales data not only underscores the dynamic nature of consumer preferences but also highlights the competitive performance of Pre-Roll products in Zips' product line.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.