Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

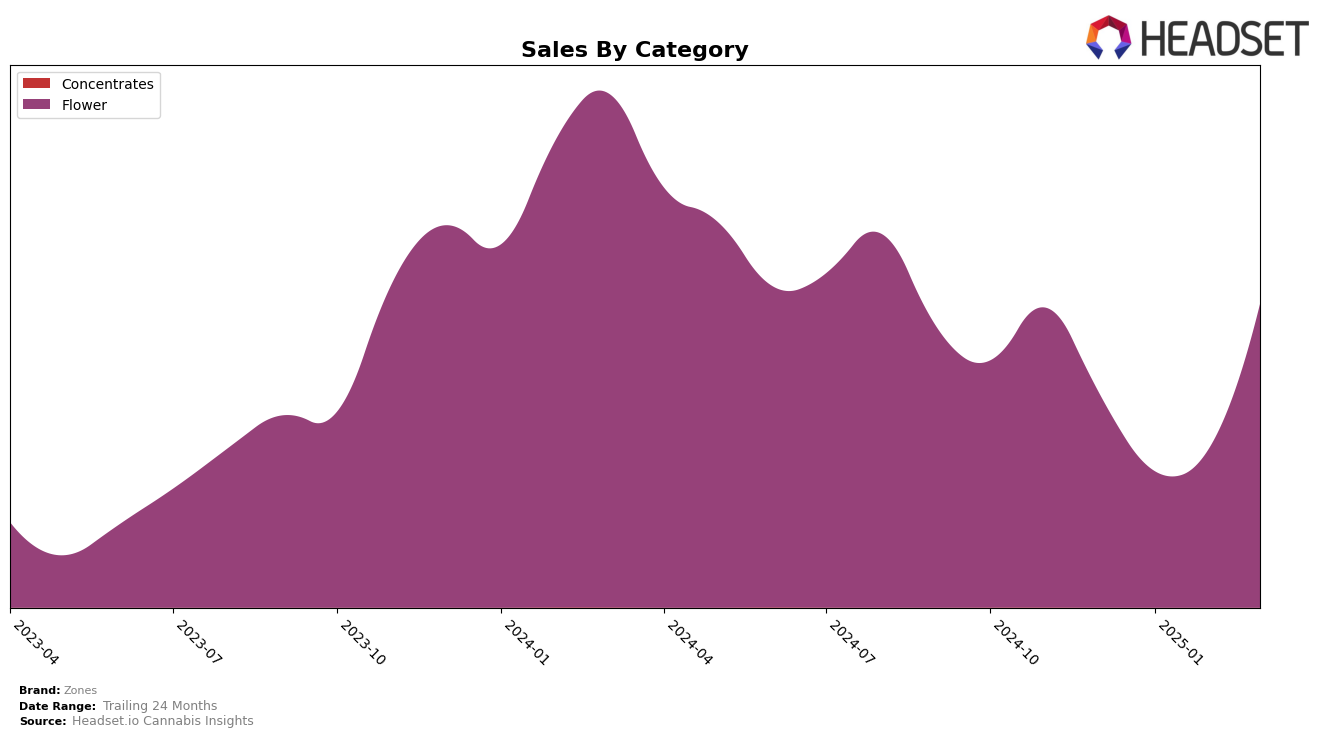

In Michigan, Zones has shown a notable fluctuation in the Flower category rankings over the first quarter of 2025. Starting from a rank of 17 in December 2024, the brand experienced a dip in January 2025, falling to 26, which suggests a challenging period for the brand. However, Zones quickly rebounded in the subsequent months, rising to 23 in February and achieving an impressive rank of 12 by March 2025. This upward trajectory indicates a strategic recovery and possibly an increase in consumer demand or successful marketing efforts that have revitalized their presence in the market.

Despite the initial setback in January, Zones' sales performance in Michigan has been quite dynamic. The brand's sales figures surged from approximately $905,192 in January to over $2 million by March 2025, reflecting a significant recovery and growth. The absence of Zones from the top 30 in any other states or categories suggests either a concentrated focus on the Michigan Flower market or challenges in expanding their market presence elsewhere. This could be an area for potential growth or a strategic decision to solidify their standing in Michigan before diversifying further.

Competitive Landscape

In the competitive landscape of the Michigan flower category, Zones has experienced notable fluctuations in its ranking, reflecting a dynamic market presence. From December 2024 to March 2025, Zones improved its rank from 17th to 12th, demonstrating a positive trajectory in the latter months. This upward trend in March is particularly significant, as it indicates a recovery from a dip in January 2025 when Zones fell to 26th, dropping out of the top 20. In comparison, Common Citizen maintained a relatively stable position, although it experienced a decline from 5th to 14th place, suggesting potential challenges in sustaining its earlier momentum. Meanwhile, Goldkine showed consistent improvement, climbing from 23rd to 10th, which could pose increased competition for Zones. Additionally, The Limit demonstrated strong performance, peaking at 6th in February before slightly dropping to 11th in March. These shifts underscore the competitive pressures Zones faces, highlighting the importance of strategic positioning to capitalize on its recent sales growth and maintain its upward rank trajectory.

Notable Products

In March 2025, Zones' top-performing product was Sonic Strawberry (28g) in the Flower category, leading the sales with 1,759 units sold. It was followed by Sneaky Sweets (28g) and Greasy Runtz (28g), which ranked second and third respectively. Bubble Beltz (28g) and 1st Class (28g) rounded out the top five. Notably, Sonic Strawberry climbed to the number one spot for the first time, showing a significant jump from previous months. Sneaky Sweets and Greasy Runtz maintained their strong positions, consistently staying within the top three since the start of the year.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.