Mar-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

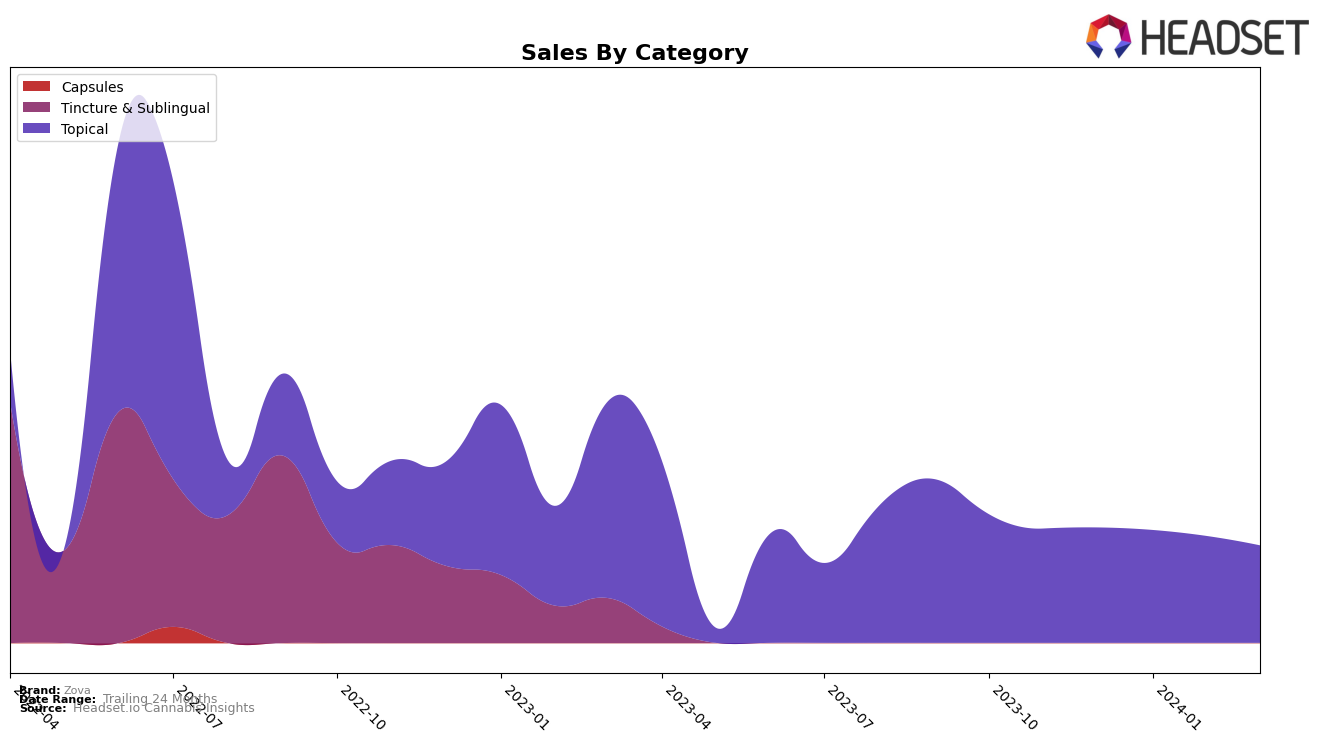

In the Michigan market, Zova has shown a fluctuating performance within the Topical category. Initially ranking at 22 in December 2023, Zova experienced a notable absence from the top 30 brands in January and February 2024, which may indicate a temporary dip in their market presence or a shift in consumer preferences during these months. However, the brand made a comeback in March 2024, securing the 21st position. This rebound suggests a possible recovery in brand visibility and consumer interest. The sales figures, dropping from 2361 in December 2023 to 1994 in March 2024, hint at a challenging quarter for Zova in Michigan, yet the brand's ability to re-enter the rankings is noteworthy.

The absence of Zova from the top 30 in January and February 2024 within the competitive Michigan Topical market highlights a potential area for improvement or a strategic pivot. The fluctuation in rankings, coupled with the sales dip, reflects the volatile nature of consumer product preferences and the challenges brands face in maintaining consistent visibility and engagement. However, the re-entry into the rankings in March 2024 could signal the beginning of a positive trend for Zova, as they manage to regain some of their lost ground. This performance trajectory underscores the importance of strategic marketing and product quality in sustaining and enhancing brand positioning in a dynamic market landscape.

Competitive Landscape

In the competitive landscape of the topical cannabis market in Michigan, Zova has experienced fluctuations in its ranking, indicating a dynamic and competitive environment. Initially ranked 22nd in December 2023, Zova saw a disappearance from the top 20 rankings in January and February 2024, only to re-emerge at the 21st position in March 2024. This volatility highlights the brand's challenges in maintaining a consistent market presence amidst fierce competition. Notably, Meg & Zen, a direct competitor, has shown a more stable performance, improving its rank from 21st in December 2023 to 20th in March 2024, and maintaining higher sales figures than Zova throughout the observed period. Another noteworthy competitor, Artemis Body Care, demonstrated significant growth, moving from 28th in December 2023 to 19th by March 2024, with a remarkable increase in sales, overtaking Zova by a substantial margin. This competitive analysis underscores the importance for Zova to strategize effectively to enhance its market position and sales in the face of robust competitors and shifting consumer preferences in the Michigan topical cannabis market.

Notable Products

In March 2024, Zova's top-performing product remained the CBD Botanical Salve (500mg, CBD 100ml) within the Topical category, sustaining its number one rank from December 2023. Despite maintaining its leading position, this product experienced a decrease in sales, dropping from 79 units in December 2023 to 66 units in March 2024. This indicates a consistent consumer preference for the product, although with slightly diminished demand. No other products or changes in rankings were provided, focusing the analysis solely on this top performer. The data suggests that while Zova's CBD Botanical Salve continues to be a favorite, there might be room to investigate the factors contributing to the slight sales decline.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.