Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

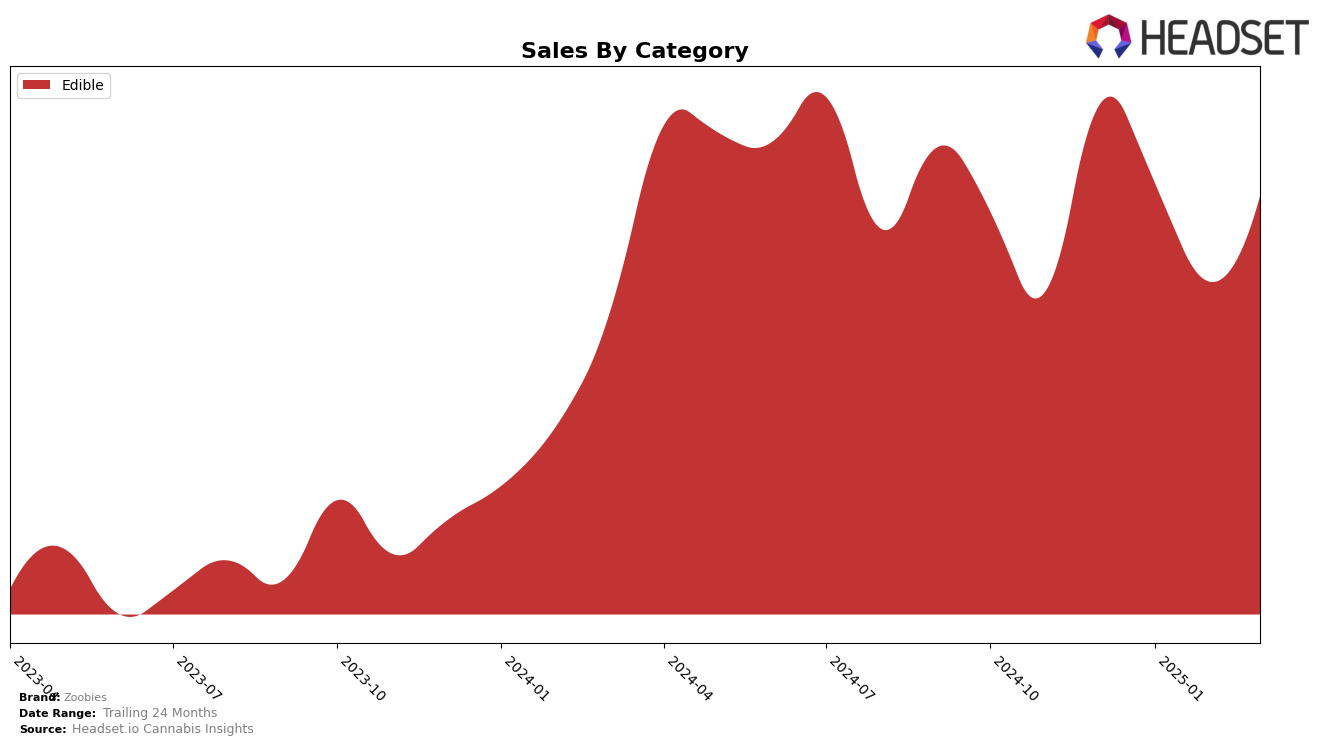

Market Insights Snapshot

Zoobies has shown a notable performance in the Colorado edible market over the past few months. Despite a dip in rankings from December 2024 to February 2025, where it slid from 21st to 25th, March 2025 saw a significant rebound to 19th place. This upward movement coincides with a substantial increase in sales, with March 2025 figures almost doubling from February 2025. This suggests a strong recovery and potential growth trajectory in the Colorado market, positioning Zoobies as a brand to watch in the edibles category.

In contrast, Zoobies' performance in the New Jersey edible market tells a different story. The brand maintained a consistent 27th position from December 2024 to February 2025, but March 2025 saw them fall out of the top 30. This decline in ranking is mirrored by a noticeable drop in sales figures, indicating potential challenges in maintaining market presence. It will be crucial for Zoobies to address these challenges to regain and improve its standing in the New Jersey market. The contrasting performances in these two states highlight the varying dynamics and consumer preferences across regions, offering insights into market-specific strategies that could benefit the brand.

Competitive Landscape

In the competitive landscape of the edible category in Colorado, Zoobies has experienced notable fluctuations in its market position, reflecting a dynamic shift in consumer preferences and brand performance. As of March 2025, Zoobies climbed to the 19th rank after a dip to 25th in February, indicating a significant recovery in sales momentum. This resurgence is contrasted by the performance of competitors like Dixie Elixirs, which maintained a relatively stable position, hovering around the 18th rank in March. Meanwhile, Dablogic showed a slight decline from 15th to 17th, and PAX experienced a drop from 17th in February to 21st in March. The fluctuating ranks of these brands suggest a competitive market where Zoobies' recent sales increase positions it as a brand to watch, potentially capitalizing on the shifting consumer landscape in Colorado's edible sector.

Notable Products

In March 2025, the top-performing product for Zoobies was Sour Fruit Gummies 10-Pack (100mg), maintaining its first-place ranking with sales of 4939 units. Mixed Fruit Gummies (100mg) held steady in second place, showing a consistent performance across the months despite a significant dip in February. The CBD/CBN/THC 1:1:1 Midnight Fruit Gummies 10-Pack (50mg CBD, 50mg CBN, 50mg THC) improved its position from fourth to third since December 2024, with notable sales growth in March. Sour Fruit Gummies (100mg) saw a drop from second place in January to fourth in March, indicating fluctuating consumer preferences. The 20-pack version of the CBD/CBN/THC 1:1:1 Midnight Fruit Gummies remained in fifth place, showing modest sales recovery since February.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.